Fill Out a Valid SSA SSA-795 Form

The SSA-795 form, also known as the Statement of Claimant or Other Person, serves as a vital tool for individuals seeking assistance from the Social Security Administration (SSA). This form is designed to collect information from claimants or other relevant parties regarding the circumstances surrounding a claim for benefits. Completing the SSA-795 can be crucial for establishing eligibility, as it allows individuals to provide detailed narratives about their situations, including medical conditions, work history, and any other pertinent details that may impact their claims. Moreover, the form is not limited to just claimants; it can also be used by family members or representatives who wish to convey information on behalf of someone else. The SSA-795 must be filled out accurately and thoroughly to ensure that the SSA can make informed decisions regarding benefits. Understanding the importance of this form and the information it requires can significantly affect the outcome of a claim, making it essential for individuals to approach the process with care and attention to detail.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all the necessary details, such as personal identification information or specifics about their disability. This can lead to delays in processing.

-

Incorrect Dates: Some people mistakenly enter wrong dates for events related to their claim, such as the onset of their disability. Accurate dates are crucial for the review process.

-

Not Signing the Form: A common oversight is neglecting to sign the form. Without a signature, the SSA cannot process the application.

-

Using Inconsistent Language: Individuals sometimes use vague or inconsistent language when describing their condition. Clear and consistent descriptions help convey the severity of the situation.

-

Failure to Provide Supporting Documents: Some applicants do not include necessary documentation, such as medical records or treatment history. These documents are essential for substantiating claims.

-

Ignoring Instructions: The form includes specific instructions that must be followed. Ignoring these can result in incomplete submissions or misunderstandings.

-

Submitting by the Wrong Method: Individuals sometimes submit the form through incorrect channels, such as email instead of mail. Adhering to the specified submission method is important for proper processing.

-

Not Keeping Copies: Failing to retain copies of the completed form and supporting documents can create problems later. Keeping records is vital for tracking the application status.

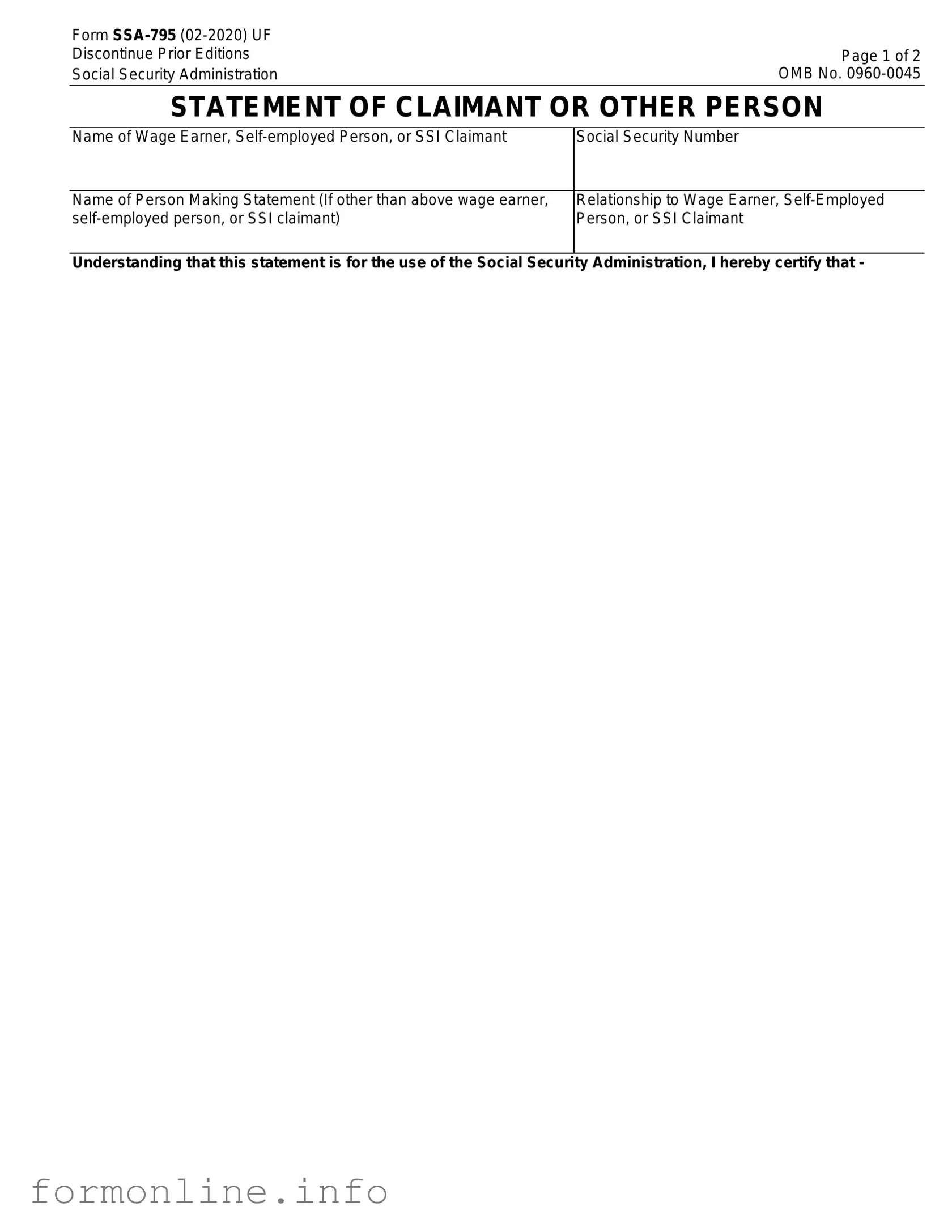

Preview - SSA SSA-795 Form

Form |

|

Discontinue Prior Editions |

Page 1 of 2 |

Social Security Administration |

OMB No. |

STATEMENT OF CLAIMANT OR OTHER PERSON |

|

Name of Wage Earner, |

Social Security Number |

|

|

Name of Person Making Statement (If other than above wage earner, |

Relationship to Wage Earner, |

Person, or SSI Claimant |

|

Understanding that this statement is for the use of the Social Security Administration, I hereby certify that -

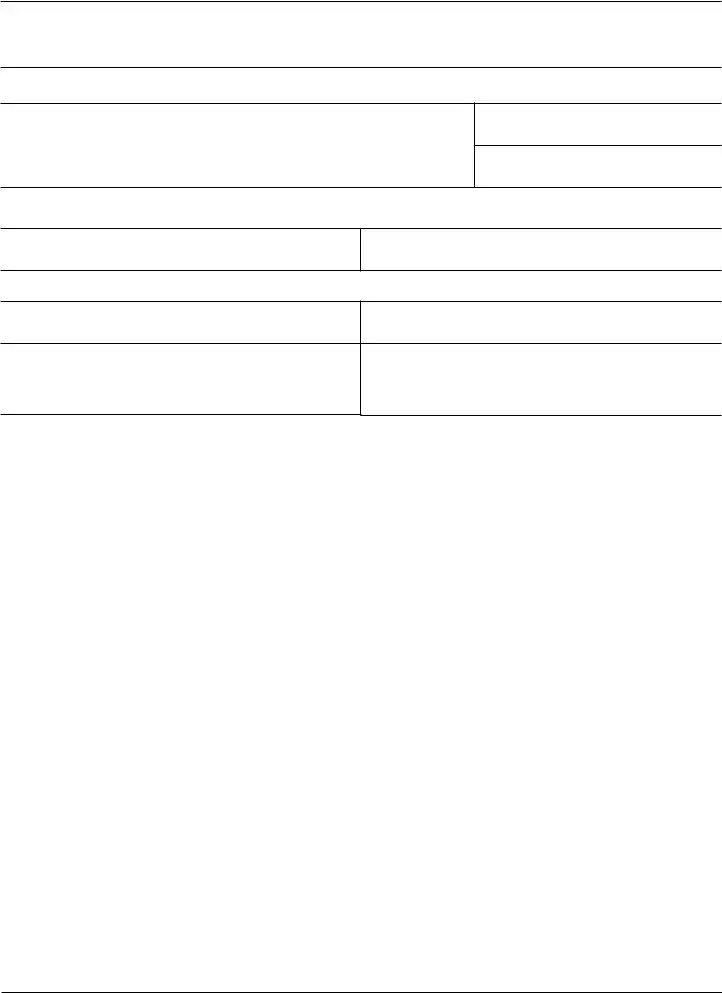

Form |

Page 2 of 2 |

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and may be subject to a fine or imprisonment.

SIGNATURE OF PERSON MAKING STATEMENT

Signature (First name, middle initial, last name) (Write in ink)

Mailing Address (Number and street, Apt. No.,P.O.Box, Rural Route)

Date (Month, day, year)

Telephone Number (Include Area Code )

City and State |

ZIP Code |

Witnesses are required ONLY if this statement has been signed by mark (X) above. If signed by mark (X), two witnesses to the signing who know the individual must sign below, giving their full addresses.

1. Signature of Witness

2. Signature of Witness

Address (Number and street, City, State, and ZIP Code)

Address (Number and street, City, State, and ZIP Code)

Privacy Act Statement

Collection and Use of Personal Information

Section 205 of the Social Security Act, as amended, allows us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may affect our ability to properly adjudicate claims or resolve entitlement and eligibility issues.

We may use the information to make a determination on program or

•To contractors and other Federal agencies, as necessary, for the purpose of assisting SSA in the efficient administration of its programs; and,

•To student volunteers and other workers, who technically do not have the status of Federal employees, when performing work for SSA as authorized by law, and they need access to personally identifiable information in SSA records in order to perform their assigned Agency functions.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person's eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notices (SORN)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 60 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR

LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA's website at www.socialsecurity.gov. Offices are also listed under U. S. Government agencies in your telephone directory or you may call Social Security at

Security Blvd, Baltimore, MD

the completed form.

Other PDF Templates

Doctor Note - Keep this form as a record of your healthcare-related absences.

Free Printable D1 Form - Applicants can specify a desired start date for the driving licence, within the allowed timeframe.

In the state of Missouri, completing a transaction involving a mobile home requires a Mobile Home Bill of Sale, which is essential for transferring ownership securely and legally. For those looking to navigate this process seamlessly, resources such as the Mobile Home Bill of Sale are invaluable, ensuring that all necessary details are captured and understood by both buyer and seller.

Texas Temporary Tag - Fill out this form to get a temporary tag for vehicle operation on public roads.

Documents used along the form

The SSA-795 form is often used to provide a statement regarding an individual's work history or other relevant information for Social Security purposes. When filing this form, you may need to submit additional documents to support your claims or provide necessary context. Below is a list of other forms and documents that are commonly used alongside the SSA-795 form.

- SSA-3368: This form is used to collect information about your disability and work history. It helps Social Security evaluate your eligibility for benefits.

- SSA-827: This is a consent form allowing the Social Security Administration to obtain medical records and other information from your healthcare providers.

- SSA-3881: This form is used to provide information about your representative payee, if you have one. It helps ensure that benefits are managed properly.

- SSA-8000: This is an application for Supplemental Security Income (SSI). It gathers information about your income and resources to determine eligibility.

- Form 1099: This document reports income received from Social Security benefits. It is important for tax purposes and verifying income levels.

- Notice to Quit Form: For landlords needing to formally end a tenancy, the detailed Notice to Quit form instructions provide the necessary guidelines for notifying tenants.

- Medical Records: These documents from healthcare providers can substantiate claims of disability or ongoing medical conditions affecting work capability.

- Work History Report: This document details your past employment, including job titles, duties, and dates of employment, which can help assess your work history.

Gathering these forms and documents can streamline the application process and provide the necessary information for the Social Security Administration. Ensure that all information is accurate and up-to-date to avoid delays in processing your claims.

Similar forms

The SSA-827 form, also known as the Authorization to Disclose Information to the Social Security Administration, shares similarities with the SSA-795 form in that both are used to gather information necessary for the administration of Social Security benefits. The SSA-827 specifically authorizes healthcare providers and other relevant entities to release medical and personal information to the SSA. This is crucial for determining eligibility for disability benefits, just as the SSA-795 collects detailed accounts of an individual's circumstances and experiences to support their claims.

The SSA-3368 form, or the Adult Disability Report, is another document that parallels the SSA-795. Both forms are integral to the process of applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). The SSA-3368 requires applicants to provide information about their medical conditions, work history, and daily activities. Like the SSA-795, it aims to create a comprehensive picture of the applicant's situation to aid in the decision-making process regarding benefits.

The SSA-3373 form, known as the Function Report, is also similar to the SSA-795. This document focuses on how a person's disability affects their daily life. Applicants describe their abilities and limitations in various activities, such as personal care, household tasks, and social interactions. The SSA-3373, like the SSA-795, gathers subjective information that helps the SSA evaluate the impact of a disability on an individual's functionality.

The SSA-8000 form, or the Application for Supplemental Security Income, is another important document in the Social Security framework. While the SSA-795 collects personal statements about specific situations, the SSA-8000 is a formal application for benefits. Both require detailed information about an applicant's financial status, living arrangements, and other relevant factors. The SSA-8000 serves as a foundational document for initiating the benefits process, while the SSA-795 can provide additional context to support the application.

The South Carolina Motor Vehicle Bill of Sale form is a legal document that records the sale and purchase of a motor vehicle in the state of South Carolina. It serves as proof of ownership transfer from the seller to the buyer. This form is essential for both parties to ensure the transaction is acknowledged legally and to facilitate the vehicle's registration process. To obtain this document, you can visit autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form.

Lastly, the SSA-11 form, which is the Application for Widow's or Widower's Benefits, is comparable to the SSA-795 in that it collects information to determine eligibility for specific benefits. The SSA-11 requires details about the deceased spouse and the applicant's relationship with them. Similar to the SSA-795, it emphasizes the personal circumstances surrounding the applicant's situation, which is critical for the SSA's assessment of eligibility for survivor benefits.

Dos and Don'ts

When filling out the SSA SSA-795 form, it's important to follow certain guidelines to ensure accuracy and completeness. Here are some do's and don'ts to keep in mind:

- Do read the instructions carefully before starting the form.

- Do provide clear and concise information in each section.

- Do double-check your entries for any errors or omissions.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or shorthand that may cause confusion.

Following these guidelines can help ensure that your SSA SSA-795 form is processed efficiently and accurately.

Key takeaways

The SSA SSA-795 form is a crucial document for individuals seeking to provide additional information to the Social Security Administration (SSA). Here are some key takeaways regarding its use:

- The SSA-795 form is used to report information that may affect eligibility for Social Security benefits.

- It is important to provide accurate and complete information on the form to avoid delays in processing.

- The form can be filled out by the individual or a representative, such as a family member or legal guardian.

- Once completed, the SSA-795 form should be submitted to the appropriate SSA office, either in person or by mail.

- Keep a copy of the completed form for your records, as it may be needed for future reference.

- Timeliness is key; submitting the form promptly can help ensure that benefits are processed without unnecessary delays.

How to Use SSA SSA-795

Completing the SSA SSA-795 form is an important step in addressing your needs with the Social Security Administration. After filling out the form, you will need to submit it to the appropriate office, where it will be reviewed to ensure that your information is processed correctly.

- Begin by downloading the SSA SSA-795 form from the official Social Security Administration website or request a paper copy from your local office.

- Read the instructions carefully to understand what information is required.

- Fill in your personal information at the top of the form, including your name, Social Security number, and contact details.

- In the designated section, provide a detailed description of the information or issue you are reporting.

- Be specific and clear in your explanation to avoid any misunderstandings.

- If applicable, include any relevant dates or additional information that may support your case.

- Review the completed form for accuracy and completeness.

- Sign and date the form at the bottom to certify that the information provided is true and correct.

- Make a copy of the completed form for your records before submitting it.

- Submit the form to your local Social Security office either by mail or in person, following the instructions provided.