Fill Out a Valid Stock Transfer Ledger Form

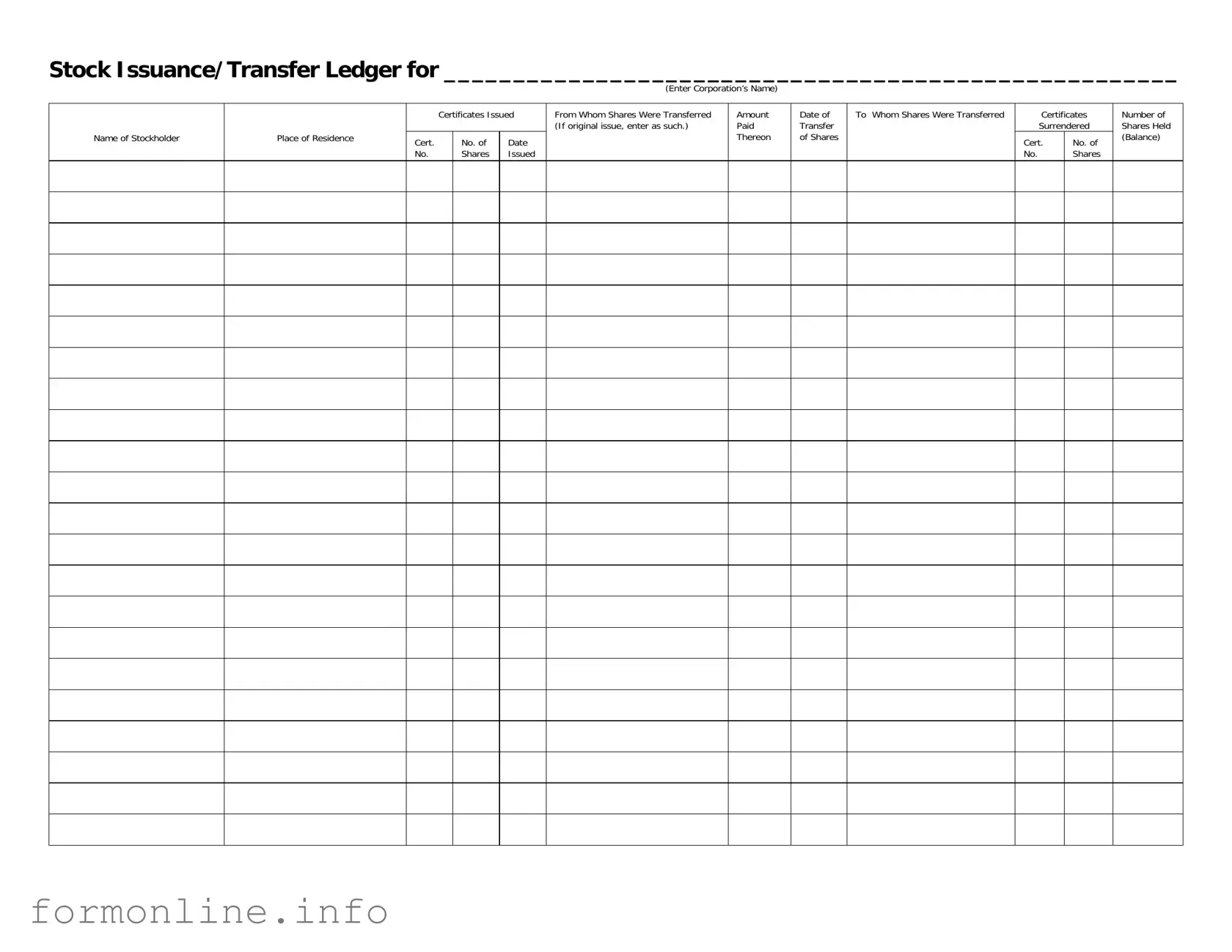

The Stock Transfer Ledger form serves as a vital tool for corporations in tracking the issuance and transfer of stock among shareholders. This form meticulously records essential details, such as the name of the corporation and the stockholder, ensuring that all transactions are documented accurately. Each entry includes the place of residence of the stockholder, the certificates issued, and their corresponding certificate numbers. The form captures the date on which shares were issued, along with the amount paid for those shares, providing a clear financial picture of each transaction. When shares are transferred, the ledger notes from whom the shares were transferred and to whom they are being transferred, ensuring transparency and accountability. Additionally, the form includes a section for the surrender of certificates and the number of shares held after the transfer, allowing for easy tracking of ownership changes over time. By maintaining a comprehensive Stock Transfer Ledger, corporations can uphold good governance practices and facilitate smoother transactions among their shareholders.

Common mistakes

-

Incomplete Corporation Name: Failing to fill in the corporation's name can lead to confusion and delays. Ensure that the name is accurate and matches official documents.

-

Incorrect Certificate Numbers: Entering the wrong certificate numbers can create discrepancies. Double-check the numbers against the original certificates to avoid mistakes.

-

Missing Shareholder Information: Omitting the name or place of residence of the stockholder can render the form invalid. All required fields must be filled out completely.

-

Not Documenting Transfers Properly: Failing to specify from whom the shares were transferred or to whom they are being transferred can lead to legal issues. Always include this information clearly.

-

Neglecting to Update Share Balances: Forgetting to record the number of shares held after the transfer can result in inaccurate records. Keep track of the balance to maintain clarity in ownership.

Preview - Stock Transfer Ledger Form

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Other PDF Templates

Which Claim Is Submitted by Institutions? - Primary and secondary insurance information must be accurately provided.

The Utah Mobile Home Bill of Sale is a legal document that facilitates the transfer of ownership of a mobile home from one party to another. This form is essential for ensuring that the sale is recorded properly and protects the rights of both the buyer and the seller. You can find a template and additional details to assist you in this process at the Mobile Home Bill of Sale, which can help streamline the buying or selling experience in Utah.

Nc-4p - Married taxpayers Completing Separately focus on their personal income during the allowance calculation.

Documents used along the form

The Stock Transfer Ledger form is a critical document for tracking the ownership and transfer of shares within a corporation. Several other forms and documents complement this ledger to ensure proper record-keeping and compliance with regulations. Below is a list of commonly used documents in conjunction with the Stock Transfer Ledger.

- Stock Certificate: This document serves as proof of ownership of shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the corporation's name.

- Shareholder Agreement: This is a contract between shareholders that outlines their rights and obligations regarding the management of the corporation and the transfer of shares.

- Transfer Request Form: This form is used by a shareholder to formally request the transfer of shares to another individual or entity. It typically requires signatures from both the transferor and transferee.

- Resolution of the Board of Directors: This document records the board's approval of the transfer of shares. It is essential for ensuring that the transfer complies with corporate governance procedures.

- Last Will and Testament Form: To outline your final wishes, utilize the comprehensive Last Will and Testament resources for an organized distribution of your assets.

- Form 1099-DIV: This IRS form reports dividends and distributions to shareholders. It is necessary for tax purposes and must be issued to shareholders who receive dividends.

- Tax Clearance Certificate: This certificate verifies that the corporation has fulfilled its tax obligations. It may be required before completing certain stock transfers, especially in regulated industries.

- Annual Report: This document provides a comprehensive overview of the corporation's financial performance and operations over the past year. It often includes details relevant to shareholders and potential investors.

These documents, when used alongside the Stock Transfer Ledger, help maintain accurate records and facilitate smooth transactions related to stock ownership. Proper documentation is essential for transparency and compliance in corporate governance.

Similar forms

The Stock Transfer Ledger is similar to a Shareholder Register. A Shareholder Register is a record that lists all the shareholders of a corporation, along with their contact information and the number of shares they own. This document is essential for maintaining accurate ownership records and ensuring that shareholders receive their dividends and voting rights. Like the Stock Transfer Ledger, it tracks changes in ownership, helping to keep the corporation informed about who holds its shares.

Another document that resembles the Stock Transfer Ledger is the Certificate of Stock. This certificate serves as proof of ownership for shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the corporation's name. While the Stock Transfer Ledger records transactions and transfers, the Certificate of Stock represents the actual ownership of those shares. Both documents work together to maintain clear records of ownership.

The Dividend Record is also similar to the Stock Transfer Ledger. This document tracks the distribution of dividends to shareholders. It lists the shareholders, the number of shares they own, and the dividends they receive. Just as the Stock Transfer Ledger maintains a record of share ownership, the Dividend Record ensures that dividends are paid accurately and fairly based on the number of shares held by each shareholder.

The Corporate Bylaws document shares similarities with the Stock Transfer Ledger as well. Bylaws outline the rules and procedures for the corporation, including how shares can be transferred. They provide guidelines for the management of the corporation and the rights of shareholders. While the Stock Transfer Ledger records specific transactions, the Bylaws establish the framework within which those transactions occur.

In addition to the documents already discussed, it's important to consider the Mobile Home Bill of Sale, which also plays a crucial role in the transfer of ownership. This legal form serves to ensure that all terms of the transaction are officially recorded, thereby protecting the interests of both the buyer and the seller in a mobile home sale.

Another comparable document is the Stock Option Agreement. This agreement grants individuals the right to purchase shares at a predetermined price. It includes details about the number of options granted and the terms of exercise. Like the Stock Transfer Ledger, it tracks ownership interests, but it focuses on options rather than actual shares. Both documents are important for managing equity within a corporation.

The Subscription Agreement also shares characteristics with the Stock Transfer Ledger. This document is used when investors agree to purchase shares in a corporation. It outlines the terms of the investment, including the number of shares and the price. While the Stock Transfer Ledger records the actual transfer of shares, the Subscription Agreement captures the initial intent to acquire those shares, making it a vital part of the share issuance process.

The Annual Report can be likened to the Stock Transfer Ledger in that it provides a comprehensive overview of the corporation's performance, including information about its shareholders. The report often includes details about share ownership and any changes that occurred during the year. While the Stock Transfer Ledger focuses on individual transactions, the Annual Report summarizes the overall state of the corporation, including its shareholders.

Lastly, the Meeting Minutes document is similar in that it records the proceedings of shareholder meetings, including discussions about share transfers and ownership issues. Meeting Minutes capture the decisions made by shareholders, including any resolutions regarding stock transfers. While the Stock Transfer Ledger tracks the actual transfers, the Meeting Minutes provide context and documentation of the discussions that led to those transfers.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. Here are ten important do's and don'ts to keep in mind:

- Do enter the corporation's name clearly at the top of the form.

- Don't leave any sections blank; every field must be completed.

- Do ensure that the names of stockholders are spelled correctly.

- Don't use abbreviations for names or addresses; clarity is key.

- Do accurately record the certificate numbers associated with each stock transfer.

- Don't mix up the dates; ensure the date of transfer matches the transaction date.

- Do indicate the number of shares being transferred in the appropriate section.

- Don't forget to note who the shares were transferred from and to.

- Do provide details about the amount paid for the shares, if applicable.

- Don't overlook the importance of signing the form where required.

By following these guidelines, you can help ensure that the Stock Transfer Ledger form is completed accurately and efficiently. This will not only aid in maintaining clear records but also facilitate smoother transactions in the future.

Key takeaways

When filling out the Stock Transfer Ledger form, consider the following key takeaways:

- Always enter the corporation's name at the top of the form to ensure proper identification.

- Clearly document the name of the stockholder and their place of residence for accurate record-keeping.

- Include details about the certificates issued, including certificate numbers and dates, to maintain a clear history of stock transfers.

- Ensure that the amount paid and the date of transfer are accurately recorded to reflect the transaction correctly.

How to Use Stock Transfer Ledger

Completing the Stock Transfer Ledger form is an essential step in documenting the transfer of stock ownership. Once filled out correctly, this form will help maintain accurate records of stock transactions and ensure compliance with corporate governance standards. Below are the steps to guide you through the process of filling out the form.

- Enter the Corporation’s Name: In the designated space at the top of the form, write the full name of the corporation involved in the stock transfer.

- Name of Stockholder: Provide the full name of the stockholder who is transferring the shares.

- Place of Residence: Fill in the stockholder’s residential address, ensuring accuracy for record-keeping purposes.

- Certificates Issued: Indicate the number of stock certificates that have been issued to the stockholder.

- Certificate Number: Enter the certificate number corresponding to the shares being transferred.

- Date Shares Issued: Write the date on which the shares were originally issued to the stockholder.

- From Whom Shares Were Transferred: If applicable, specify the name of the individual or entity from whom the shares were transferred. If it is an original issue, note that in this section.

- Amount Paid Thereon: State the amount that was paid for the shares being transferred.

- Date of Transfer of Shares: Fill in the date on which the stock transfer is taking place.

- To Whom Shares Were Transferred: Provide the name of the individual or entity receiving the shares.

- Certificates Surrendered: Indicate the number of certificates that are being surrendered as part of the transfer.

- Certificate Number: Write the certificate number for the shares that are being surrendered.

- Number of Shares Held (Balance): Finally, document the total number of shares the stockholder holds after the transfer is complete.