Fill Out a Valid Tax POA dr 835 Form

The Tax Power of Attorney (POA) DR 835 form is an essential document for individuals and businesses alike, allowing designated representatives to handle tax matters on behalf of the taxpayer. This form is particularly useful for those who may not have the time or expertise to navigate the complexities of tax regulations. By granting authority through the DR 835, taxpayers can ensure that their chosen representatives—be it a family member, accountant, or attorney—can communicate directly with tax authorities, receive confidential information, and make decisions regarding tax filings. The form requires specific details, including the taxpayer's identification information and the scope of authority granted, ensuring clarity in the representation. Understanding the nuances of the DR 835 is crucial for anyone looking to streamline their tax processes and ensure compliance with state and federal regulations. Proper completion of this form can alleviate stress and provide peace of mind, knowing that tax obligations are being managed effectively by a trusted individual.

Common mistakes

-

Incorrect Identification Information: Many individuals fail to provide accurate personal information. This includes name, address, and Social Security number. Even a small typo can lead to processing delays.

-

Missing Signatures: Some people forget to sign the form. Without a signature, the IRS will not accept the Power of Attorney.

-

Not Specifying the Tax Matters: It’s important to clearly indicate which tax matters the Power of Attorney covers. Leaving this section blank can lead to confusion and limit the authority granted.

-

Inaccurate Dates: Filling in the wrong dates can cause issues. Ensure that all dates, especially the date of signature, are correct.

-

Failure to Include Additional Representatives: If there are multiple representatives, people often forget to list them all. This can limit the effectiveness of the Power of Attorney.

-

Not Keeping a Copy: Some individuals neglect to keep a copy of the completed form for their records. This can be problematic if there are questions or issues later on.

-

Ignoring Submission Instructions: Each form has specific submission guidelines. Failing to follow these can result in delays or rejections.

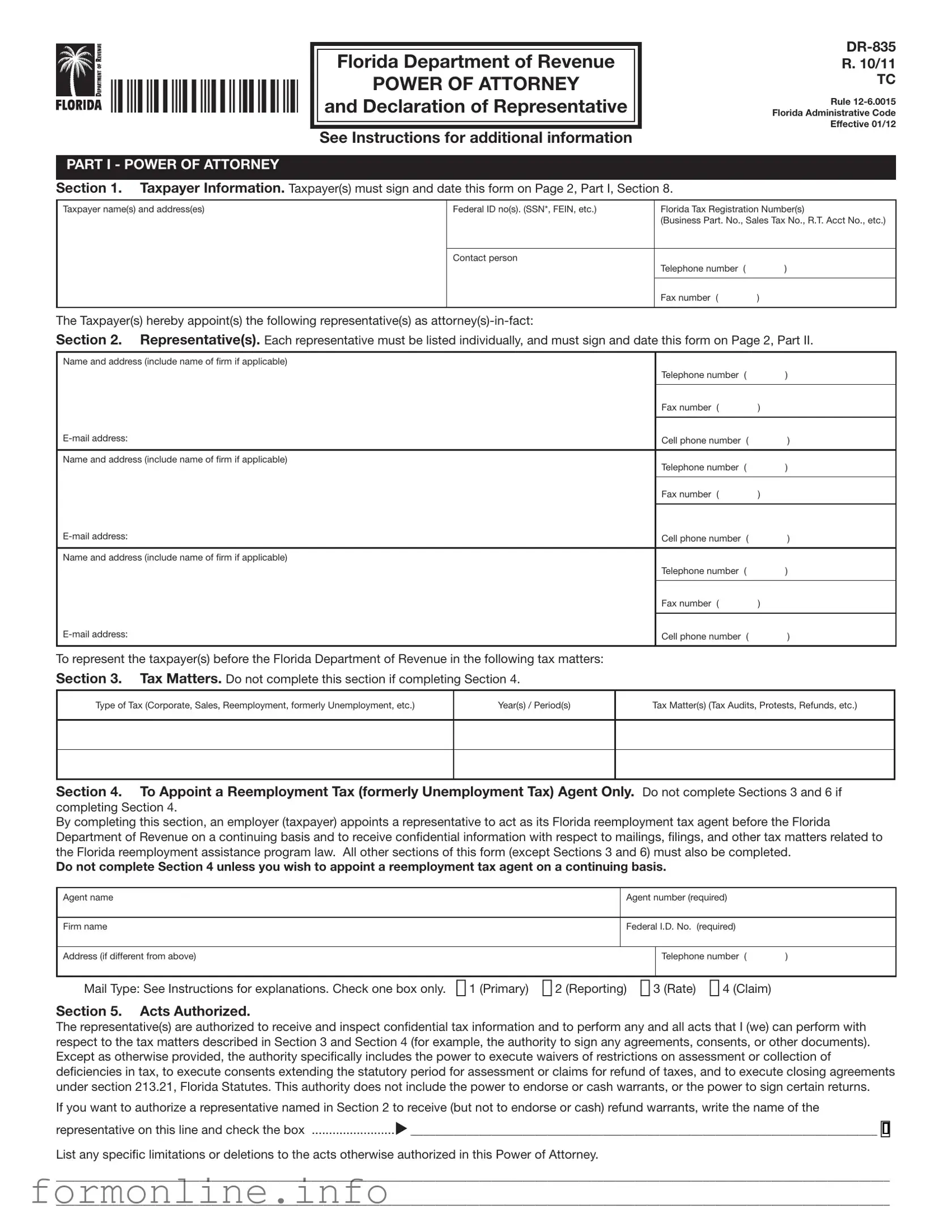

Preview - Tax POA dr 835 Form

I |

|

|

|

|

|

|

||

|

|

Florida Department of Revenue |

|

|

|

|||

1111111111111111111111111111111111 |

|

|

|

Florida |

R. 10/11 |

|||

|

I iiiiiiiiiiiiiiiiiiiiiiiiiiiiii~I |

|

|

Effective 01/12 |

||||

|

|

|

|

POWER OF ATTORNEY |

|

|

|

TC |

|

|

|

|

and Declaration of Representative |

|

|

|

Administrative Code |

|

|

|

|

L!;;;;;;;;;;;;;l |

|

|

|

Rule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Instructions for additional information |

|

|

|

|

PART I - POWER OF ATTORNEY

Section 1. Taxpayer Information. Taxpayer(s) must sign and date this form on Page 2, Part I, Section 8.

Taxpayer name(s) and address(es) |

Federal ID no(s). (SSN*, FEIN, etc.) |

Florida Tax Registration Number(s) |

|

|

|

(Business Part. No., Sales Tax No., R.T. Acct No., etc.) |

|

|

|

|

|

|

Contact person |

Telephone number ( |

) |

|

|

||

|

|

|

|

|

|

Fax number ( |

) |

|

|

|

|

The Taxpayer(s) hereby appoint(s) the following representative(s) as

Section 2. Representative(s). Each representative must be listed individually, and must sign and date this form on Page 2, Part II.

Name and address (include name of frm if applicable) |

|

|

|

|

Telephone number |

( |

) |

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

Name and address (include name of frm if applicable) |

Telephone number |

( |

) |

|

|||

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

Name and address (include name of frm if applicable) |

|

|

|

|

Telephone number |

( |

) |

|

|

|

|

|

Fax number ( |

|

) |

|

|

|

|

Cell phone number |

( |

) |

|

|

|

|

|

To represent the taxpayer(s) before the Florida Department of Revenue in the following tax matters:

Section 3. Tax Matters. Do not complete this section if completing Section 4.

Type of Tax (Corporate, Sales, Reemployment, formerly Unemployment, etc.)

Year(s) / Period(s)

Tax Matter(s) (Tax Audits, Protests, Refunds, etc.)

Section 4. To Appoint a Reemployment Tax (formerly Unemployment Tax) Agent Only. Do not complete Sections 3 and 6 if completing Section 4.

By completing this section, an employer (taxpayer) appoints a representative to act as its Florida reemployment tax agent before the Florida Department of Revenue on a continuing basis and to receive confdential information with respect to mailings, flings, and other tax matters related to the Florida reemployment assistance program law. All other sections of this form (except Sections 3 and 6) must also be completed.

Do not complete Section 4 unless you wish to appoint a reemployment tax agent on a continuing basis.

Agent name |

Agent number (required) |

|

|

|

|

|

|

Firm name |

Federal I.D. No. (required) |

|

|

|

|

|

|

Address (if different from above) |

|

Telephone number ( |

) |

|

|

|

|

Mail Type: See Instructions for explanations. Check one box only. ❑ 1 (Primary) ❑ 2 (Reporting) ❑ 3 (Rate) ❑ 4 (Claim)

Section 5. Acts Authorized.

The representative(s) are authorized to receive and inspect confdential tax information and to perform any and all acts that I (we) can perform with respect to the tax matters described in Section 3 and Section 4 (for example, the authority to sign any agreements, consents, or other documents). Except as otherwise provided, the authority specifcally includes the power to execute waivers of restrictions on assessment or collection of defciencies in tax, to execute consents extending the statutory period for assessment or claims for refund of taxes, and to execute closing agreements under section 213.21, Florida Statutes. This authority does not include the power to endorse or cash warrants, or the power to sign certain returns.

If you want to authorize a representative named in Section 2 to receive (but not to endorse or cash) refund warrants, write the name of the

representative on this line and check the box |

u___________________________________________________________________________ ❑ |

List any specifc limitations or deletions to the acts otherwise authorized in this Power of Attorney.

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

I |

|

|

|

|

111111111111111111111111111111111111111 |

R. 10/11 |

|

|

|||

|

Page 2 |

||

|

|

|

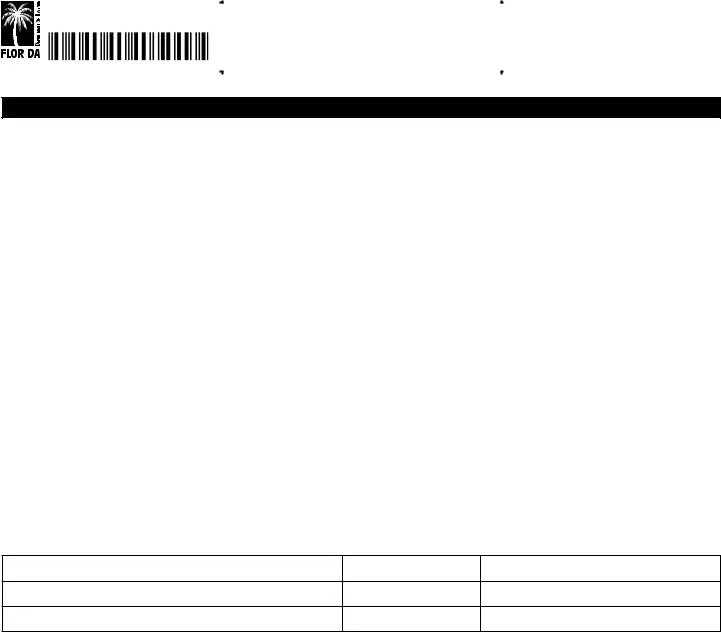

Florida Tax Registration Number: |

Taxpayer Name(s): |

Federal Identifcation Number: |

||

•Taxpayer(s) must complete Page 1 of this Power of Attorney or it will not be processed.

Section 6. Notices and Communication. Do not complete Section 6 if completing Section 4.

•Notices and other written communications will be sent to the first representative listed in Part I, Section 2, unless the taxpayer selects one of the options below. Receipt by either the representative or the taxpayer will be considered receipt by both.

a. |

If you want notices and communications sent to both you and your representative, check this box |

u |

❑ |

b. |

If you want notices or communications sent to you and not your representative, check this box |

u |

❑ |

Certain

Section 7. Retention / Nonrevocation of Prior Power(s) of Attorney.

The fling of this Power of Attorney will not revoke earlier Power(s) of Attorney on fle with the Florida Department of Revenue, even for the same tax matters and years or periods covered by this document. If you want to revoke a prior Power of

Attorney, check this box |

u ❑ |

You must attach a copy of any Power of Attorney you wish to revoke.

Section 8. Signature of Taxpayer(s).

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate offcer, partner, member/managing member, guardian, tax matters partner/person, executor, receiver, administrator, trustee, or fduciary on behalf of the taxpayer, I declare under penalties of perjury that I have the authority to execute this form on behalf of the taxpayer.

Under penalties of perjury, I (we) declare that I (we) have read the foregoing document, and the facts stated in it are true.

If this Power of Attorney is not signed and dated, it will be returned.

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

_______________________________________________________________________________________ |

________________________________________ |

_________________________________________ |

Signature |

Date |

Title (if applicable) |

_______________________________________________________________________________________ |

|

|

Print name |

|

|

PART II - DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

•I am familiar with the mandatory standards of conduct governing representation before the Department of Revenue, including Rules

•I am familiar with the law and facts related to this matter and am qualified to represent the taxpayer(s) in this matter.

•I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified therein, and to receive and inspect confidential taxpayer information.

•I am one of the following:

a.Attorney - a member in good standing of the bar of the highest court of the jurisdiction shown below.

b.Certifed Public Accountant - duly qualifed to practice as a certifed public accountant in the jurisdiction shown below.

c.Enrolled Agent – enrolled as an agent pursuant to the requirements of Treasury Department Circular Number 230.

d.Former Department of Revenue Employee. As a representative, I cannot accept representation in a matter upon which I had direct involvement while I was a public employee.

e.Reemployment Tax Agent authorized in Section 4 of this form.

f.Other Qualifed Representative

•I have read the foregoing Declaration of Representative and the facts stated in it are true.

If this Declaration of Representative is not signed and dated, it will not be processed.

Designation – Insert |

Jurisdiction (State) and |

Signature |

Letter from Above (a |

Enrollment Card No. (if any) |

|

|

|

|

Date

Made fillable by FormsPal.

POWER OF ATTORNEY INSTRUCTIONS

R.10/11 Page 3

Purpose of this form

A Power of Attorney (Form

to an attorney, certifed public accountant, enrolled agent, former Department employee, reemployment tax agent, or any other qualifed individual. A Power of Attorney is a legal document authorizing someone other than yourself to act as your representative.

You may use this form for any matters affecting any tax administered by the Department of Revenue. This includes both the audit and collection processes. A Power of Attorney will remain in effect until you revoke it. If you provide more than one Power of Attorney with respect to a tax and tax period, the Department employee handling your case will address notices and correspondence relative to that issue to the frst person listed on the latest Power of Attorney.

A Power of Attorney Form is generally not required, if the representative is, or is accompanied by: a trustee, a receiver, an administrator, an executor of an estate, a corporate offcer, or an authorized employee of the taxpayer.

Photocopies and fax copies of Form

How to Complete Form

PART I POWER OF ATTORNEY

Section 1 – Taxpayer Information

•For individuals and sole proprietorships: Enter your name, address, social security number, and telephone number(s) in the spaces provided. Enter your federal employer identifcation number (FEIN), if you have one. If a joint return is involved, and you and your spouse are designating the same

•For a corporation, limited liability company, or partnership: Enter the name, business address, FEIN, a contact person familiar with this matter, and telephone number(s).

•For a trust: Enter the name, title, address, and telephone number(s) of the fduciary, and name and FEIN of the trust.

•For an estate: Enter the name, title, address, and telephone number(s) of the decedent’s personal representative, and the name and identifcation number of the estate. The identifcation number for an estate includes both the FEIN if the estate has one and the decedent’s social security number.

•For any other entity: Enter the name, business address, FEIN, and telephone number(s), as well as the name of a contact person familiar with this matter.

•Identifcation Number: The Department may have assigned you a Florida tax registration number such as a sales tax number, a reemployment tax account number, or a business partner number. These numbers further assist the Department in identifying your particular tax matter, and you should enter them in the appropriate box. If you do not provide this information, the Department may not be able to process the Power of Attorney.

Section 2 – Representative(s)

Enter the individual name, frm name (if applicable), address, telephone number(s), and fax number of each individual appointed as

Section 3 – Tax Matters

Enter the type(s) of tax this Power of Attorney authorization applies to and the years or periods for which the Power of Attorney is granted. The word “All” is not specifc enough. If your tax situation does not ft into a tax type or period (for example, a specifc administrative appeal, audit, or collection matter), describe it in the blank space provided for “Tax Matters.” The Power of Attorney can be limited to specifc reporting period(s) that can be stated in year(s), quarter(s), month(s), etc., or can be granted for an indefnite period. You must indicate the tax types, periods, and/or matters for which you are authorizing representation by your

Examples: |

|

|

Sales and Use Tax |

First and second quarter 2008 |

|

Corporate Income Tax |

|

7/1/07 – 6/30/08 |

Communications Services Tax |

|

2006 thru 2008 |

Insurance Premium Tax |

|

1/1/06 – 12/31/08 |

Technical Assistance Advisement Request |

dated 8/6/08 |

|

Claim for Refund |

|

3/7/07 |

Section 4 – To Appoint a Reemployment Tax Agent Complete this section only if you wish to appoint an agent for reemployment taxes on a continuing basis. You should not complete Section 3 or Section 6, but you must complete the remaining sections of Form

Enter the agent’s name. It must be the same name as found in Section 2. Enter the frm name and address. You do not need to complete the address line if you reported that information in Section 2.

1.Enter the agent number. The agent number is a

2.Enter the federal employer identifcation number. The FEIN is a

3.Select the mail type.

Primary Mail. If you select primary mail, the agent will receive all documents from the Department of Revenue related to this reemployment tax account, and will be authorized to receive confdential information and discuss matters related to the tax and wage report, beneft information, claims, and the employer’s rate.

Reporting Mail. If you select reporting mail, the agent will receive the Employer’s Quarterly Report (Form

Rate Mail. If you select rate mail, the agent will receive tax rate notices and correspondence related to the rate and will be authorized to receive confdential information and discuss the employer’s rate notices and rate with the Department.

Claims Mail. If you select claims mail, the agent will receive the notice of benefts paid, and will be authorized to receive confdential information and discuss matters related to benefts.

Note: Duplicate copies of certain

Note: If you wish to appoint a representative to act on your behalf in a specifc and

Section 5 – Acts Authorized

Your signature on the back of the Power of Attorney authorizes the individual(s) you designate (your representative or

Section 6 – Mailing of Notices and Communications

If you do not check a box, the Department will send notices and other written communications to the frst representative listed in Section 2, unless you select another option. If you wish to have no documents sent to your representative, or documents sent to both you and your representative, you should check the appropriate box in Section 6. Check the second box if you wish to have notices and other written communications sent to you and not to your representative. In certain instances, the Department can only send documents to the taxpayer. Therefore, the taxpayer has the responsibility of keeping the representative informed of tax matters.

Note: Taxpayers completing Section 4 (To Appoint a Reemployment Tax Agent Only) should not complete Section 6. See Section 4 of these instructions for information regarding notices and communications sent to a reemployment tax agent.

Section 7 – Retention/Nonrevocation of Prior Power(s) of Attorney The most recent Power of Attorney will take precedence over, but will not revoke, prior Powers of Attorney. If you wish to revoke a prior Power of Attorney, you must check the box on the form and attach a copy of the old Power of Attorney.

Section 8 – Signature of Taxpayer(s)

The Power of Attorney is not valid until signed and dated by the taxpayer. The individual signing the Power of Attorney is representing, under penalties of perjury, that he or she is the taxpayer or authorized to execute the Power of Attorney on behalf of the taxpayer.

•For a corporation, trust, estate, or any other entity: A corporate offcer or person having authority to bind the entity must sign.

•For partnerships: All partners must sign unless one partner is authorized to act in the name of the partnership.

•For a sole proprietorship: The owner of the sole proprietorship must sign.

•For a joint return: Both husband and wife must sign if the representative represents both. If the representative only represents one spouse, then only that spouse should sign.

PART II – DECLARATION OF REPRESENTATIVE

Any party who appears before the Department of Revenue has the right, at his or her own expense, to be represented by counsel or by a qualifed representative. The representative(s) you name must declare, under penalties of perjury, that he or she is qualifed to represent you in this matter and will comply with the mandatory standards of conduct

R. 10/11

Page 4

governing representation before the Department of Revenue. The representative(s) must also declare, under penalties of perjury, that he or she has been authorized to represent the taxpayer(s) in this matter and authorized by the taxpayer(s) to receive confdential taxpayer information.

The representative(s) you name must sign and date this declaration and enter the designation (i.e., items

a.Attorney – Enter the

b.Certifed Public Accountant – Enter the

c.Enrolled Agent – Enter the enrollment card number issued by the Internal Revenue Service.

d.Former Department of Revenue Employee – Former employees may not accept representation in matters in which they were directly involved, and in certain cases, on any matter for a period of two years following termination of employment. If a former Department of Revenue employee is also an attorney or CPA, then the additional designation, jurisdiction, and enrollment card should also be entered.

e.Reemployment Tax Agent – A person(s) appointed under Section 4 of the Power of Attorney to handle reemployment tax matters on a continuing basis. A separate Power of Attorney form must be completed in order for a reemployment tax agent to handle a specifc and

f.Other Qualifed Representative – An individual may represent a taxpayer before the Department of Revenue if training and experience qualifes that person to handle a specifc matter.

Rule

(a)Engage in conduct involving dishonesty, fraud, deceit, or misrepresentation.

(b)Engage in conduct that is prejudicial to the administration of justice.

(c)Handle a matter that the representative knows or should know that he or she is not competent to handle.

(d)Handle a legal or factual matter without adequate preparation.

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www.foridarevenue.com and select “Privacy Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

Where to Mail Form

If Form

If Form

Other PDF Templates

Purpose of Nda - Successors and assigns of the parties are bound by the agreement's terms, ensuring continuity of obligations.

When completing the process of transferring ownership, it's important to have the proper documentation in place. The Georgia Motor Vehicle Bill of Sale form serves as an essential resource for buyers and sellers alike, providing all necessary details to facilitate a legitimate exchange. For additional guidance and to access the form, visit this link: https://georgiapdf.com/.

How to Get a Gun License - Accuracy in filling out all sections is vital to avoid delays or refusals in processing permits.

Free Printable Puppy Health Guarantee - This health guarantee affirms the well-being of your new puppy at the time of sale.

Documents used along the form

The Tax Power of Attorney (POA) Form DR 835 is an important document that allows an individual to designate someone else to handle their tax matters. When dealing with tax issues, there are several other forms and documents that are commonly used alongside the Tax POA. Below is a list of these forms, each serving a specific purpose in the tax process.

- IRS Form 2848: This is the official Power of Attorney and Declaration of Representative form used by the IRS. It allows taxpayers to appoint someone to represent them before the IRS, covering various tax matters.

- IRS Form 8821: This form authorizes an individual to receive and inspect confidential tax information but does not grant them the authority to represent the taxpayer before the IRS.

- IRS Form 1040: The standard individual income tax return form that taxpayers use to report their income, claim deductions, and calculate their tax liability.

- Wisconsin Motorcycle Bill of Sale: This form is essential for documenting the sale or transfer of a motorcycle in Wisconsin, ensuring proper ownership transfer and providing legal protection for both parties involved. For more details, visit https://autobillofsaleform.com/motorcycle-bill-of-sale-form/wisconsin-motorcycle-bill-of-sale-form.

- IRS Form 4868: This form is used to request an automatic extension of time to file the individual income tax return. It provides additional time to submit the tax return without incurring penalties.

- IRS Form 9465: This form is used to request a monthly installment plan for paying taxes owed. It helps taxpayers manage their payments over time if they cannot pay their tax bill in full.

- IRS Form 1099: This series of forms reports various types of income other than wages, salaries, and tips. It is important for both the payer and the recipient for tax reporting purposes.

- State Tax Forms: Each state has its own tax forms that may be required for filing state income taxes. These forms vary by state and can include individual income tax returns, property tax forms, and more.

- Tax Return Transcripts: These are documents provided by the IRS that summarize the information reported on a taxpayer’s return. They can be useful for verifying income or tax filing history.

Understanding these forms can help individuals navigate their tax responsibilities more effectively. Each document plays a role in ensuring that tax matters are handled accurately and efficiently, whether through representation, filing, or requesting extensions.

Similar forms

The IRS Form 2848, Power of Attorney and Declaration of Representative, serves a similar purpose to the Tax POA DR 835 form. Both documents allow individuals to authorize someone else to represent them before the IRS. This includes the ability to receive confidential tax information and to make decisions on behalf of the taxpayer. The IRS Form 2848 specifically outlines the scope of authority granted, detailing which tax matters the representative can handle, similar to how the Tax POA DR 835 delineates the powers given to the authorized individual.

The IRS Form 8821, Tax Information Authorization, is another document akin to the Tax POA DR 835. While both forms permit a designated representative to access a taxpayer’s information, the Form 8821 does not grant the authority to represent the taxpayer in dealings with the IRS. Instead, it strictly allows the representative to receive and review confidential tax information, making it less comprehensive than the Tax POA DR 835.

In the realm of mobile home transactions, the importance of using a well-structured document cannot be overstated; that’s where the Mobile Home Bill of Sale comes into play, providing a necessary legal foundation for transferring ownership and ensuring all essential details are captured to protect both parties involved in the sale.

The California Form 3520, Power of Attorney, resembles the Tax POA DR 835 in that it allows individuals to appoint someone to act on their behalf regarding state tax matters. This form is specific to California and provides a framework for the appointed representative to manage tax-related issues, similar to the powers outlined in the Tax POA DR 835 for federal matters.

The New York State Form POA-1, Power of Attorney, is another comparable document. It enables taxpayers in New York to designate a representative for tax purposes, similar to the Tax POA DR 835. The POA-1 form includes specific instructions on the powers granted, aligning with the purpose of the Tax POA DR 835 in allowing representation for tax issues.

The IRS Form 4506, Request for Copy of Tax Return, can also be seen as related to the Tax POA DR 835, although it serves a different function. This form allows individuals to authorize someone to request copies of their tax returns from the IRS. While the Tax POA DR 835 grants broader powers for representation, the Form 4506 focuses specifically on obtaining tax documents through an authorized representative.

The IRS Form 8822, Change of Address, shares a connection with the Tax POA DR 835 in that both forms involve communication with the IRS. The Form 8822 allows taxpayers to update their address records with the IRS, while the Tax POA DR 835 enables a representative to manage various tax matters. Both forms facilitate the taxpayer's interaction with the IRS but serve distinct purposes.

The IRS Form 9465, Installment Agreement Request, can be compared to the Tax POA DR 835 in terms of managing tax obligations. While the Form 9465 is specifically for requesting a payment plan for tax debts, the Tax POA DR 835 allows a representative to negotiate or discuss payment options on behalf of the taxpayer. Both forms are essential for addressing tax liabilities but focus on different aspects of tax management.

The IRS Form 1040, U.S. Individual Income Tax Return, is another document that relates to the Tax POA DR 835, though it serves a different purpose. The Form 1040 is the primary document used by individuals to report their income and calculate their tax obligations. However, if someone uses the Tax POA DR 835, they can have a representative file the Form 1040 on their behalf, allowing for assistance in tax preparation and submission.

The IRS Form 8822-B, Change of Address or Responsible Party – Business, is similar to the Tax POA DR 835 in that it deals with business tax matters. This form allows businesses to update their address or designate a new responsible party with the IRS. While the Tax POA DR 835 focuses on granting representation for tax issues, the Form 8822-B ensures that the IRS has the correct contact information for the business, highlighting the importance of accurate communication in tax matters.

Dos and Don'ts

When filling out the Tax POA DR 835 form, it's essential to approach the task with care. Here are five things you should do and five things you shouldn't do to ensure a smooth process.

Things You Should Do:

- Double-check all personal information for accuracy.

- Ensure that the form is signed and dated appropriately.

- Read the instructions carefully before starting.

- Keep a copy of the completed form for your records.

- Submit the form to the correct tax authority.

Things You Shouldn't Do:

- Don't leave any required fields blank.

- Avoid using correction fluid on the form.

- Don't forget to verify the eligibility of your representative.

- Never submit the form without reviewing it for errors.

- Don't ignore the submission deadlines set by the tax authority.

Key takeaways

When filling out and using the Tax POA DR 835 form, keep these key takeaways in mind:

- Understand the Purpose: The Tax POA DR 835 form allows you to authorize someone to represent you before the Colorado Department of Revenue.

- Provide Accurate Information: Ensure that all personal and tax information is correct. Mistakes can delay processing and create complications.

- Sign and Date: Your signature is required on the form. Failing to sign or date it may render the form invalid.

- Limitations of Authority: Clearly specify the scope of authority granted to your representative. This helps prevent any misunderstandings about what they can do on your behalf.

- Submit Promptly: File the form as soon as possible to ensure your representative can act on your behalf without delays.

How to Use Tax POA dr 835

Completing the Tax POA DR 835 form is an important step in granting someone the authority to act on your behalf regarding tax matters. Ensure all required information is accurate and complete before submitting the form to avoid delays.

- Obtain the Tax POA DR 835 form from the appropriate tax authority's website or office.

- Enter your name and address in the designated fields at the top of the form.

- Provide your Social Security Number (SSN) or Employer Identification Number (EIN) in the specified area.

- Fill in the name and address of the person you are authorizing to represent you.

- Indicate the specific tax matters for which the authorization applies, such as income tax or sales tax.

- Specify the years or periods for which the authorization is valid.

- Sign and date the form at the bottom, ensuring your signature matches the name provided at the top.

- Submit the completed form to the appropriate tax authority, either by mail or electronically, as required.

After submitting the form, keep a copy for your records. Monitor any communications from the tax authority to ensure the authorization is processed without issues.