Printable Single-Member Operating Agreement Form

The Single-Member Operating Agreement is an essential document for individuals who own a single-member limited liability company (LLC). This form serves as a foundational blueprint for the operation and management of the business, outlining the rights and responsibilities of the owner. It addresses key aspects such as the structure of the LLC, decision-making processes, and the distribution of profits and losses. By detailing how the business will be run, the agreement helps to protect the owner's personal assets from business liabilities, ensuring that the LLC maintains its status as a separate legal entity. Furthermore, it can specify procedures for adding new members in the future, should the owner choose to expand the business. Overall, this document not only provides clarity and direction but also enhances the legitimacy of the LLC in the eyes of potential clients, partners, and creditors.

Common mistakes

-

Not Including Essential Information: Some individuals forget to add crucial details like the name of the LLC, the registered agent, and the principal office address. Omitting this information can lead to confusion and complications down the line.

-

Failing to Specify Ownership Percentage: Even in a single-member LLC, it's important to state the ownership percentage clearly. This helps establish clear ownership rights and can prevent misunderstandings.

-

Ignoring State-Specific Requirements: Each state may have different requirements for operating agreements. Not checking local laws can result in a document that doesn't meet legal standards.

-

Neglecting to Sign and Date: A common mistake is forgetting to sign and date the agreement. Without a signature, the document may not hold up in court if needed.

-

Using Ambiguous Language: Vague terms can create confusion. It's crucial to use clear and precise language to ensure the document is understood as intended.

-

Overlooking Amendment Procedures: Failing to include how amendments to the agreement will be handled can lead to issues if changes are needed in the future.

-

Not Keeping a Copy: After filling out the form, some forget to keep a copy for their records. Always retain a signed version for future reference.

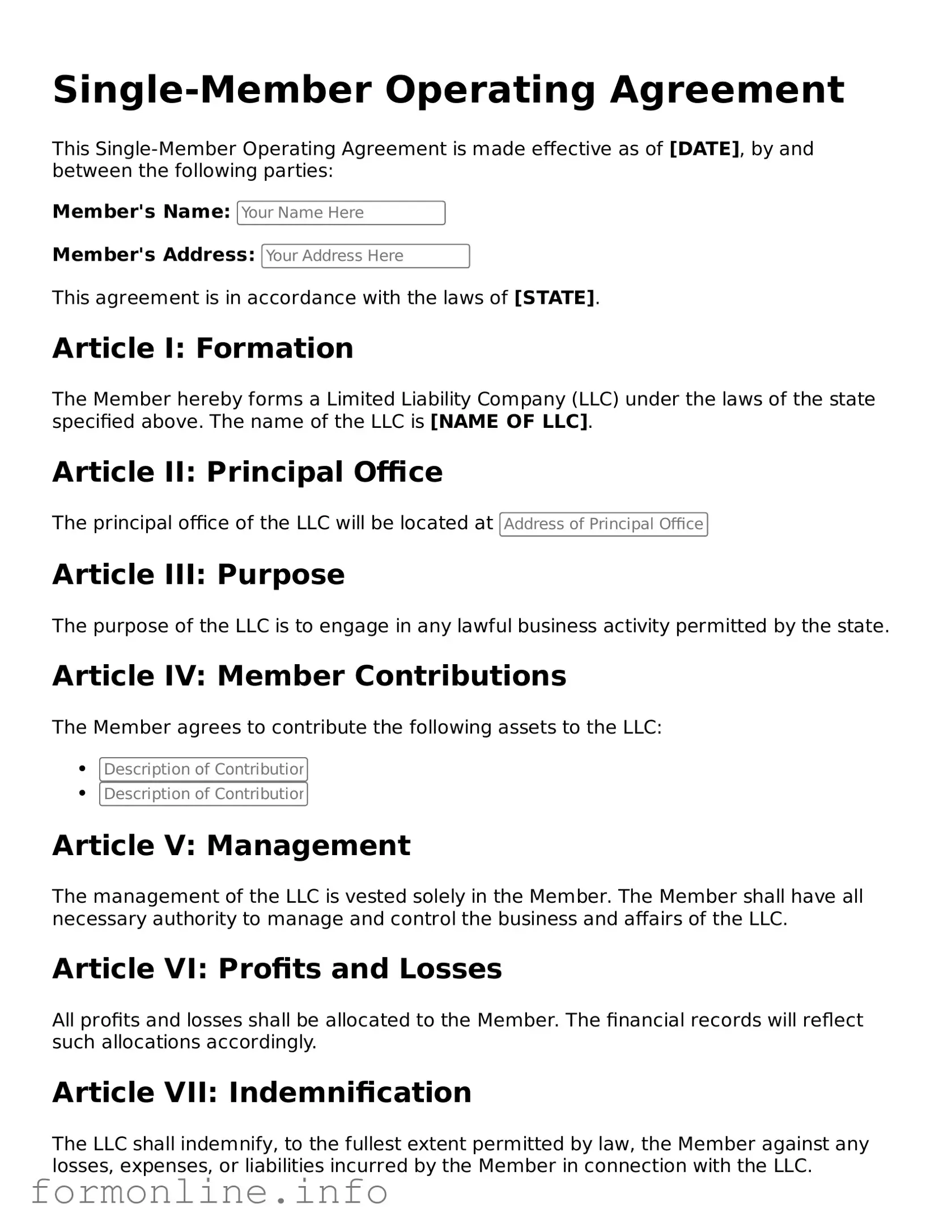

Preview - Single-Member Operating Agreement Form

Single-Member Operating Agreement

This Single-Member Operating Agreement is made effective as of [DATE], by and between the following parties:

Member's Name:

Member's Address:

This agreement is in accordance with the laws of [STATE].

Article I: Formation

The Member hereby forms a Limited Liability Company (LLC) under the laws of the state specified above. The name of the LLC is [NAME OF LLC].

Article II: Principal Office

The principal office of the LLC will be located at

Article III: Purpose

The purpose of the LLC is to engage in any lawful business activity permitted by the state.

Article IV: Member Contributions

The Member agrees to contribute the following assets to the LLC:

Article V: Management

The management of the LLC is vested solely in the Member. The Member shall have all necessary authority to manage and control the business and affairs of the LLC.

Article VI: Profits and Losses

All profits and losses shall be allocated to the Member. The financial records will reflect such allocations accordingly.

Article VII: Indemnification

The LLC shall indemnify, to the fullest extent permitted by law, the Member against any losses, expenses, or liabilities incurred by the Member in connection with the LLC.

Article VIII: Amendments

This Operating Agreement may only be amended by a written agreement signed by the Member.

Signature

By signing below, the Member agrees to the terms and conditions outlined in this Single-Member Operating Agreement.

Member's Signature:

Date:

More Types of Single-Member Operating Agreement Templates:

How to Create an Operating Agreement for an Llc - Clarifies the expectations of each member’s time commitment to the business.

The California Operating Agreement form is a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the management structure, member responsibilities, and operational procedures of the LLC, ensuring clarity and legal protection for all parties involved. For further resources, you can visit California Documents Online, which provides valuable insights for anyone looking to establish or manage an LLC in California.

Documents used along the form

A Single-Member Operating Agreement is an essential document for a single-member LLC, outlining the management structure and operational guidelines. However, several other forms and documents often accompany it to ensure compliance and effective operation. Below is a list of these documents, each serving a specific purpose.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Employer Identification Number (EIN): Issued by the IRS, this number is necessary for tax purposes. It allows the LLC to open a bank account, hire employees, and file taxes.

- Operating Agreement Form: When establishing your LLC, it is crucial to have a full understanding of the Operating Agreement details to ensure clarity in management and operations.

- Membership Certificate: This document certifies the ownership of the LLC. It can serve as proof of ownership for the single member and may be required for certain transactions.

- Bylaws: While not always required, bylaws outline the rules governing the internal management of the LLC. They can include procedures for meetings, voting, and decision-making.

- Operating Procedures: These are detailed guidelines on how the LLC will operate on a day-to-day basis. They may cover everything from financial management to employee responsibilities.

- Bank Resolution: This document authorizes specific individuals to open and manage bank accounts on behalf of the LLC. It is crucial for establishing financial authority.

- Annual Report: Many states require LLCs to file an annual report. This document provides updated information about the LLC, including its address and members, and ensures compliance with state regulations.

- Tax Forms: Depending on the LLC's structure, various tax forms may be required for federal and state tax purposes. These forms help ensure that the LLC meets its tax obligations.

Understanding these accompanying documents is vital for maintaining compliance and ensuring the smooth operation of a single-member LLC. Each form plays a unique role in the overall management and legal standing of the business, contributing to its success and longevity.

Similar forms

A Sole Proprietorship Agreement is similar to a Single-Member Operating Agreement in that both documents outline the operational structure of a business owned by one individual. In a Sole Proprietorship, the owner has complete control over the business and its decisions, much like a single-member LLC. However, a Sole Proprietorship does not provide the same liability protection that an LLC offers. This distinction is crucial for individuals looking to separate their personal and business liabilities.

A Partnership Agreement, while designed for businesses with two or more owners, shares similarities with a Single-Member Operating Agreement in terms of outlining management roles and responsibilities. Both documents serve to clarify the expectations of the owners, though a Partnership Agreement must address the dynamics between multiple partners, including profit-sharing and decision-making processes, which are less complex in a single-member context.

An LLC Formation Document is a foundational document for establishing a Limited Liability Company. Like a Single-Member Operating Agreement, it outlines the structure and management of the business. However, the LLC Formation Document is typically filed with the state to officially create the LLC, while the Operating Agreement is an internal document that details how the LLC will operate, including rules for management and member roles.

A Buy-Sell Agreement is often utilized in multi-member LLCs, but it can also bear similarities to a Single-Member Operating Agreement in terms of addressing ownership transfer. Both documents can specify what happens if the owner decides to sell their interest or if they pass away. This ensures that the business can continue to operate smoothly, regardless of changes in ownership.

An Employment Agreement may also be compared to a Single-Member Operating Agreement, especially if the single member plans to hire employees. Both documents outline the terms of employment, responsibilities, and expectations. However, an Employment Agreement focuses specifically on the relationship between the employer and employee, while the Operating Agreement focuses on the management and operational structure of the business.

A Non-Disclosure Agreement (NDA) is relevant for single-member LLCs, particularly when sensitive information is involved. While an NDA protects confidential information shared with third parties, a Single-Member Operating Agreement may include clauses about confidentiality regarding the business's internal operations. Both documents aim to protect the interests of the business, albeit in different contexts.

Understanding the various documents that govern business operations is essential for LLCs and their owners. An important component within this framework is the Operating Agreement form, which not only clarifies the management structure but also delineates the rights and responsibilities of members, thus helping prevent disputes and ensuring organized management.

A Corporate Bylaws document serves a similar purpose for corporations as a Single-Member Operating Agreement does for LLCs. Both documents outline the governance structure and operational procedures. However, Corporate Bylaws are specific to corporations and include details about board meetings, officer roles, and shareholder rights, while the Operating Agreement focuses on the single-member LLC's management and operational guidelines.

A Franchise Agreement can also be related to a Single-Member Operating Agreement in that both establish the terms under which a business operates. A Franchise Agreement details the relationship between the franchisor and franchisee, including operational guidelines, fees, and support. In contrast, a Single-Member Operating Agreement focuses on the internal workings of the LLC, emphasizing the rights and responsibilities of the single member.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it is essential to approach the task with care. Here are some key points to consider:

- Do provide accurate information about yourself and your business.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Do clearly define the purpose of your business in the agreement.

- Don't use vague language that could lead to misunderstandings.

- Do include your business's registered name and address.

- Don't forget to sign and date the document to validate it.

- Do keep a copy of the completed agreement for your records.

Key takeaways

When filling out and using the Single-Member Operating Agreement form, it's important to keep several key points in mind:

- Understand the Purpose: The agreement outlines the structure and rules for your single-member LLC, providing clarity on how the business operates.

- Identify the Member: Clearly state your name and any other relevant personal information to establish ownership.

- Define the Business: Include the name and purpose of your LLC. This gives context to the agreement and helps define your business's mission.

- Outline Management Structure: Specify how the LLC will be managed. As a single member, you have full control, but it’s good to document this for future reference.

- Detail Financial Arrangements: Include information about capital contributions, profit distribution, and any other financial matters to avoid confusion later.

- Address Liability: The agreement can help protect your personal assets by reinforcing the separation between your personal and business finances.

- Include Amendment Procedures: Specify how changes to the agreement can be made in the future, ensuring flexibility as your business evolves.

- Consult a Professional: While it’s possible to complete the form on your own, seeking legal advice can help ensure that all necessary details are included.

- Keep it Accessible: Store the agreement in a safe but accessible location. It should be easy to reference when needed.

By keeping these points in mind, you can effectively complete and utilize your Single-Member Operating Agreement, ensuring that your business operates smoothly and within legal guidelines.

How to Use Single-Member Operating Agreement

Completing the Single-Member Operating Agreement form is an important step in establishing your business structure. This document outlines the rules and regulations governing your single-member LLC, ensuring clarity and legal protection as you operate your business. Follow these steps carefully to fill out the form correctly.

- Start with your name and address: At the top of the form, enter your full name and the address of your business. Make sure this information is accurate, as it will be used for official correspondence.

- Identify your LLC: Clearly state the name of your Limited Liability Company (LLC) as registered with your state. This name should match the one on your Articles of Organization.

- Provide the date of formation: Indicate the date your LLC was officially formed. This information is typically found in your formation documents.

- List your business purpose: Describe the primary purpose of your LLC. Be concise yet specific about the activities your business will engage in.

- Define the management structure: Specify that you are the sole member and manager of the LLC. This section clarifies that you will have full control over the business operations.

- Address financial matters: Include details about how profits and losses will be handled. Typically, these will flow directly to you as the sole member.

- Include provisions for amendments: State how changes to the operating agreement can be made in the future. This ensures flexibility as your business evolves.

- Sign and date the document: Finally, sign and date the agreement to make it official. Your signature signifies your acceptance of the terms outlined in the document.

After completing the form, keep a copy for your records and consider filing it with your state’s business office if required. This will solidify your commitment to the business structure you've chosen.