Printable Quitclaim Deed Form

When it comes to transferring property ownership, understanding the Quitclaim Deed form is essential for anyone involved in real estate transactions. This particular form allows one party, known as the grantor, to relinquish any claim or interest they may have in a property to another party, the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply conveys whatever interest the grantor may possess, if any. This makes it a popular choice for situations such as transferring property between family members, resolving disputes, or clearing up title issues. Additionally, the form must be properly executed and recorded to ensure that the transfer is legally recognized. Understanding the implications of using a Quitclaim Deed can help individuals navigate the complexities of property ownership and ensure a smoother transaction process.

State-specific Tips for Quitclaim Deed Templates

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This can lead to confusion and potential legal issues down the line.

-

Missing Signatures: All parties involved must sign the deed. Omitting a signature can render the document invalid.

-

Improper Notarization: A quitclaim deed typically needs to be notarized. If this step is overlooked, the deed may not be accepted by the county recorder.

-

Failure to Check State Requirements: Different states have varying requirements for quitclaim deeds. Not adhering to these can result in delays or rejection.

-

Inaccurate Grantee Information: Providing incorrect information about the person receiving the property can lead to ownership disputes. It’s essential to double-check names and addresses.

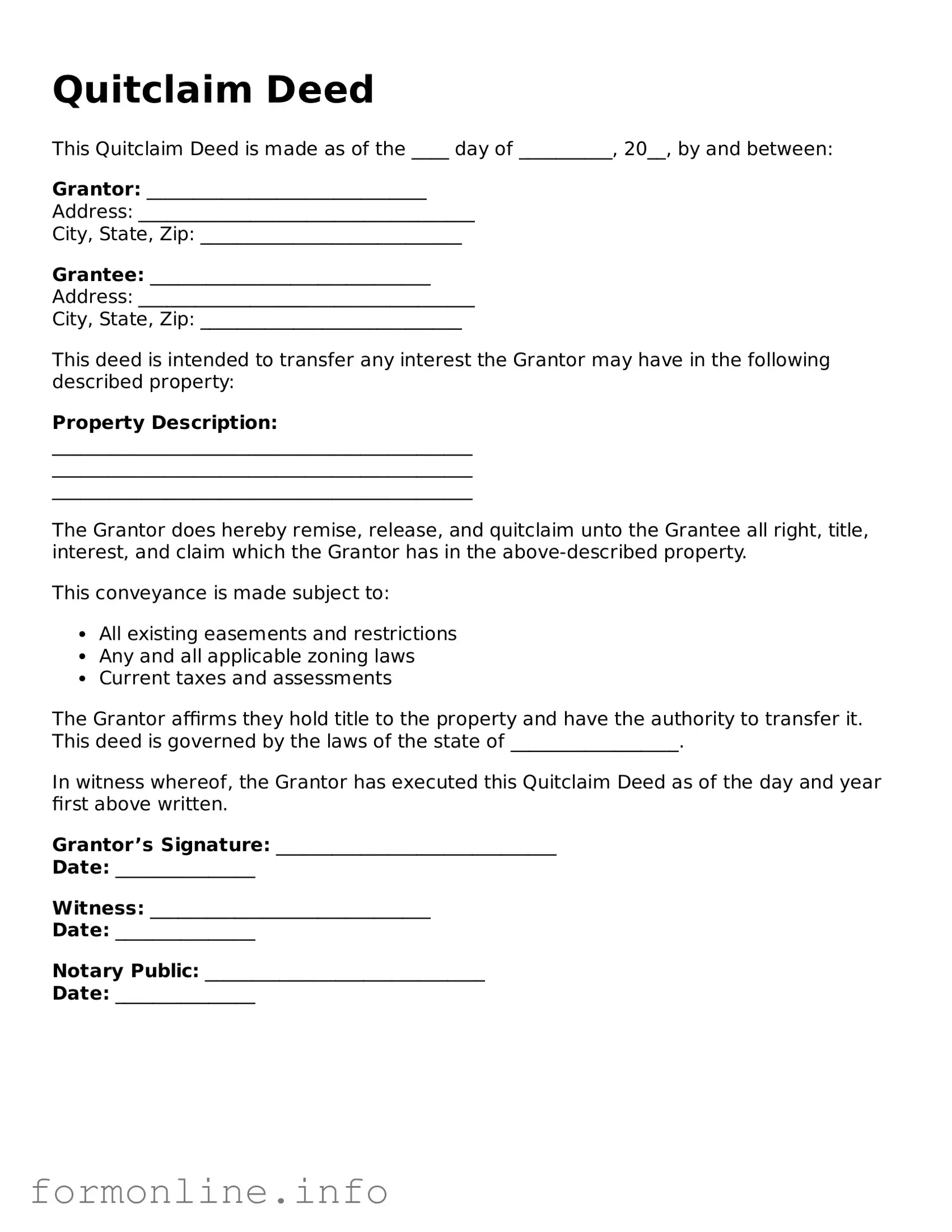

Preview - Quitclaim Deed Form

Quitclaim Deed

This Quitclaim Deed is made as of the ____ day of __________, 20__, by and between:

Grantor: ______________________________

Address: ____________________________________

City, State, Zip: ____________________________

Grantee: ______________________________

Address: ____________________________________

City, State, Zip: ____________________________

This deed is intended to transfer any interest the Grantor may have in the following described property:

Property Description:

_____________________________________________

_____________________________________________

_____________________________________________

The Grantor does hereby remise, release, and quitclaim unto the Grantee all right, title, interest, and claim which the Grantor has in the above-described property.

This conveyance is made subject to:

- All existing easements and restrictions

- Any and all applicable zoning laws

- Current taxes and assessments

The Grantor affirms they hold title to the property and have the authority to transfer it. This deed is governed by the laws of the state of __________________.

In witness whereof, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

Grantor’s Signature: ______________________________

Date: _______________

Witness: ______________________________

Date: _______________

Notary Public: ______________________________

Date: _______________

More Types of Quitclaim Deed Templates:

Lady Bird Deed Example - Using a Lady Bird Deed can streamline the transfer of property without the need for a will.

When engaging in a vehicle transaction, it is crucial to utilize the South Carolina Motor Vehicle Bill of Sale form properly, as it acts not only as a record of the sale but also as a safeguard for both the buyer and the seller. For further details and to obtain this important document, you can visit https://autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form.

Does California Have a Transfer on Death Deed - One of the greatest advantages is that property remains in the owner's control until death.

Free Deed of Trust Template - It can streamline the foreclosure process if needed.

Documents used along the form

A Quitclaim Deed is a useful document for transferring ownership of property. However, several other forms often accompany it to ensure a smooth transaction and clear record of ownership. Below are four commonly used documents that may be relevant when executing a Quitclaim Deed.

- Property Transfer Tax Form: This form is required in many jurisdictions to report the transfer of property and assess any applicable taxes. It helps local governments track property transactions and ensures compliance with tax regulations.

- Mobile Home Bill of Sale: Essential for the transfer of ownership of a mobile home in Missouri, this document outlines the buyer's and seller's information, the mobile home's description, and the sale price. For more details, refer to the Mobile Home Bill of Sale.

- Affidavit of Title: This document is a sworn statement by the seller confirming their ownership of the property and asserting that there are no undisclosed liens or claims against it. It provides additional protection to the buyer by affirming the seller's legal standing.

- Title Search Report: A title search report is an investigation of the property’s title history. It reveals any existing liens, encumbrances, or legal issues that may affect ownership. This report is crucial for buyers to understand what they are acquiring.

- Closing Statement: This document outlines all financial details related to the property transaction, including purchase price, closing costs, and any adjustments. It provides a clear summary of the transaction for both parties and is typically reviewed at the closing meeting.

These documents work together with the Quitclaim Deed to facilitate a clear and legally sound transfer of property. Properly completing and understanding these forms can help prevent future disputes and ensure a smooth transition of ownership.

Similar forms

A warranty deed is a document that transfers ownership of property from one party to another, guaranteeing that the seller has clear title to the property. Unlike a quitclaim deed, which offers no guarantees, a warranty deed assures the buyer that the property is free from any claims or liens. This added security makes warranty deeds more common in traditional real estate transactions, where buyers want to ensure they are getting a legitimate title.

A special warranty deed is similar to a warranty deed but with a crucial difference. It only guarantees that the seller has not done anything to harm the title during their ownership. This means that while the seller is responsible for their actions, they do not make any promises about the title's history before their ownership. This type of deed is often used in commercial transactions.

A grant deed is another type of property transfer document. It provides some assurance to the buyer that the seller has not transferred the property to anyone else and that the property is free from encumbrances created by the seller. While it offers more protection than a quitclaim deed, it does not provide the same level of assurance as a warranty deed. Grant deeds are commonly used in many real estate transactions.

For individuals navigating the complexities of licensing in the nursing field, it's crucial to consider the AZ Forms Online resource, which provides essential guidance on the Arizona Board of Nursing License form. Understanding this official document will ensure that all necessary steps for obtaining or renewing a nursing license are followed correctly, in compliance with state regulations.

A deed of trust is a legal document used to secure a loan on real property. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee, who holds it as security for the loan. If the borrower defaults, the trustee can sell the property to satisfy the debt. This document differs from a quitclaim deed, as it is primarily concerned with securing a loan rather than transferring ownership.

An easement deed grants a person or entity the right to use a portion of another person's property for a specific purpose, such as access or utility installation. This document does not transfer ownership but allows for certain uses of the property. Unlike a quitclaim deed, which transfers ownership without warranties, an easement deed establishes rights that can affect property use.

A lease agreement is a contract that allows one party to use another party's property for a specified period in exchange for payment. While a lease does not transfer ownership, it establishes a legal relationship between the landlord and tenant. This document is different from a quitclaim deed, as it does not involve the transfer of title but rather the temporary use of the property.

A bill of sale is used to transfer ownership of personal property, such as vehicles or equipment. It serves as proof of the transaction and outlines the terms of the sale. Unlike a quitclaim deed, which deals with real estate, a bill of sale is focused on personal property and does not involve the complexities of property title issues.

A trust agreement establishes a trust, which is a legal entity that holds property for the benefit of designated beneficiaries. While a quitclaim deed transfers property directly, a trust agreement involves a third party (the trustee) who manages the property according to the terms of the trust. This document provides a different approach to property management and ownership transfer.

An affidavit of heirship is a document used to establish the heirs of a deceased person’s estate when there is no will. It helps clarify who inherits property and can be used to transfer title without going through probate. While a quitclaim deed transfers property ownership, an affidavit of heirship serves to identify rightful heirs and facilitate the transfer process.

A partition deed is used when co-owners of property decide to divide their interests in the property. This document outlines how the property will be divided among the owners. Unlike a quitclaim deed, which transfers ownership without division, a partition deed formalizes the division of property, ensuring that each owner receives their designated share.

Dos and Don'ts

When filling out a Quitclaim Deed form, it is important to approach the task with care. This document transfers ownership of property from one party to another, and accuracy is essential. Here are some important dos and don’ts to consider:

- Do ensure that all parties involved are correctly identified, including their full names and addresses.

- Do clearly describe the property being transferred, including any relevant details such as the legal description.

- Do sign the form in front of a notary public to ensure its validity.

- Do check local laws and regulations to confirm that you are using the correct version of the Quitclaim Deed.

- Don’t leave any blanks on the form; all fields should be filled out completely.

- Don’t use vague language when describing the property; specificity is crucial.

- Don’t forget to file the completed Quitclaim Deed with the appropriate local government office to make the transfer official.

Key takeaways

Here are some important points to consider when filling out and using a Quitclaim Deed form:

- Understand the purpose of a Quitclaim Deed. It transfers ownership interest in a property without guaranteeing the title's validity.

- Gather all necessary information. This includes the names of the grantor (the person giving up the interest) and the grantee (the person receiving the interest).

- Clearly describe the property. Include the address and legal description to avoid confusion.

- Ensure that the form is signed in front of a notary public. This step is essential for the deed to be legally valid.

- Check state requirements. Some states may have specific rules regarding Quitclaim Deeds.

- Record the Quitclaim Deed with the county recorder's office. This makes the transfer official and protects the grantee's rights.

- Be aware of tax implications. Transferring property may have tax consequences that should be considered.

- Keep a copy of the completed Quitclaim Deed for your records. This is important for future reference.

- Consult a legal professional if you have questions. It's always wise to seek advice when dealing with property transfers.

- Remember that a Quitclaim Deed does not clear any liens or debts associated with the property. The grantee may still be responsible for those.

How to Use Quitclaim Deed

After completing the Quitclaim Deed form, you will need to ensure it is signed and notarized before submitting it to the appropriate local government office. This step is essential to make the transfer of property official and legally binding.

- Obtain the Form: Acquire the Quitclaim Deed form from your local county recorder's office or download it from a reliable online source.

- Identify the Parties: Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide Property Description: Include a clear description of the property being transferred. This typically includes the address and legal description.

- Specify Consideration: Indicate the consideration, or value, exchanged for the property. If no money is involved, you can state “for love and affection” or similar wording.

- Sign the Document: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name provided on the form.

- Notarization: Have the notary public complete their section on the form, confirming the identity of the signer and the authenticity of the signature.

- Submit the Form: Take the completed and notarized Quitclaim Deed to your local county recorder's office to file it. There may be a filing fee.