Printable Real Estate Power of Attorney Form

The Real Estate Power of Attorney (POA) form serves as a vital tool in real estate transactions, allowing individuals to appoint someone they trust to act on their behalf in matters related to property management and transactions. This form is particularly useful when the property owner is unable to be present for important decisions or actions, such as buying, selling, or leasing property. By granting this authority, the principal can ensure that their interests are represented, whether due to travel, health issues, or other commitments. The form typically includes essential details, such as the names of the principal and agent, the specific powers granted, and any limitations on those powers. Additionally, it may require notarization to enhance its legal validity. Understanding the implications of this document is crucial, as it not only facilitates smoother real estate dealings but also protects the principal’s rights and interests. As with any legal document, careful consideration and, if necessary, consultation with a legal professional are advisable to ensure that the form meets the specific needs of the individual and complies with state laws.

Common mistakes

-

Not Clearly Identifying the Principal: It is essential to provide accurate personal information about the person granting the power of attorney. Omitting details or using incorrect names can lead to confusion or invalidation of the document.

-

Failing to Specify Powers Granted: The form should clearly outline the specific powers being granted. Vague language can result in misunderstandings about what the agent is authorized to do.

-

Neglecting to Include an Effective Date: Without a specified date, it may be unclear when the power of attorney becomes effective. This can create complications in real estate transactions.

-

Not Signing the Document Properly: All parties involved must sign the document in accordance with state laws. Failure to do so can render the power of attorney ineffective.

-

Ignoring Witness and Notary Requirements: Many states require the presence of witnesses or a notary public for the document to be valid. Skipping this step can lead to legal challenges.

-

Forgetting to Update the Document: Life circumstances change, and so should the power of attorney. Failing to update the form can lead to outdated information and potential disputes.

-

Overlooking Revocation Procedures: Individuals should understand how to revoke a power of attorney if needed. Not including this information can create confusion if the principal wishes to change their agent.

-

Assuming All Agents Have Equal Authority: If multiple agents are appointed, it’s important to clarify their powers. Assuming they all have the same authority can lead to conflicting actions and decisions.

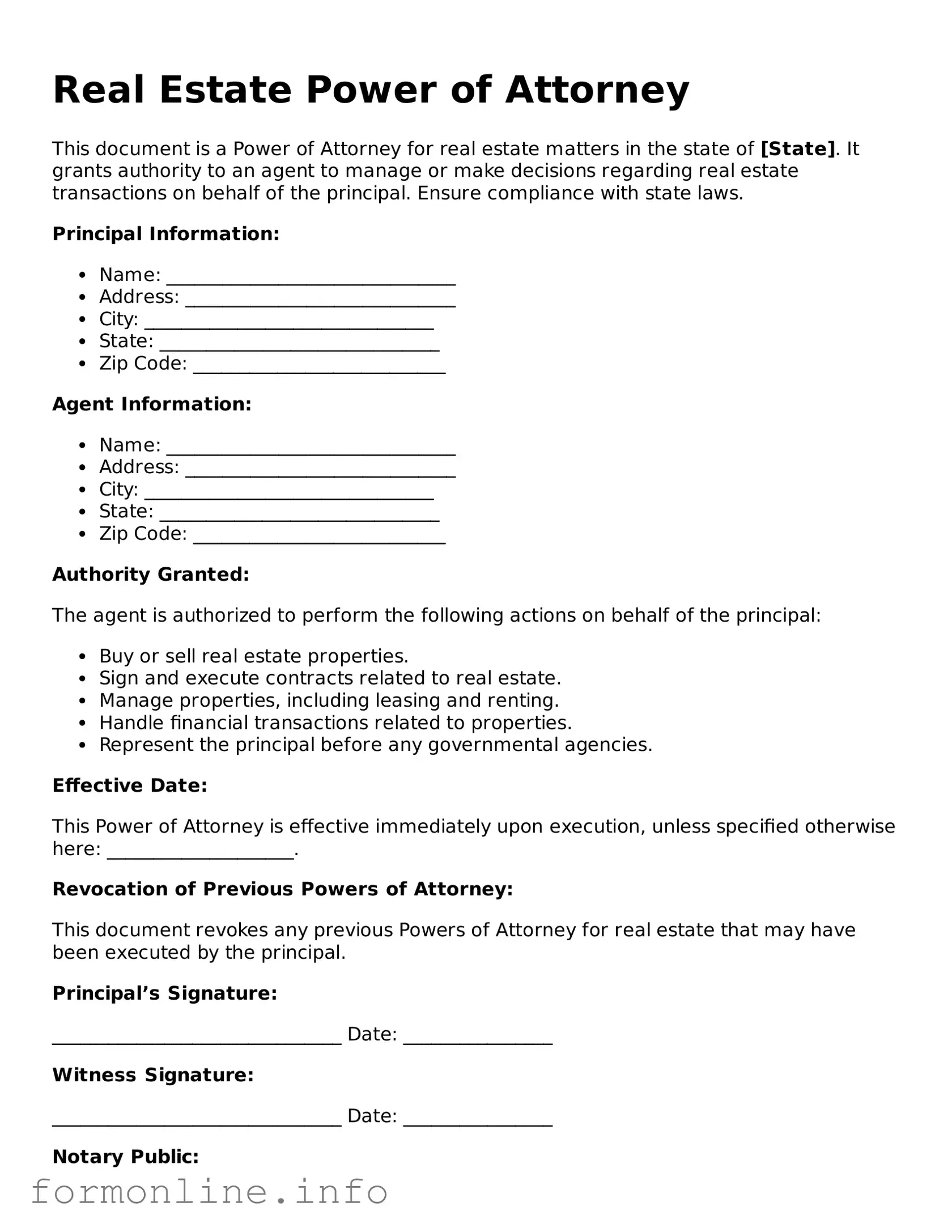

Preview - Real Estate Power of Attorney Form

Real Estate Power of Attorney

This document is a Power of Attorney for real estate matters in the state of [State]. It grants authority to an agent to manage or make decisions regarding real estate transactions on behalf of the principal. Ensure compliance with state laws.

Principal Information:

- Name: _______________________________

- Address: _____________________________

- City: _______________________________

- State: ______________________________

- Zip Code: ___________________________

Agent Information:

- Name: _______________________________

- Address: _____________________________

- City: _______________________________

- State: ______________________________

- Zip Code: ___________________________

Authority Granted:

The agent is authorized to perform the following actions on behalf of the principal:

- Buy or sell real estate properties.

- Sign and execute contracts related to real estate.

- Manage properties, including leasing and renting.

- Handle financial transactions related to properties.

- Represent the principal before any governmental agencies.

Effective Date:

This Power of Attorney is effective immediately upon execution, unless specified otherwise here: ____________________.

Revocation of Previous Powers of Attorney:

This document revokes any previous Powers of Attorney for real estate that may have been executed by the principal.

Principal’s Signature:

_______________________________ Date: ________________

Witness Signature:

_______________________________ Date: ________________

Notary Public:

State of ____________________, County of ___________________

Subscribed and sworn to before me on this _____ day of ____________, 20__.

_______________________________

Notary Public Signature

My Commission Expires: ________________

More Types of Real Estate Power of Attorney Templates:

Does Ca Dmv Power of Attorney Need to Be Notarized - This document allows for the execution of important vehicle documents without your presence.

The Arizona Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This form can cover various aspects, including financial matters and healthcare decisions. For those looking for assistance with this process, resources such as AZ Forms Online can be invaluable in understanding its purpose and requirements, making it essential for anyone considering this important legal tool.

Documents used along the form

A Real Estate Power of Attorney (POA) is a crucial document that allows one person to act on behalf of another in real estate transactions. However, several other forms and documents may accompany this form to ensure that the transaction is executed smoothly and legally. Below are some of the common documents that are often used in conjunction with a Real Estate Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It is essential for managing affairs when the principal is unable to make decisions.

- Property Deed: This legal document conveys ownership of real property from one party to another. It is often necessary to accompany the power of attorney when transferring property ownership.

- Real Estate Purchase Agreement: This contract outlines the terms of a sale between a buyer and seller. It provides details such as the sale price, property description, and closing date.

- Disclosure Statements: These documents provide necessary information about the property's condition, including any known defects or issues. They help protect both the buyer and seller during the transaction.

- Power of Attorney Form: For those looking to delegate authority in legal matters, consider our essential Power of Attorney form resources to ensure proper representation.

- Closing Statement: Also known as a settlement statement, this document summarizes the financial aspects of the transaction, including costs, fees, and the final amount due at closing.

- Title Insurance Policy: This insurance protects against losses due to defects in the title or ownership disputes. It is often required by lenders and provides peace of mind to the buyer.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and assures the buyer that there are no undisclosed liens or claims against it.

Utilizing a Real Estate Power of Attorney alongside these documents can streamline the process and safeguard the interests of all parties involved. Each document plays a vital role in ensuring that the transaction is legally sound and that the rights of the individuals are protected throughout the process.

Similar forms

The Real Estate Power of Attorney (POA) form is similar to a General Power of Attorney. Both documents allow one person to act on behalf of another in various matters. While a Real Estate POA is specifically focused on real estate transactions, a General POA covers a broader range of financial and legal decisions. This means that the agent can handle everything from banking to property management, depending on the authority granted by the principal. Both forms require careful consideration of the agent's powers and the principal's intentions.

A Durable Power of Attorney is another document that shares similarities with the Real Estate POA. The key difference lies in the durability of the authority granted. A Durable POA remains effective even if the principal becomes incapacitated, allowing the agent to continue making decisions on behalf of the principal. This is particularly important in real estate transactions, where timely decisions may be crucial. Both documents require clear language to ensure that the agent’s powers are understood and respected.

A Power of Attorney form can be an essential part of estate planning in California, ensuring that your wishes are honored when you're unable to make decisions for yourself. It's important to familiarize yourself with the different types available, such as the General Power of Attorney and the Medical Power of Attorney, as each serves unique purposes and scopes of authority. For those seeking a customizable option, it's worth exploring the editable versions found at https://californiapdf.com/editable-power-of-attorney/, allowing you to tailor the document to fit specific needs and preferences.

The Limited Power of Attorney also resembles the Real Estate POA, but it is more restrictive. A Limited POA grants an agent authority to act on behalf of the principal for specific tasks or for a limited time. For instance, a Limited POA might allow someone to sign a property sale agreement while the principal is out of the country. This form provides flexibility and control, ensuring that the principal retains authority over other matters. Both documents require clarity in defining the scope of authority granted.

A Medical Power of Attorney, while focused on healthcare decisions, shares the fundamental principle of appointing an agent to act on behalf of another person. This document allows the appointed individual to make medical decisions if the principal is unable to do so. Like the Real Estate POA, it emphasizes trust in the agent's judgment. Both documents require the principal to choose someone they trust implicitly, as the agent will have significant authority over important decisions.

Lastly, the Financial Power of Attorney is akin to the Real Estate POA in that it authorizes someone to manage financial affairs. While the Real Estate POA is limited to real estate transactions, a Financial POA can cover a wide range of financial matters, including banking, investments, and property management. This document is essential for individuals who want to ensure their financial interests are protected, especially in situations where they may be unable to manage their affairs. Both forms necessitate a clear understanding of the powers being granted to the agent.

Dos and Don'ts

When filling out a Real Estate Power of Attorney form, it is essential to follow certain guidelines to ensure the document is valid and effective. Here are nine things you should and shouldn't do:

- Do: Clearly identify the principal and the agent in the form.

- Do: Specify the powers granted to the agent, including any limitations.

- Do: Ensure the form is signed in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Do: Review the form for accuracy before submission.

- Don't: Leave any sections of the form blank, as this may lead to confusion.

- Don't: Use vague language that could be misinterpreted.

- Don't: Sign the form without understanding the implications of the powers granted.

- Don't: Forget to check state-specific requirements, as they may vary.

Key takeaways

Here are some important points to consider when filling out and using the Real Estate Power of Attorney form:

- Ensure that the form is completed accurately and legibly. Mistakes can lead to delays or invalidation.

- The principal must be of sound mind and legal age when signing the document.

- Clearly define the powers granted to the agent. This helps avoid confusion and potential disputes.

- Consider having the document notarized. Notarization can enhance the form's credibility and may be required by some institutions.

- Keep copies of the signed form in a safe place. This ensures that all parties have access to the document when needed.

How to Use Real Estate Power of Attorney

Filling out a Real Estate Power of Attorney form is straightforward. This document allows someone to act on your behalf in real estate transactions. You’ll need to provide specific information about yourself and the person you’re granting authority to. Follow these steps to complete the form accurately.

- Start with your full legal name and address. Ensure the information is current and correct.

- Next, enter the name and address of the person you are granting power of attorney to. This is the agent who will represent you.

- Clearly specify the powers you are granting. Indicate whether the agent can handle all real estate transactions or just specific ones.

- Include the date when the power of attorney becomes effective. This could be immediately or at a future date.

- Sign the document in the presence of a notary public. Your signature must match the name you provided at the beginning.

- Have the notary public complete their section. They will verify your identity and witness your signature.

- Make copies of the signed document for your records and for the agent.

Once you’ve completed these steps, your Real Estate Power of Attorney form will be ready to use. Keep it in a safe place and inform your agent where they can access it when needed.