Printable Real Estate Purchase Agreement Form

The Real Estate Purchase Agreement (REPA) serves as a foundational document in the property transaction process, encapsulating the essential terms and conditions agreed upon by the buyer and seller. This legally binding contract outlines critical elements such as the purchase price, financing arrangements, and the timeline for closing the sale. Additionally, it specifies contingencies that may affect the transaction, including inspections, appraisals, and the buyer's ability to secure financing. The REPA also addresses the responsibilities of both parties, detailing what is expected during the transaction, from disclosures about the property to the handling of earnest money deposits. By clearly defining these aspects, the agreement not only protects the interests of both parties but also helps to facilitate a smoother transaction process, minimizing the potential for disputes. Understanding the components of the REPA is essential for anyone involved in real estate transactions, as it lays the groundwork for a successful transfer of property ownership.

State-specific Tips for Real Estate Purchase Agreement Templates

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. This includes missing names, addresses, or contact details of the buyer and seller. Ensure that every section is filled out completely to avoid delays.

-

Incorrect Property Description: Accurately describing the property is crucial. Errors in the address or legal description can lead to confusion or disputes. Always double-check the property details before submitting the form.

-

Neglecting to Specify Terms: The agreement should clearly outline the terms of the sale, including the purchase price, deposit amount, and closing date. Leaving these details vague can lead to misunderstandings later on.

-

Ignoring Contingencies: Contingencies protect both parties. Failing to include them, such as home inspections or financing conditions, may expose you to unnecessary risks. It’s wise to address these aspects explicitly.

-

Not Understanding the Legal Implications: Many people overlook the legal significance of the agreement. Each clause can have serious consequences. Taking the time to understand what you are agreeing to is essential.

-

Forgetting Signatures: A signed agreement is legally binding. Omitting signatures from either party can render the contract invalid. Always confirm that all necessary signatures are present before finalizing the document.

-

Failing to Keep Copies: After submitting the agreement, it’s important to retain a copy for your records. This will help in future reference and in case any disputes arise. Always keep a documented trail of your transactions.

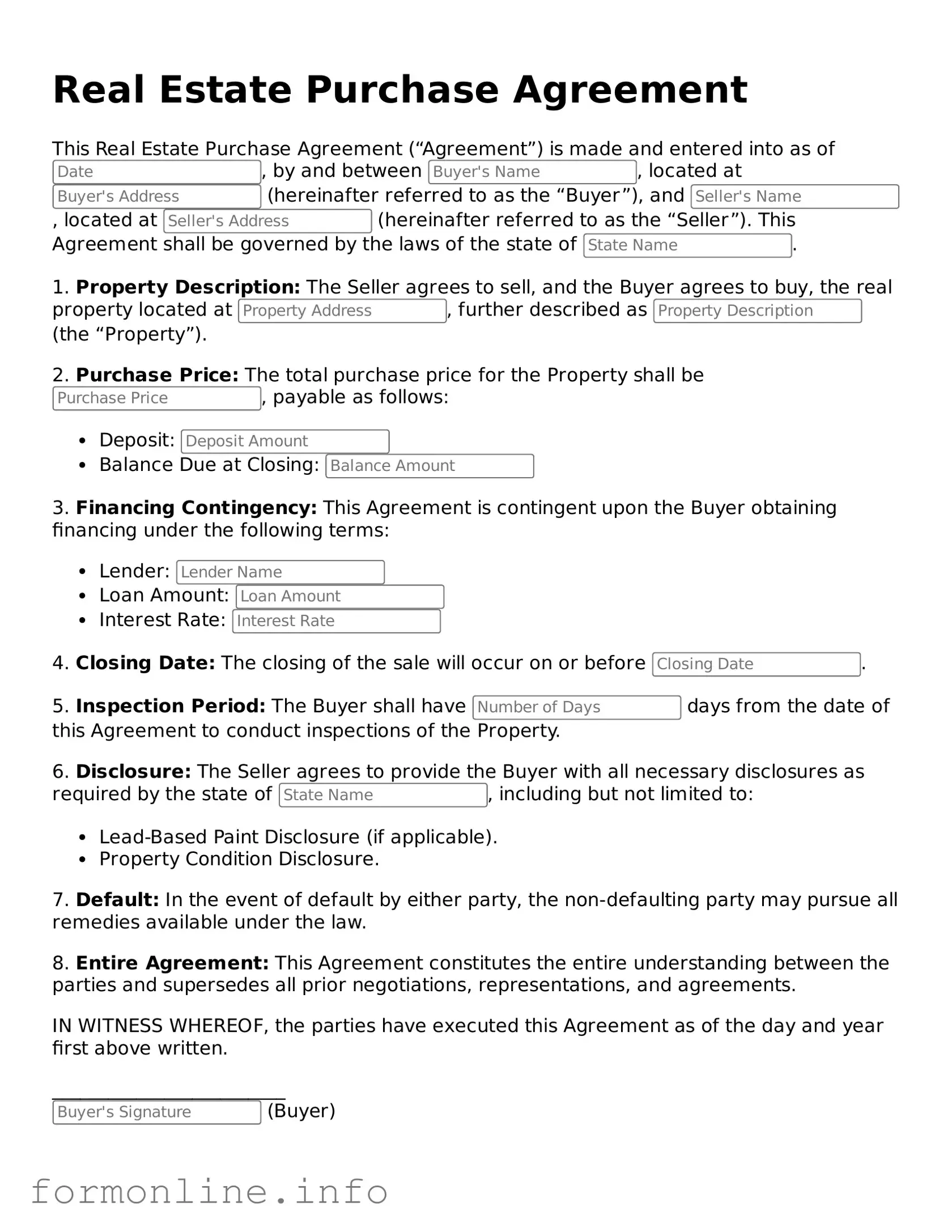

Preview - Real Estate Purchase Agreement Form

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into as of , by and between , located at (hereinafter referred to as the “Buyer”), and , located at (hereinafter referred to as the “Seller”). This Agreement shall be governed by the laws of the state of .

1. Property Description: The Seller agrees to sell, and the Buyer agrees to buy, the real property located at , further described as (the “Property”).

2. Purchase Price: The total purchase price for the Property shall be , payable as follows:

- Deposit:

- Balance Due at Closing:

3. Financing Contingency: This Agreement is contingent upon the Buyer obtaining financing under the following terms:

- Lender:

- Loan Amount:

- Interest Rate:

4. Closing Date: The closing of the sale will occur on or before .

5. Inspection Period: The Buyer shall have days from the date of this Agreement to conduct inspections of the Property.

6. Disclosure: The Seller agrees to provide the Buyer with all necessary disclosures as required by the state of , including but not limited to:

- Lead-Based Paint Disclosure (if applicable).

- Property Condition Disclosure.

7. Default: In the event of default by either party, the non-defaulting party may pursue all remedies available under the law.

8. Entire Agreement: This Agreement constitutes the entire understanding between the parties and supersedes all prior negotiations, representations, and agreements.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

_________________________

(Buyer)

_________________________

(Seller)

Common Forms:

Letter of Intent to Buy - May involve negotiations over confidentiality and exclusivity periods.

The Florida Articles of Incorporation is a crucial document that officially establishes a corporation in the state of Florida. This form outlines essential details about the corporation, such as its name, purpose, and authorized shares. To facilitate this process, individuals can refer to the Articles of Incorporation form, which serves as a valuable resource for ensuring a smooth and compliant incorporation process.

Acord Binder - Legal compliance is a primary function of the Acord 50 WM form.

Real Estate Purchase Agreement Form Subtypes

Documents used along the form

The Real Estate Purchase Agreement is a key document in real estate transactions, but it is often accompanied by several other forms and documents that facilitate the process. Below is a list of commonly used documents that complement the Purchase Agreement.

- Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are typically required to disclose information about the condition of the home, including any past repairs or hazards, to ensure transparency in the transaction.

- Affidavit of Service: This important document validates that a legal notice has been delivered to the involved parties. For proper completion, refer to the Affidavit of Service form.

- Title Report: A title report provides information about the ownership history of the property. It reveals any liens, easements, or other encumbrances that may affect the buyer’s ownership rights. This report is crucial for ensuring that the title is clear before the sale is finalized.

- Financing Addendum: This document details the terms of financing for the purchase. It may include information about the loan amount, interest rate, and payment schedule. Buyers often use this addendum to specify any contingencies related to obtaining financing.

- Closing Statement: Also known as a settlement statement, this document summarizes the financial details of the transaction at closing. It includes all costs associated with the sale, such as closing costs, commissions, and prorated taxes, providing a clear overview of the final financial obligations for both parties.

Each of these documents plays a vital role in ensuring a smooth transaction process. Understanding their purpose can help both buyers and sellers navigate the complexities of real estate deals more effectively.

Similar forms

The Real Estate Purchase Agreement (REPA) is similar to a Lease Agreement in that both documents outline the terms under which property is used or transferred. A Lease Agreement allows one party to use a property owned by another for a specified period, usually in exchange for rent. Like the REPA, it details obligations, rights, and conditions, ensuring both parties understand their responsibilities. While the REPA culminates in ownership transfer, the Lease Agreement maintains the landlord-tenant relationship, emphasizing the temporary nature of the arrangement.

Another document akin to the Real Estate Purchase Agreement is the Option to Purchase Agreement. This agreement grants a potential buyer the right, but not the obligation, to purchase a property within a specified timeframe. Similar to the REPA, it outlines the purchase price and terms, but it allows for flexibility. The buyer can decide whether to proceed with the purchase, providing a unique opportunity to secure a property without immediate commitment.

The Seller's Disclosure Statement shares similarities with the REPA, as it is often provided during the home buying process. This document requires sellers to disclose known issues or defects related to the property. Like the REPA, it aims to protect buyers by ensuring they are fully informed before making a significant financial commitment. Transparency is key in both documents, helping to avoid disputes after the sale.

The Purchase and Sale Agreement (PSA) is another document that closely resembles the REPA. The PSA outlines the terms of a real estate transaction, similar to the REPA, including purchase price, closing date, and contingencies. While the terminology may differ slightly, both documents serve the same purpose: to formalize the agreement between buyer and seller, ensuring clarity and reducing the risk of misunderstandings.

A Financing Agreement can also be compared to the Real Estate Purchase Agreement. This document details the terms under which a buyer borrows money to purchase property. Like the REPA, it specifies the amount, interest rate, and repayment terms. Both agreements are crucial in the real estate transaction process, as they define the financial obligations that accompany property ownership.

The Escrow Agreement bears resemblance to the REPA as well. This document establishes a neutral third party to hold funds and documents until all conditions of the sale are met. While the REPA focuses on the terms of the sale itself, the Escrow Agreement ensures that both parties fulfill their obligations before the transaction is finalized. This protective measure adds an extra layer of security for both buyers and sellers.

In addition to the important documents mentioned, another essential form in the realm of property transactions is the Mobile Home Bill of Sale, which facilitates the legal transfer of ownership for mobile homes, ensuring all pertinent details are documented and agreed upon by both parties involved.

The Title Insurance Policy also shares characteristics with the Real Estate Purchase Agreement. This document protects the buyer against potential defects in the title of the property. While the REPA outlines the terms of the sale, the Title Insurance Policy ensures that the buyer is safeguarded against unforeseen claims or issues that may arise after the purchase. Both documents work together to provide a secure and informed transaction.

Lastly, the Closing Statement is similar to the Real Estate Purchase Agreement in that it summarizes the final financial details of the transaction. This document outlines the costs, fees, and adjustments associated with the sale. Like the REPA, it is crucial for transparency, ensuring that both parties understand the financial implications before finalizing the purchase. Clarity in the Closing Statement helps prevent surprises at the closing table.

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it is essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do read the entire agreement thoroughly before signing.

- Do include all necessary details, such as the property address and purchase price.

- Do clarify any terms or conditions that are unclear.

- Do ensure that all parties involved sign the agreement.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any blanks; fill in all required fields.

- Don't ignore local laws or regulations that may affect the agreement.

By following these guidelines, you can help ensure that the Real Estate Purchase Agreement is completed correctly and serves its intended purpose effectively.

Key takeaways

When it comes to filling out and using a Real Estate Purchase Agreement, there are several important points to keep in mind. Here are key takeaways to ensure a smooth transaction:

- Understand the Basics: A Real Estate Purchase Agreement is a legally binding document that outlines the terms of a property sale.

- Identify the Parties: Clearly state the names and contact information of both the buyer and the seller. This helps avoid any confusion later on.

- Describe the Property: Provide a detailed description of the property being sold, including its address and any relevant legal descriptions.

- Purchase Price: Clearly specify the agreed-upon purchase price. This is a critical component of the agreement.

- Contingencies: Include any contingencies, such as financing or inspection requirements. These are conditions that must be met for the sale to proceed.

- Closing Date: Establish a timeline for closing the sale. This is when the property officially changes hands.

- Earnest Money: Indicate the amount of earnest money the buyer will provide. This shows the seller that the buyer is serious about the purchase.

- Disclosures: Ensure all necessary disclosures about the property are included. This protects both parties and promotes transparency.

- Signatures: Both parties must sign and date the agreement. Without signatures, the document is not enforceable.

By keeping these points in mind, you can navigate the Real Estate Purchase Agreement process with greater confidence and clarity.

How to Use Real Estate Purchase Agreement

Filling out a Real Estate Purchase Agreement is an important step in the home buying process. Once you have your form ready, you will need to provide specific information to ensure that all parties are on the same page. Below are the steps to help you accurately complete the form.

- Begin by entering the date at the top of the form. This establishes when the agreement is being made.

- Identify the parties involved. Fill in the names and contact information of both the buyer and the seller.

- Clearly describe the property being sold. Include the address, legal description, and any relevant details that define the property.

- Specify the purchase price. Write down the agreed amount that the buyer will pay for the property.

- Outline the payment terms. Indicate how the buyer plans to pay, whether it’s through a mortgage, cash, or other financing options.

- Include any contingencies. These are conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Detail the closing date. State when the transaction will be finalized and ownership will transfer.

- Sign and date the agreement. Both the buyer and seller must sign the document to make it legally binding.

After completing the form, it's crucial to review it carefully for any errors or omissions. Once both parties have signed, the agreement is ready to be executed, leading you one step closer to closing the deal.