Printable Promissory Note Form

A Promissory Note is a crucial financial document that outlines the terms of a loan between a borrower and a lender. It serves as a written promise from the borrower to repay a specified amount of money, typically with interest, by a certain date. This form includes essential details such as the principal amount, interest rate, repayment schedule, and any collateral involved. Additionally, it specifies the rights and obligations of both parties, providing clarity on what happens in the event of default. Understanding the components of a Promissory Note is vital for both lenders and borrowers, as it protects their interests and ensures that the terms of the loan are legally enforceable. By utilizing this form, individuals can establish a clear framework for their financial transactions, reducing the potential for disputes and misunderstandings.

State-specific Tips for Promissory Note Templates

Common mistakes

-

Incorrect Names or Information: One of the most common mistakes is failing to accurately fill in the names of the borrower and lender. It’s crucial that the names match official identification documents. Typos can lead to confusion or even disputes later on.

-

Missing Loan Amount: Another frequent error is neglecting to specify the exact amount of the loan. This detail is essential, as it defines the financial obligation. Without it, the terms of the agreement become unclear.

-

Omitting Interest Rate: Some individuals forget to include the interest rate or miscalculate it. This omission can affect the total amount owed and create misunderstandings about repayment expectations.

-

Not Stating Repayment Terms: Failing to outline the repayment schedule is a significant oversight. Clearly stating when payments are due and the method of payment helps avoid confusion and ensures both parties are on the same page.

-

Neglecting Signatures: Lastly, many people overlook the necessity of signatures. Both the borrower and lender must sign the document for it to be legally binding. Without signatures, the agreement lacks validity.

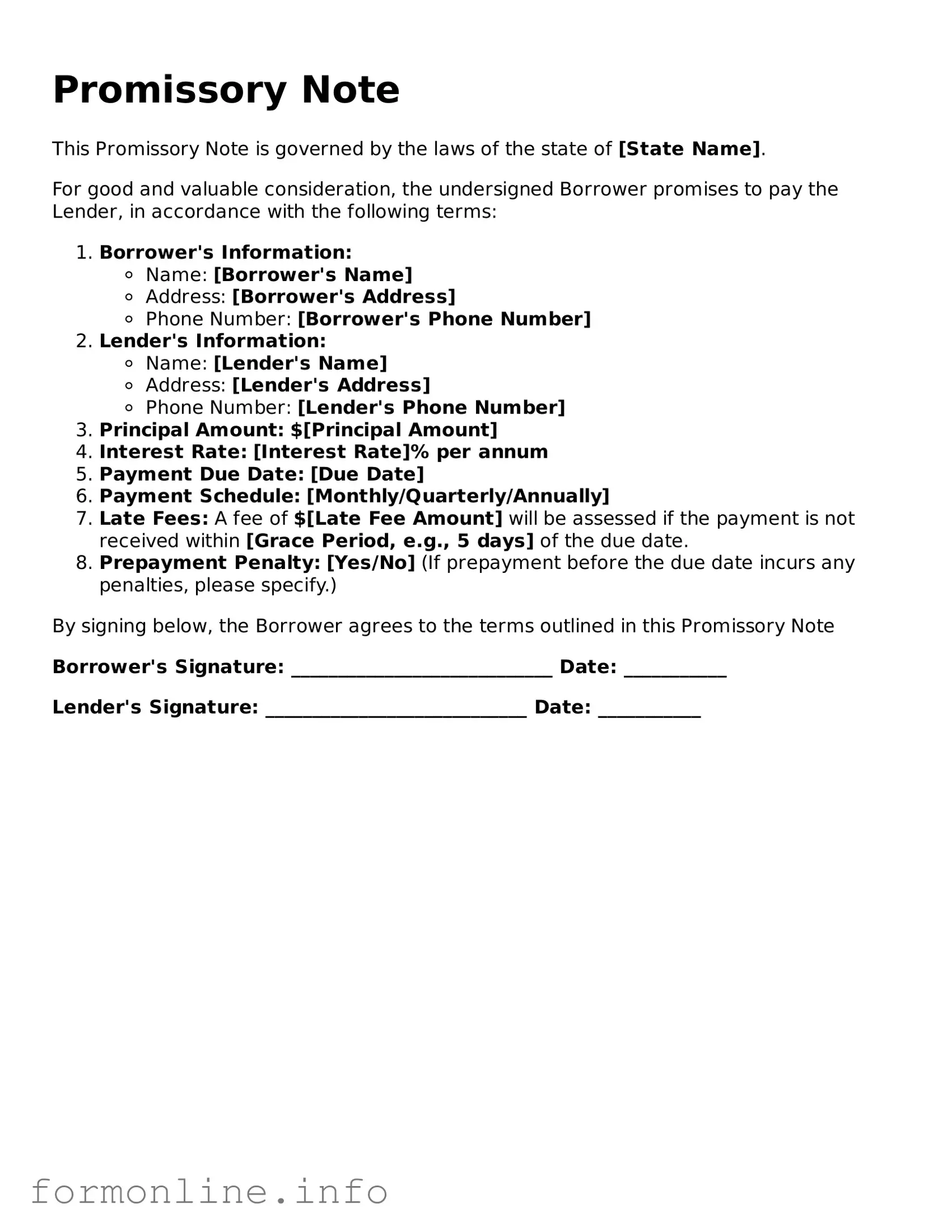

Preview - Promissory Note Form

Promissory Note

This Promissory Note is governed by the laws of the state of [State Name].

For good and valuable consideration, the undersigned Borrower promises to pay the Lender, in accordance with the following terms:

- Borrower's Information:

- Name: [Borrower's Name]

- Address: [Borrower's Address]

- Phone Number: [Borrower's Phone Number]

- Lender's Information:

- Name: [Lender's Name]

- Address: [Lender's Address]

- Phone Number: [Lender's Phone Number]

- Principal Amount: $[Principal Amount]

- Interest Rate: [Interest Rate]% per annum

- Payment Due Date: [Due Date]

- Payment Schedule: [Monthly/Quarterly/Annually]

- Late Fees: A fee of $[Late Fee Amount] will be assessed if the payment is not received within [Grace Period, e.g., 5 days] of the due date.

- Prepayment Penalty: [Yes/No] (If prepayment before the due date incurs any penalties, please specify.)

By signing below, the Borrower agrees to the terms outlined in this Promissory Note

Borrower's Signature: ____________________________ Date: ___________

Lender's Signature: ____________________________ Date: ___________

Common Forms:

Affidavit of Residence Pdf - Used by schools, banks, and government agencies, this affidavit validates residency claims.

When engaging in the sale of a vehicle in South Carolina, it is important to utilize the correct documentation, such as the South Carolina Motor Vehicle Bill of Sale form, which can be found at https://autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form. This document not only establishes the legitimacy of the transaction but also simplifies the registration process for the new owner.

Make a Fake Insurance Card - Keep the card in a safe but accessible location within your vehicle.

Promissory Note Form Subtypes

Documents used along the form

A Promissory Note is a crucial document in financial transactions, outlining the terms of a loan between a borrower and a lender. Several other forms and documents often accompany a Promissory Note to ensure clarity and legal protection for both parties involved. Below is a list of commonly used documents that may be relevant in such transactions.

- Loan Agreement: This document details the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the loan's conditions.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged by the borrower. It outlines the lender's rights in case of default.

- Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and terms. It ensures that the borrower understands the costs associated with the loan.

- Personal Guarantee: A personal guarantee may be required from the borrower or a third party, ensuring that they will repay the loan personally if the borrower defaults.

- Bill of Sale: This document is essential for transferring ownership of personal property, providing a legal proof of transaction between the buyer and seller. For more information, visit https://nypdfforms.com.

- Payment Schedule: This document outlines the specific dates and amounts of payments due throughout the loan term, helping both parties keep track of obligations.

- Amendment Agreement: If any terms of the original Promissory Note need to be changed, this document formally amends the agreement, ensuring both parties consent to the new terms.

- Default Notice: In the event of non-payment, this notice is issued to inform the borrower of the default and the potential consequences, including legal action.

- Release of Liability: Once the loan is repaid, this document confirms that the borrower has fulfilled their obligations and releases them from any further liability regarding the loan.

Understanding these accompanying documents can help borrowers and lenders navigate their financial agreements more effectively. Each document plays a role in ensuring transparency and protecting the interests of all parties involved in the transaction.

Similar forms

A promissory note is often compared to a loan agreement, as both documents outline the terms of borrowing money. A loan agreement details the amount borrowed, the interest rate, and the repayment schedule. However, it typically includes more extensive legal language and conditions than a promissory note. While a promissory note is a straightforward promise to pay, a loan agreement may cover additional aspects like collateral, default consequences, and borrower responsibilities, making it more comprehensive for larger or more complex transactions.

Another document similar to a promissory note is a mortgage. A mortgage is a specific type of loan secured by real property. While a promissory note is simply a promise to repay, a mortgage involves a legal claim against the property itself. If the borrower fails to repay, the lender can take possession of the property through foreclosure. This document also includes terms about interest rates and payment schedules, but it adds layers of security for the lender by tying the loan to a tangible asset.

A personal guarantee can also resemble a promissory note. This document involves a third party agreeing to take responsibility for a debt if the primary borrower defaults. Like a promissory note, it signifies a commitment to repay; however, it adds another layer of accountability. In this case, the lender has the option to pursue the guarantor for payment if the borrower fails to fulfill their obligation, providing additional security for the lender.

Credit agreements are another type of document that shares similarities with promissory notes. These agreements outline the terms under which a borrower can access credit from a lender. They include details about the credit limit, interest rates, and repayment terms. Unlike a promissory note, which is a one-time promise to pay a specific amount, a credit agreement often allows for ongoing borrowing and repayment, making it a more flexible option for consumers and businesses alike.

For those navigating the process of buying or selling a mobile home, it is essential to utilize a clear and formalized approach, such as a Mobile Home Bill of Sale, to ensure that all parties understand their rights and obligations throughout the transaction.

In the realm of business transactions, a business loan agreement is closely related to a promissory note. This document specifies the terms of a loan made to a business entity. While a promissory note can be used for personal loans, a business loan agreement often includes additional clauses that address the unique risks and needs of businesses, such as financial covenants and operational restrictions. It serves to protect the lender while ensuring the borrower understands their obligations.

Lease agreements also share some characteristics with promissory notes, particularly when it comes to payment obligations. A lease agreement outlines the terms under which a tenant pays rent to a landlord. Like a promissory note, it specifies the amount due and the payment schedule. However, a lease agreement typically involves a longer-term commitment and includes conditions regarding property use, maintenance responsibilities, and termination clauses, making it more complex than a simple promise to pay.

Lastly, a conditional sales contract is similar to a promissory note in that it involves a promise to pay for goods or services over time. In this arrangement, the buyer agrees to pay for an item, like a vehicle, in installments. The seller retains ownership of the item until the buyer completes all payments. While both documents involve a payment promise, a conditional sales contract ties the payment to the specific item being purchased, creating a unique set of rights and obligations for both parties.

Dos and Don'ts

When filling out a Promissory Note form, there are several important things to keep in mind. Here’s a list of what to do and what to avoid:

- Do ensure all personal information is accurate and complete.

- Do clearly state the loan amount and interest rate.

- Do specify the repayment terms, including due dates.

- Do sign and date the document before submitting it.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be clear and specific in your terms.

By following these guidelines, you can help ensure that your Promissory Note is filled out correctly and serves its intended purpose.

Key takeaways

When filling out and using a Promissory Note form, it's important to keep several key points in mind. Below are five essential takeaways:

- Clear Identification: Ensure that all parties involved are clearly identified. This includes the borrower and the lender, along with their addresses and contact information.

- Loan Amount: Specify the exact amount being borrowed. This figure should be clearly stated in both numerical and written form to avoid any confusion.

- Interest Rate: If applicable, include the interest rate. This can be a fixed rate or variable, but it must be clearly defined in the document.

- Repayment Terms: Outline the repayment schedule. Indicate the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Signatures: Ensure that all parties sign the document. This confirms their agreement to the terms outlined in the Promissory Note.

Following these guidelines can help ensure that the Promissory Note is effective and legally binding.

How to Use Promissory Note

Once you have the Promissory Note form in hand, it’s time to fill it out carefully. This document will need accurate information to ensure that all parties involved are clear on the terms. Follow these steps to complete the form correctly.

- Identify the parties: Write the full legal names of both the borrower and the lender at the top of the form.

- Enter the loan amount: Clearly state the total amount of money being borrowed.

- Specify the interest rate: If applicable, include the annual interest rate as a percentage.

- Set the repayment schedule: Indicate how often payments will be made (e.g., monthly, quarterly) and the due date for the first payment.

- Include the maturity date: This is the date when the loan must be fully repaid.

- Detail any collateral: If the loan is secured by collateral, describe the asset clearly.

- Sign the document: Both the borrower and the lender should sign and date the form at the designated spots.

- Provide additional information: If necessary, include any additional terms or conditions that apply to the loan.

After completing the form, ensure that all parties receive a copy for their records. This helps maintain transparency and accountability moving forward.