Printable Release of Promissory Note Form

The Release of Promissory Note form serves as a crucial document in financial transactions, particularly when a borrower has fulfilled their obligation to repay a loan. This form is designed to formally acknowledge that the debt has been satisfied, thereby releasing the borrower from any further obligations associated with the promissory note. It typically includes essential details such as the names of the parties involved, the original amount of the loan, the date of repayment, and any relevant terms that governed the loan agreement. By signing this form, the lender confirms that they relinquish any claim to the debt, providing the borrower with a clear record of their financial responsibility being met. The form not only protects the interests of both parties but also serves as a vital reference in case of future disputes regarding the loan. Ensuring that this document is properly executed can help avoid misunderstandings and provide peace of mind to all involved. As financial transactions evolve, understanding the significance of the Release of Promissory Note form remains essential for both lenders and borrowers alike.

Common mistakes

-

Failing to provide all necessary information. It is crucial to include the names of all parties involved, the date of the original promissory note, and the amount owed. Missing any of these details can lead to confusion or delays.

-

Not signing the document. A signature is essential for the release to be valid. Both the lender and borrower must sign the form to confirm their agreement.

-

Incorrectly dating the form. Ensure that the date on the form reflects the actual date of signing. An incorrect date can create complications in the future.

-

Using vague language. Clear and specific language is important. Ambiguous terms may lead to misunderstandings about the release of obligations.

-

Neglecting to keep copies. After completing the form, retain copies for your records. This can be helpful in case of future disputes or questions.

-

Overlooking state-specific requirements. Different states may have unique regulations regarding promissory notes. It is important to be aware of any specific requirements that apply in your state.

-

Not consulting a professional when needed. If there are uncertainties about the process or the implications of the release, seeking legal advice can provide clarity and ensure that everything is handled correctly.

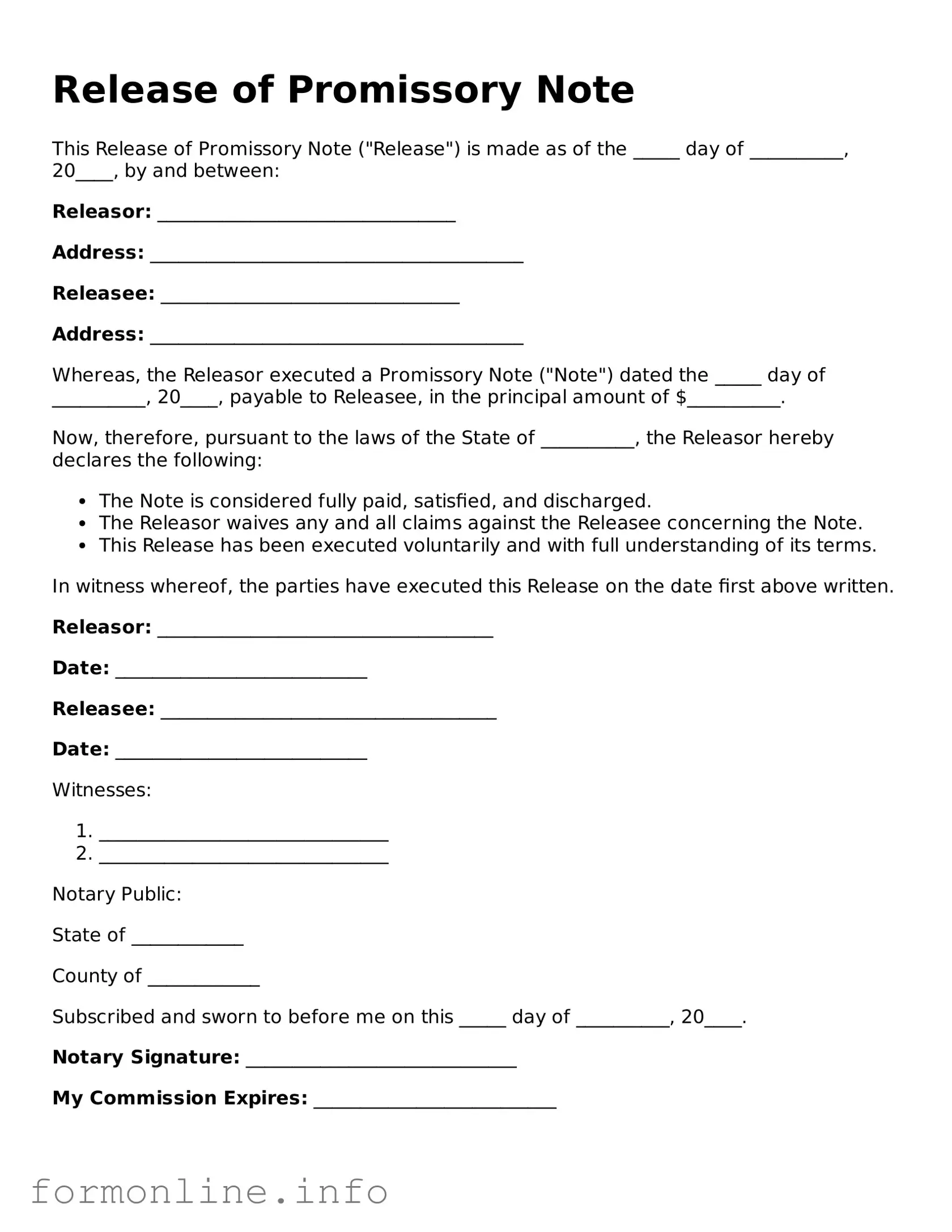

Preview - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note ("Release") is made as of the _____ day of __________, 20____, by and between:

Releasor: ________________________________

Address: ________________________________________

Releasee: ________________________________

Address: ________________________________________

Whereas, the Releasor executed a Promissory Note ("Note") dated the _____ day of __________, 20____, payable to Releasee, in the principal amount of $__________.

Now, therefore, pursuant to the laws of the State of __________, the Releasor hereby declares the following:

- The Note is considered fully paid, satisfied, and discharged.

- The Releasor waives any and all claims against the Releasee concerning the Note.

- This Release has been executed voluntarily and with full understanding of its terms.

In witness whereof, the parties have executed this Release on the date first above written.

Releasor: ____________________________________

Date: ___________________________

Releasee: ____________________________________

Date: ___________________________

Witnesses:

- _______________________________

- _______________________________

Notary Public:

State of ____________

County of ____________

Subscribed and sworn to before me on this _____ day of __________, 20____.

Notary Signature: _____________________________

My Commission Expires: __________________________

More Types of Release of Promissory Note Templates:

Online Promissory Note - Indispensable for anyone looking to understand their financial commitments for a car.

In New Jersey, using a Promissory Note form is essential for establishing the lender-borrower relationship, as it formalizes the commitments and expectations regarding the loan. For individuals seeking a structured approach to their lending agreements, the Money Promissory Note provides a customizable template that can help streamline the process and ensure that all necessary terms are clearly defined and agreed upon.

Documents used along the form

When dealing with a Release of Promissory Note form, several other documents often come into play. Each of these forms serves a specific purpose and can help clarify the agreement between the parties involved. Below is a list of commonly used documents that accompany the Release of Promissory Note.

- Promissory Note: This is the original document where one party promises to pay a specified amount to another party under agreed terms. It outlines the loan amount, interest rate, and repayment schedule.

- Loan Agreement: This document details the terms and conditions of the loan, including repayment terms, collateral, and any penalties for default. It provides a comprehensive overview of the borrowing arrangement.

- Payment Schedule: This outlines the specific dates and amounts due for each payment. It helps both parties keep track of when payments are expected and ensures clarity on payment obligations.

- Security Agreement: If the loan is secured by collateral, this document describes the collateral and the rights of the lender in case of default. It protects the lender's interests by outlining what can be seized if payments are not made.

- Release of Lien: This document is used when a lien on property is released after the debt has been satisfied. It serves as proof that the lender no longer has a claim on the asset.

- Promissory Note Form: To facilitate your lending process, utilize the detailed Maryland Promissory Note form template for proper documentation of loan agreements.

- Settlement Agreement: If there are disputes regarding the loan or repayment, a settlement agreement may be drafted to resolve issues amicably. It outlines the terms of the settlement reached by both parties.

- Affidavit of Debt: This is a sworn statement by the lender confirming the amount owed by the borrower. It can be used in legal proceedings if necessary.

- Notice of Default: If the borrower fails to make payments, this document formally notifies them of their default. It typically outlines the consequences of not addressing the missed payments.

Understanding these documents can help ensure a smoother transaction and provide clarity for all parties involved. Each one plays a role in protecting rights and responsibilities, making it easier to manage financial agreements.

Similar forms

The Release of Promissory Note form is similar to a Loan Satisfaction Letter. This document serves as proof that a borrower has fully repaid their loan. When a lender issues a Loan Satisfaction Letter, it confirms that the borrower has met all obligations under the loan agreement. Just like the Release of Promissory Note, this letter provides assurance to the borrower that their debt has been cleared, allowing them to move forward without lingering financial burdens.

Another comparable document is the Mortgage Satisfaction Document. When a mortgage is paid off, the lender issues this document to release the lien on the property. It signifies that the borrower has fulfilled their payment obligations. Similar to the Release of Promissory Note, the Mortgage Satisfaction Document protects the borrower’s interests by officially stating that they own their property free and clear of the mortgage debt.

The Deed of Reconveyance is also akin to the Release of Promissory Note. This document is used in the context of a trust deed, where a lender conveys the property back to the borrower once the loan is paid off. Just as the Release of Promissory Note signifies the end of a borrower’s obligations, the Deed of Reconveyance formally concludes the lender’s interest in the property, ensuring the borrower’s ownership is restored.

A similar document is the Certificate of Satisfaction. This certificate is issued by a lender to confirm that a debt has been paid in full. It serves as an official acknowledgment that the borrower has completed their financial obligations. Like the Release of Promissory Note, the Certificate of Satisfaction provides peace of mind and legal proof for the borrower, allowing them to demonstrate that they no longer owe the debt.

In addition to understanding various financial documents, it is essential to have access to the correct templates for drafting legal agreements, such as the Promissory Note. To ensure that you have everything you need for this process, consider utilizing a pdf download that can guide you through creating a comprehensive and legally binding contract that protects all parties involved.

Lastly, the Settlement Statement can be compared to the Release of Promissory Note. This document outlines the financial details of a real estate transaction, including the payoff of any existing loans. It provides a comprehensive view of all costs involved in the transaction. While it serves a different purpose, both the Settlement Statement and the Release of Promissory Note offer clarity and transparency regarding financial obligations, ensuring that all parties are on the same page after a transaction is completed.

Dos and Don'ts

When filling out the Release of Promissory Note form, it’s essential to approach the task with care. Here’s a list of things to do and avoid to ensure the process goes smoothly.

- Do read the entire form thoroughly before starting.

- Do provide accurate information, including names and dates.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Do check for any additional requirements specific to your situation.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't use white-out or make alterations to the form.

- Don't forget to notify the other party once the form is submitted.

- Don't overlook any deadlines associated with the release process.

Key takeaways

When filling out and using the Release of Promissory Note form, keep the following key points in mind:

- Ensure all parties involved in the promissory note are clearly identified.

- Provide accurate details about the original promissory note, including the date and amount.

- Include a statement confirming that the note has been paid in full or otherwise satisfied.

- Signatures from all parties are essential; without them, the release may not be valid.

- Consider having the document notarized to add an extra layer of authenticity.

- Keep a copy of the completed form for your records after it has been signed.

- Understand that the release effectively cancels the original obligation under the promissory note.

- Consult with a legal professional if you have questions or concerns about the process.

How to Use Release of Promissory Note

Once you have gathered all necessary information, you are ready to fill out the Release of Promissory Note form. This form will require specific details to ensure clarity and accuracy. Please follow the steps outlined below to complete the form correctly.

- Begin by entering the date at the top of the form. This should be the date you are filling out the form.

- Next, provide your name and contact information. This includes your full name, address, phone number, and email address.

- Identify the party to whom the promissory note was originally made. Include their full name and contact information as well.

- Clearly state the amount of the promissory note. This should be the total amount that was originally agreed upon.

- In the designated area, specify the date when the promissory note was executed. This is the date when the note was initially signed.

- If applicable, include any additional terms or conditions that were part of the original agreement. Be concise but thorough in your description.

- Sign the form at the bottom. Your signature indicates your agreement with the information provided.

- Finally, date your signature to confirm when you signed the form.

After completing the form, ensure that all information is accurate. It may be beneficial to keep a copy for your records. Once you have verified the details, you can submit the form to the appropriate party as instructed.