Fill Out a Valid Roofing Certificate Form

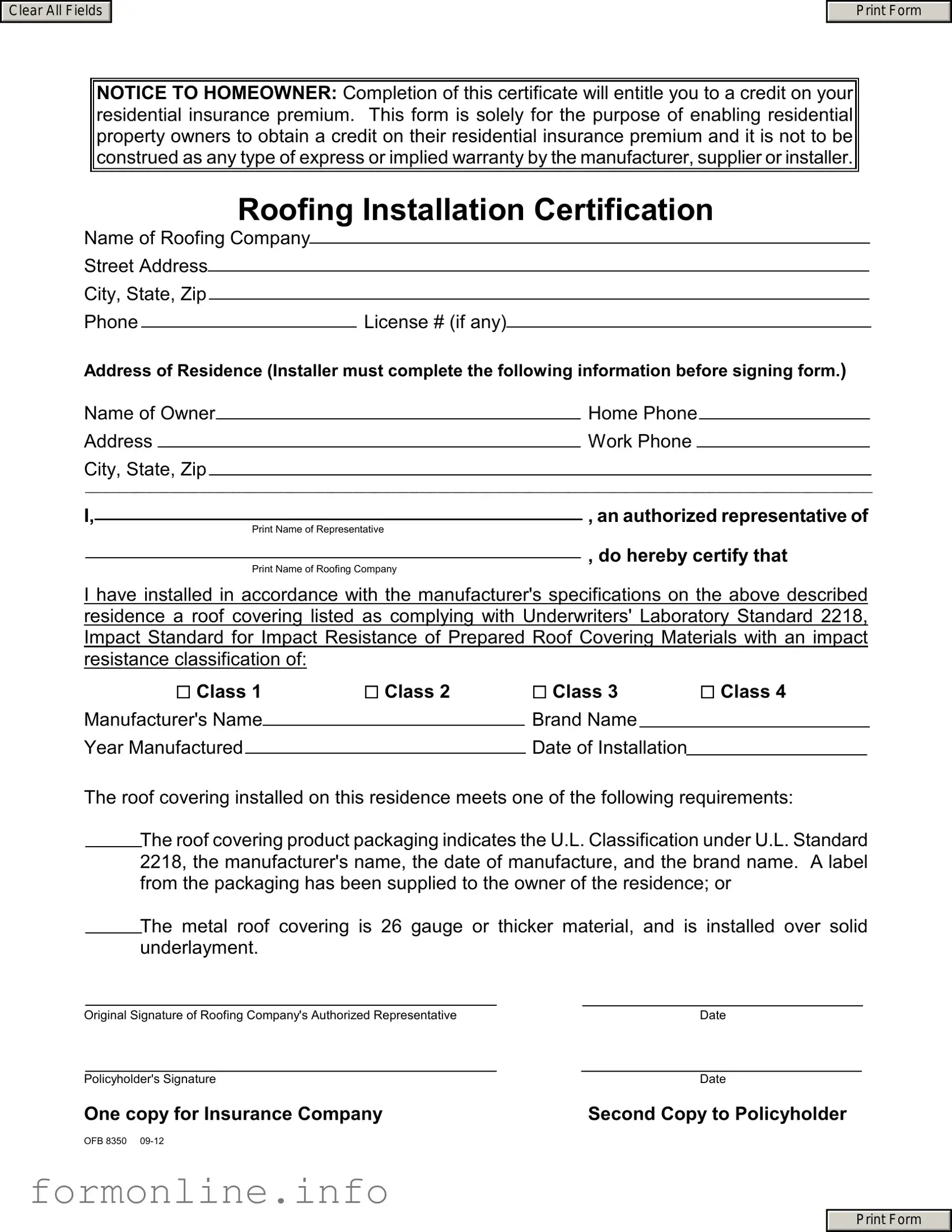

The Roofing Certificate form serves as a vital tool for homeowners seeking to reduce their residential insurance premiums in Texas. This document, issued by the Texas Department of Insurance, requires specific information about the roofing installation, ensuring that the work meets established safety and quality standards. Homeowners benefit from this form by obtaining a certification that their roof covering complies with the Underwriters’ Laboratory Standard 2218, which assesses the impact resistance of roofing materials. The form necessitates details such as the roofing company's name, contact information, and license number, along with the homeowner's information, including their address and phone numbers. An authorized representative from the roofing company must certify that the installation adheres to the manufacturer's specifications and includes the appropriate impact resistance classification. Additionally, the form requires labeling information about the roofing materials, ensuring transparency and compliance with regulations. It is important to note that while the completion of this certificate can lead to premium reductions, it does not serve as a warranty from the manufacturer or installer. Homeowners and roofing companies must both retain copies of this form to maintain accurate records, as any intentional misrepresentation could lead to serious legal consequences.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays. Ensure that the name of the roofing company, address, and contact information are complete.

-

Incorrect License Number: Providing an incorrect or outdated license number can result in the rejection of the form. Verify the license number with the appropriate state authority before submission.

-

Missing Signature: The form must be signed by an authorized representative of the roofing company. Omitting this signature will invalidate the certification.

-

Improper Classification Selection: Selecting the wrong impact resistance classification can affect the eligibility for insurance premium reduction. Review the classification options carefully.

-

Failure to Attach Labels: Not including the required labels from the roofing product packaging can lead to complications. Ensure that these labels are attached to the form as specified.

-

Ignoring Submission Instructions: Not following the submission instructions, such as sending copies to the correct parties, can delay processing. Double-check the mailing requirements to ensure compliance.

Preview - Roofing Certificate Form

Clear All Fields

Print Form

NOTICE TO HOMEOWNER: Completion of this certificate will entitle you to a credit on your residential insurance premium. This form is solely for the purpose of enabling residential property owners to obtain a credit on their residential insurance premium and it is not to be construed as any type of express or implied warranty by the manufacturer, supplier or installer.

Roofing Installation Certification

Name of Roofing Company

Street Address

City, State, Zip

PhoneLicense # (if any)

Address of Residence (Installer must complete the following information before signing form.)

Name of Owner |

|

Home Phone |

|

|

|||||

Address |

|

|

|

Work Phone |

|

|

|||

City, State, Zip |

|

|

|

|

|

|

|||

I, |

|

|

, an authorized representative of |

||||||

|

|

||||||||

|

|

|

|

|

Print Name of Representative |

||||

|

|

|

|

|

|

, do hereby certify that |

|||

|

|

|

|

|

|

||||

|

|

|

|

|

Print Name of Roofing Company |

||||

I have installed in accordance with the manufacturer's specifications on the above described residence a roof covering listed as complying with Underwriters' Laboratory Standard 2218, Impact Standard for Impact Resistance of Prepared Roof Covering Materials with an impact resistance classification of:

Class 1 |

Class 2 |

|

Class 3 |

Class 4 |

||||

Manufacturer's Name |

|

|

Brand Name |

|

|

|

||

Year Manufactured |

|

|

|

Date of Installation |

|

|

||

|

|

|

|

|

|

|

|

|

The roof covering installed on this residence meets one of the following requirements:

The roof covering product packaging indicates the U.L. Classification under U.L. Standard 2218, the manufacturer's name, the date of manufacture, and the brand name. A label from the packaging has been supplied to the owner of the residence; or

The metal roof covering is 26 gauge or thicker material, and is installed over solid underlayment.

|

|

|

|

|

Original Signature of Roofing Company's Authorized Representative |

|

Date |

||

|

|

|

|

|

|

Policyholder's Signature |

|

Date |

|

One copy for Insurance Company |

|

Second Copy to Policyholder |

||

OFB 8350 |

|

|

|

|

Print Form

Other PDF Templates

Chick Fil a Worker - Play a key role in upholding the high standards Chick-fil-A is known for.

For those looking to understand the process of transferring vehicle ownership, a well-structured Motor Vehicle Bill of Sale document is crucial. This essential form outlines the details of the transaction and is a key component in protecting both the buyer's and seller's interests. You can find more information by visiting the necessary Motor Vehicle Bill of Sale documentation.

CBP Declaration Form 6059B - The CBP 6059B collects details on both personal and commercial items.

Documents used along the form

When applying for a reduction in residential insurance premiums through the Roofing Certificate form, several other documents may also be required or beneficial. These documents help provide additional information and support the certification process. Below is a list of commonly used forms and documents that often accompany the Roofing Certificate.

- Insurance Policy Declaration Page: This document summarizes the key details of a homeowner's insurance policy, including coverage limits, deductibles, and premium amounts. It serves as proof of insurance and helps verify the homeowner's eligibility for premium reductions.

- Roofing Contract: A formal agreement between the homeowner and the roofing contractor that outlines the scope of work, materials to be used, and the cost of the project. This contract is essential for confirming that the roofing work was completed as agreed.

- Building Permit: A document issued by the local government that authorizes the roofing project. It ensures that the work complies with local building codes and regulations, providing further assurance to the insurance company regarding the quality of the installation.

- Inspection Report: A report generated by a qualified inspector who assesses the completed roofing work. This document may detail the condition of the roof and confirm that it meets the necessary standards for impact resistance.

- Manufacturer's Warranty: A warranty provided by the roofing material manufacturer that guarantees the quality and durability of the roofing products used. This document can add credibility to the roofing installation and may be required by some insurance companies.

- Mobile Home Bill of Sale: This document is crucial for anyone involved in the sale or purchase of a mobile home. It facilitates the transfer of ownership legally, ensuring both parties are protected. For a comprehensive view, see the Mobile Home Bill of Sale.

- Proof of Payment: Documentation showing that the homeowner has paid for the roofing work. This could be in the form of receipts or bank statements, and it helps to establish that the work was completed and compensated for.

Gathering these documents can streamline the process of obtaining a premium reduction and ensure that all necessary information is readily available for the insurance company. Each document plays a vital role in verifying the quality and compliance of the roofing installation, ultimately benefiting the homeowner.

Similar forms

The Certificate of Insurance is a document that provides proof of insurance coverage for a property. Like the Roofing Certificate, it serves a specific purpose: to assure third parties that the property owner has valid insurance in place. This certificate typically includes details such as the type of coverage, policy limits, and the effective dates of the policy. Both documents aim to facilitate financial transactions, with the Roofing Certificate helping homeowners secure lower insurance premiums and the Certificate of Insurance ensuring that contractors or service providers are covered during their work.

The Home Warranty Certificate is another document that shares similarities with the Roofing Certificate. This certificate provides homeowners with assurance that certain repairs or replacements will be covered for a specified period. Just as the Roofing Certificate helps homeowners reduce their insurance premiums by certifying the quality of the roof installation, the Home Warranty Certificate guarantees that the systems or appliances in the home will be repaired or replaced if they fail due to defects. Both documents serve to enhance the homeowner's peace of mind regarding their property investments.

A Building Permit serves as an official approval from a local government agency to proceed with construction or renovation work. This document is similar to the Roofing Certificate in that it validates compliance with local building codes and safety regulations. Homeowners must obtain a Building Permit before starting work on their property, much like how they need the Roofing Certificate to secure a reduction in insurance premiums. Both documents ensure that the work done meets established standards, protecting the homeowner's investment and safety.

The Inspection Report is a document that provides an assessment of a property's condition, often required during real estate transactions. Similar to the Roofing Certificate, the Inspection Report verifies that certain aspects of the property, such as the roof, are in good condition or meet specific standards. This document can influence insurance premiums and buyer decisions, just as the Roofing Certificate can help homeowners lower their insurance costs by demonstrating that their roof meets quality standards.

In addition to the documents mentioned, potential buyers should also be aware of the important role played by the https://autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form, which serves to formalize the transfer of ownership for motor vehicles in Pennsylvania, further ensuring clarity and legality in such transactions.

The Energy Efficiency Certificate is another relevant document. This certificate indicates that a home meets specific energy efficiency standards, which can lead to lower utility bills and sometimes reduced insurance premiums. Like the Roofing Certificate, the Energy Efficiency Certificate serves to validate that certain criteria have been met, providing homeowners with financial benefits and assurance that their property is up to standard.

The Certificate of Occupancy is issued by a local government agency and signifies that a building is safe for occupancy. This document is akin to the Roofing Certificate in that it confirms compliance with building codes and regulations. Both documents are essential for homeowners, as they ensure that the property is safe and meets legal requirements, which can ultimately affect insurance coverage and costs.

The Warranty Deed is a legal document that conveys ownership of a property from one party to another. This document is similar to the Roofing Certificate in that it provides proof of certain conditions being met regarding the property. While the Roofing Certificate assures that the roof installation complies with standards, the Warranty Deed ensures that the buyer receives a clear title to the property, free of any liens or claims. Both documents play critical roles in protecting the interests of homeowners.

Lastly, the Appraisal Report provides an estimated value of a property, often required by lenders during the mortgage process. This document is similar to the Roofing Certificate in that it assesses the condition and value of the property, which can influence insurance rates. Both documents serve to protect homeowners by ensuring that their property is valued accurately, which can impact their financial obligations and insurance premiums.

Dos and Don'ts

When filling out the Roofing Certificate form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are six things to do and not do:

- Do provide complete and accurate information for each section of the form.

- Do ensure that the roofing company’s name and contact details are clearly stated.

- Do verify that the roof covering meets the Underwriters’ Laboratory Standard 2218 requirements.

- Do include the manufacturer’s name, brand name, and year manufactured for the roofing materials.

- Don't leave any sections of the form blank; incomplete forms may delay processing.

- Don't misrepresent any information, as this could be considered fraud.

Key takeaways

When filling out and using the Roofing Certificate form, homeowners should keep several important points in mind to ensure a smooth process and to maximize potential benefits.

- Purpose of the Form: This certificate is designed to help homeowners qualify for a reduction in their residential insurance premiums.

- Not a Warranty: Completing this form does not create any warranty from the manufacturer, supplier, or installer regarding the roofing materials or installation.

- Accurate Information: Homeowners must provide accurate information about their roofing company, including the name, address, and license number, if applicable.

- Certification by Installer: An authorized representative of the roofing company must certify that the installation meets the manufacturer’s specifications and complies with Underwriters’ Laboratory Standard 2218.

- Impact Resistance Classification: The form requires the classification of the roofing material's impact resistance, which can range from Class 1 to Class 4.

- Labeling Requirements: The roofing materials must be properly labeled with the U.L. classification, manufacturer’s name, date of manufacture, and brand name.

- Distribution of Copies: Homeowners should retain one copy of the completed form while providing a second copy to their insurance company.

By following these guidelines, homeowners can effectively utilize the Roofing Certificate form to potentially lower their insurance premiums while ensuring compliance with all necessary regulations.

How to Use Roofing Certificate

Once you have gathered the necessary information, filling out the Roofing Certificate form is straightforward. This certificate will help you secure a reduction in your residential insurance premium. Follow these steps carefully to ensure that all required information is accurately provided.

- Enter the Roofing Company Information: Fill in the name of the roofing company, street address, city, county, zip code, phone number, and license number (if applicable).

- Complete the Homeowner Information: Provide the name of the homeowner, home phone number, address, office phone number, city, county, and zip code.

- Certification Details: The authorized representative of the roofing company must certify that the installation was done according to the manufacturer’s specifications. Include the impact resistance classification of the roof covering (Class 1, 2, 3, or 4) and the manufacturer’s name, brand name, and year manufactured.

- Date of Installation: Write down the date when the roof covering was installed.

- Labeling Information: Check one of the options regarding the labeling of the roof covering products. Ensure that the information about the U.L. classification, manufacturer’s name, date of manufacture, and brand name is accurate.

- Signature: The authorized representative of the roofing company must sign and date the form to validate the certification.

After completing the form, keep one copy for your records and send another to your insurance company. This documentation is crucial for obtaining your premium reduction.