Fill Out a Valid Release Of Lien Texas Form

The Release of Lien Texas form serves a crucial role in the process of clearing a property from financial claims, ensuring that the borrower can move forward without lingering obligations. This form is specifically prepared for use by attorneys and provides a structured way to document the release of a lien held by a lender. Key details included in the form encompass the date of the release, the identity of the holder of the note and lien, and their mailing address. It also specifies the original principal amount of the loan, the names of the borrower and lender, and the maturity date, if applicable. Importantly, the form acknowledges that the holder has received full payment of the note, thereby releasing the property from the lien and any associated claims. Furthermore, it includes a waiver of future rights to enforce the lien, ensuring that the borrower is free from any further financial encumbrances related to that debt. The document concludes with sections for notary acknowledgment, which lends it legal validity, and instructions for returning the form after recording. Overall, this form is an essential tool in facilitating clear property ownership and financial freedom for borrowers in Texas.

Common mistakes

-

Neglecting to Include the Date: One common mistake is failing to fill in the date at the top of the form. The date is crucial as it indicates when the release is effective.

-

Incorrect Holder Information: Providing inaccurate details for the holder of the note and lien can lead to confusion. Ensure that the name and mailing address, including the county, are correct.

-

Omitting the Original Principal Amount: Forgetting to specify the original principal amount of the loan is another frequent error. This information is essential for clarity.

-

Not Identifying the Borrower and Lender: Failing to clearly state the names of both the borrower and the lender can cause issues. It is vital to ensure that both parties are correctly identified.

-

Ignoring the Maturity Date: While the maturity date is optional, leaving it blank when it should be included can lead to misunderstandings about the terms of the loan.

-

Misdescribing the Property: The property description must be accurate and thorough. Omitting details or providing vague descriptions can complicate the release process.

-

Not Acknowledging Payment: The form must clearly state that the holder acknowledges payment in full. This acknowledgment is a key part of releasing the lien.

-

Forgetting the Notary Section: Finally, neglecting to have the document notarized can invalidate the release. Ensure the notary’s name and commission expiration date are filled out correctly.

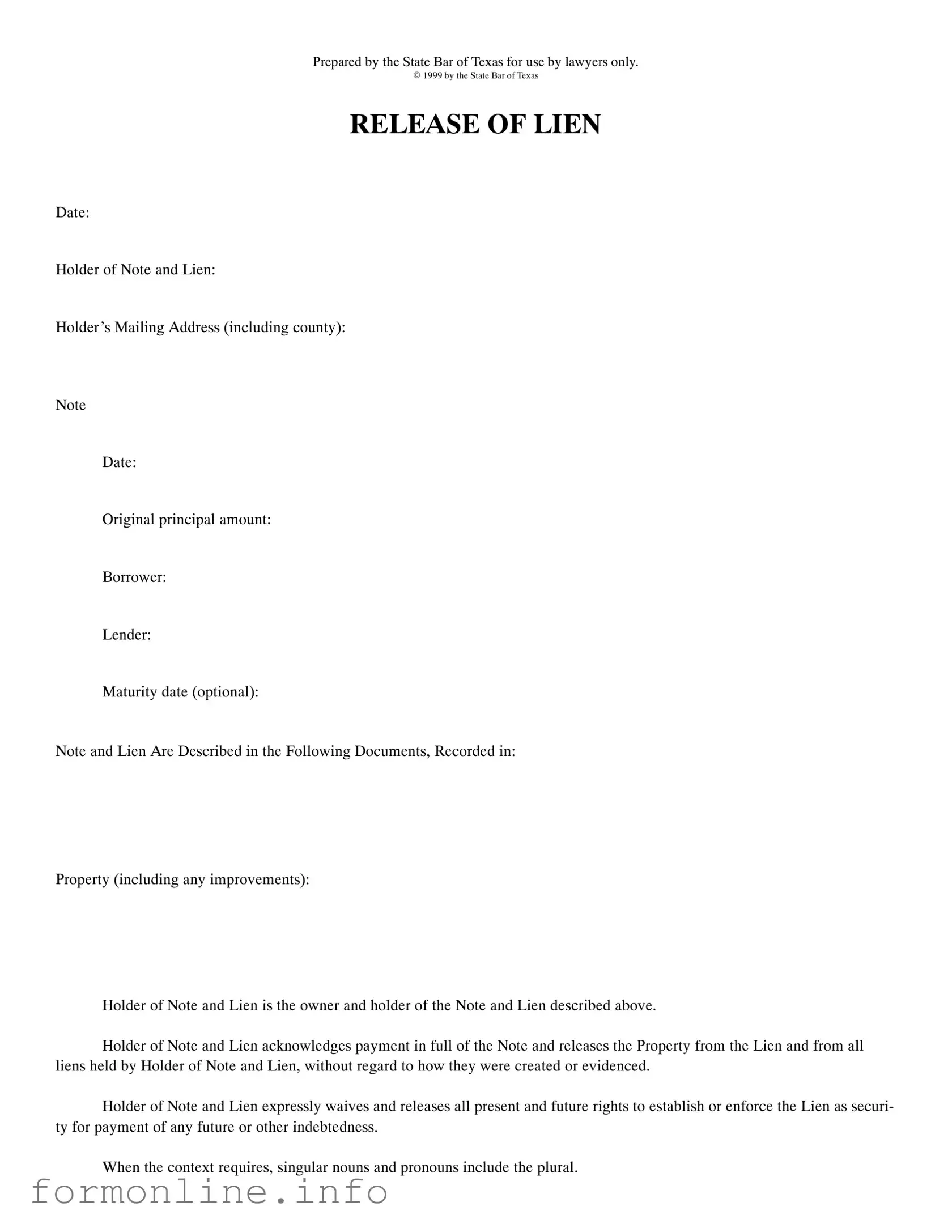

Preview - Release Of Lien Texas Form

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Other PDF Templates

Why Would a Prosecutor Ask for a Continuance - Emergency situations can warrant a continuance, but proper documentation is still required.

In addition to the necessary paperwork, obtaining a reliable autobillofsaleform.com/ohio-motor-vehicle-bill-of-sale-form/ can significantly streamline the vehicle transaction process, ensuring that all legal requirements are met effectively.

Employee Misconduct Form - Documents the third warning details, including sign-off by the supervisor.

Documents used along the form

The Release of Lien Texas form is an essential document for clearing a property from any financial claims. However, several other forms and documents often accompany this release to ensure a smooth transaction. Understanding these documents is crucial for anyone involved in real estate transactions or debt settlements in Texas.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the borrower pays off the debt. It outlines the terms of the loan and the rights of all parties involved.

- Promissory Note: This is a written promise from the borrower to repay a specified amount of money to the lender under agreed-upon terms. It includes details such as the interest rate, payment schedule, and consequences of default.

- Loan Agreement: This comprehensive document outlines the terms of the loan, including the amount borrowed, repayment terms, and any collateral involved. It serves as the legal basis for the lender-borrower relationship.

- Notice of Default: If a borrower fails to meet their payment obligations, this document notifies them of their default. It typically outlines the steps needed to remedy the situation and may precede foreclosure proceedings.

- Mobile Home Bill of Sale: This crucial document facilitates the transfer of mobile home ownership, containing essential details such as the buyer and seller's information, the mobile home's description, and the sale price. It's essential to understand this document for a smooth transaction and to protect both parties' rights. For more information, refer to the Mobile Home Bill of Sale.

- Affidavit of Payment: This sworn statement confirms that the borrower has fulfilled their payment obligations. It can serve as evidence in disputes regarding the status of the lien or loan.

Each of these documents plays a vital role in the transaction process. Ensuring that all necessary forms are correctly completed and filed can prevent future disputes and provide clarity for all parties involved. Take the time to understand these documents to protect your interests effectively.

Similar forms

The Satisfaction of Mortgage document serves a similar purpose to the Release of Lien in Texas. When a mortgage is paid off, this document is filed to officially acknowledge that the borrower has fulfilled their financial obligation. Just like the Release of Lien, the Satisfaction of Mortgage removes the lender’s claim on the property, allowing the homeowner to have a clear title. Both documents signify the end of a financial relationship regarding the property and ensure that the borrower can freely sell or transfer ownership without the burden of the prior debt hanging over them.

Another document that parallels the Release of Lien is the Quitclaim Deed. This deed is often used to transfer ownership of property without any warranties or guarantees about the title. While a Quitclaim Deed does not specifically address the release of liens, it can be used to clear up any claims that may exist on the property. In essence, when a property owner transfers their interest via a Quitclaim Deed, it can implicitly release any liens they may have held, similar to how the Release of Lien formally acknowledges that a debt has been satisfied and the lien is no longer valid.

For those involved in equine transactions, understanding the process is essential. A valuable resource is the comprehensive Horse Bill of Sale guide available at Horse Bill of Sale, which outlines the necessary steps and information required for a smooth transfer of ownership.

The Subordination Agreement is another document that bears resemblance to the Release of Lien. This agreement allows a lender to agree to subordinate their lien position to another lender's lien. While it does not release a lien outright, it alters the priority of the liens on the property. In this way, both documents deal with the hierarchy of claims against a property. A Release of Lien removes a claim entirely, while a Subordination Agreement changes the order in which claims are satisfied, both impacting the rights of the property owner and the lenders involved.

Lastly, the Assignment of Mortgage can be compared to the Release of Lien. This document transfers the lender’s interest in a mortgage to another party. Although it does not release the lien itself, it signifies a change in the holder of the lien. Much like the Release of Lien, which acknowledges that a debt has been paid and the lien is removed, the Assignment of Mortgage indicates that the responsibility and rights associated with the mortgage have shifted. Both documents play crucial roles in the management and transfer of property rights and obligations.

Dos and Don'ts

When filling out the Release Of Lien form in Texas, it is important to approach the process with care. Here are some dos and don'ts to guide you:

- Do ensure all information is accurate and complete. Double-check names, addresses, and dates.

- Do include the correct details about the property and the lien being released.

- Do have the form notarized to validate the release. This step is crucial for legal recognition.

- Do keep a copy of the completed form for your records after filing.

- Do submit the form to the appropriate county office for recording.

- Don't leave any sections blank unless specified. Incomplete forms may lead to delays.

- Don't use outdated versions of the form. Always ensure you have the latest version.

- Don't forget to sign the form before having it notarized. A missing signature can invalidate the document.

- Don't assume that the lien is automatically released without filing the form. Filing is necessary for legal purposes.

- Don't ignore local filing fees that may apply. Be prepared to pay any required fees at the time of submission.

Key takeaways

Filling out and utilizing the Release of Lien form in Texas is a critical step for property owners and lenders. Understanding the nuances of this process can help ensure that all parties are protected and that the transaction is legally sound. Here are some key takeaways:

- Purpose of the Form: The Release of Lien form serves to formally acknowledge that a debt has been paid in full and that the lien on the property is no longer valid.

- Accurate Information: It is essential to provide accurate details, including the names of the holder of the note and lien, the borrower, and the property's description. Errors can lead to complications in the future.

- Notarization Requirement: The form must be acknowledged before a notary public. This step adds an extra layer of verification and ensures the authenticity of the signatures involved.

- Waiving Future Claims: By signing the form, the holder of the lien waives any future rights to enforce the lien for any other debts. This is a significant commitment that should be understood fully.

- Recording the Document: After completing the form, it must be recorded in the appropriate county office to make the release official. This step is crucial for protecting the rights of the property owner.

How to Use Release Of Lien Texas

Completing the Release of Lien form in Texas requires careful attention to detail. After filling out the form, it must be signed and acknowledged by a notary public. Once completed, the form should be filed with the appropriate county office to officially release the lien.

- Begin by entering the Date at the top of the form.

- Fill in the Holder of Note and Lien section with the name of the lien holder.

- Provide the Holder’s Mailing Address, including the county.

- Enter the Note Date when the original loan was issued.

- Specify the Original principal amount of the loan.

- List the name of the Borrower.

- Include the name of the Lender.

- If applicable, fill in the Maturity date.

- Describe the Note and Lien in the designated section, including the documents where they are recorded.

- Provide details about the Property that is subject to the lien, including any improvements.

- Confirm that the Holder of Note and Lien is the owner and holder of the note and lien.

- Acknowledge payment in full and release the property from the lien.

- Sign the form, and ensure to include the Acknowledgment section with the state and county.

- Have a notary public acknowledge the form by filling in their name and commission expiration date.

- If applicable, complete the Corporate Acknowledgment section for corporate signatories.

- Finally, indicate the return address for the completed form after recording.