Printable Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TOD Deed) serves as a useful estate planning tool for property owners who wish to designate beneficiaries for their real estate assets without the need for probate. This legal instrument allows individuals to transfer ownership of their property directly to named beneficiaries upon their death, thereby simplifying the transfer process and potentially reducing the associated costs and delays. By completing and recording a TOD Deed, property owners retain full control over their property during their lifetime, including the ability to sell, mortgage, or change beneficiaries as desired. Additionally, the TOD Deed must be executed in accordance with state-specific requirements, which may include notarization and proper recording with the local land records office. Understanding the implications of this deed is essential for individuals looking to streamline their estate planning and ensure their property is passed on according to their wishes.

State-specific Tips for Transfer-on-Death Deed Templates

Common mistakes

-

Failing to include all required information. Each section of the form must be completed accurately.

-

Not signing the deed. A Transfer-on-Death Deed must be signed by the property owner to be valid.

-

Using incorrect names. Ensure that the names of the beneficiaries are spelled correctly and match their legal documents.

-

Neglecting to provide the correct property description. A complete and accurate description of the property is essential.

-

Forgetting to have the deed notarized. Most states require notarization for the deed to be legally binding.

-

Not recording the deed with the appropriate county office. This step is crucial for the deed to take effect upon the owner's death.

-

Overlooking state-specific requirements. Each state may have unique rules regarding Transfer-on-Death Deeds.

-

Failing to update the deed after changes in circumstances. Changes in beneficiaries or property details require a new deed.

-

Not consulting with a legal professional. Seeking advice can help avoid mistakes and ensure compliance with the law.

-

Assuming the deed is effective immediately. The Transfer-on-Death Deed only takes effect upon the death of the property owner.

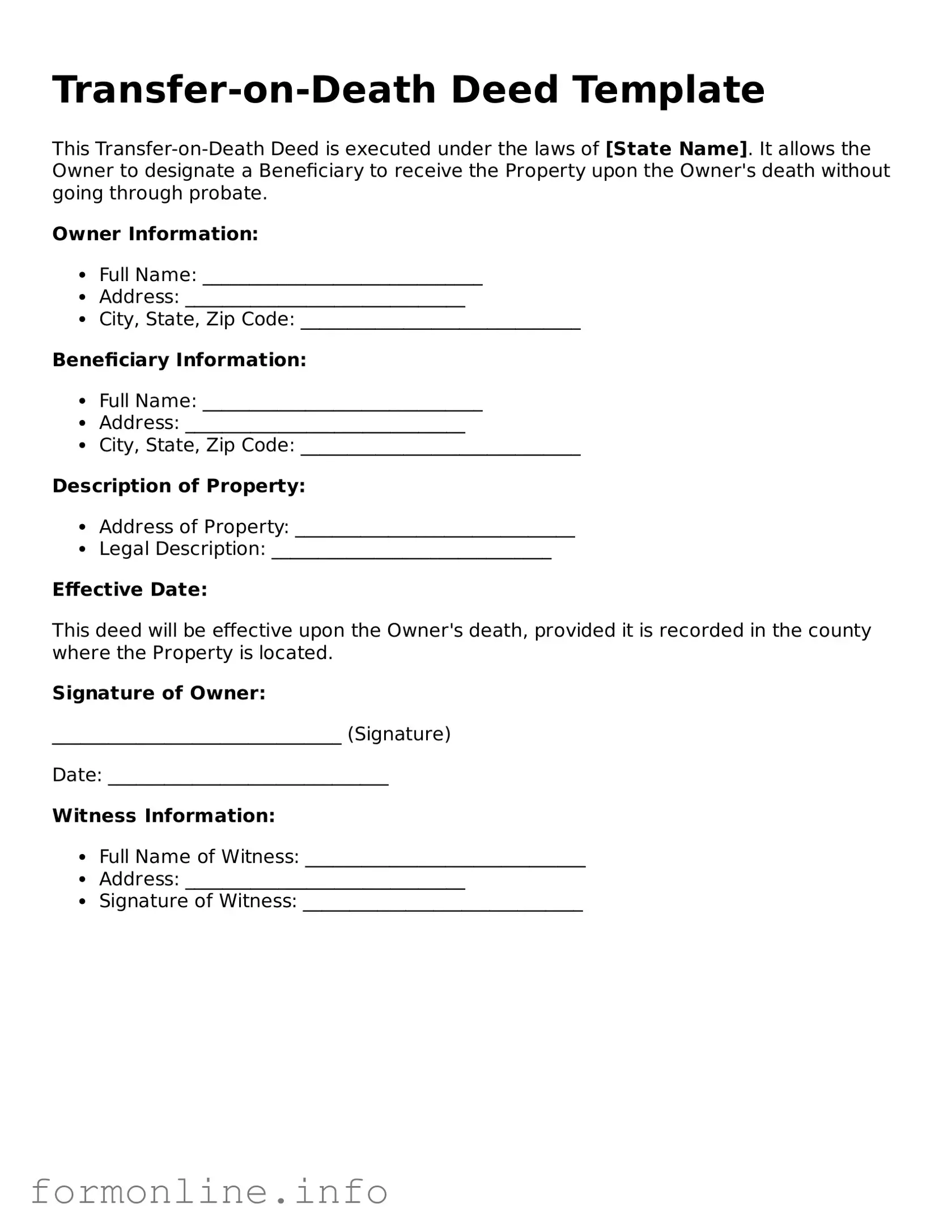

Preview - Transfer-on-Death Deed Form

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed under the laws of [State Name]. It allows the Owner to designate a Beneficiary to receive the Property upon the Owner's death without going through probate.

Owner Information:

- Full Name: ______________________________

- Address: ______________________________

- City, State, Zip Code: ______________________________

Beneficiary Information:

- Full Name: ______________________________

- Address: ______________________________

- City, State, Zip Code: ______________________________

Description of Property:

- Address of Property: ______________________________

- Legal Description: ______________________________

Effective Date:

This deed will be effective upon the Owner's death, provided it is recorded in the county where the Property is located.

Signature of Owner:

_______________________________ (Signature)

Date: ______________________________

Witness Information:

- Full Name of Witness: ______________________________

- Address: ______________________________

- Signature of Witness: ______________________________

More Types of Transfer-on-Death Deed Templates:

Lady Bird Deed Example - It helps protect property from being sold to pay for nursing home costs, depending on state regulations.

The importance of the Pennsylvania Motor Vehicle Bill of Sale form cannot be overstated, as it serves as a legal agreement that confirms the transfer of ownership from the seller to the buyer. It details the specifics of the transaction and ensures transparency between both parties, which is essential in any motor vehicle sale. To streamline the process and obtain the necessary documentation, you can visit autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form for more information.

Printable Quitclaim Deed - A Quitclaim Deed is popular in transactions involving property held in common among multiple owners.

Documents used along the form

A Transfer-on-Death (TOD) deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. While the TOD deed is a crucial document in estate planning, several other forms and documents are often used in conjunction with it to ensure a smooth transfer of assets and to clarify the intentions of the property owner. Below is a list of common documents that may accompany a Transfer-on-Death deed.

- This document outlines how a person wishes to distribute their assets upon death. It can serve to clarify intentions regarding any property not covered by the TOD deed.

- A trust that allows the creator to maintain control over their assets during their lifetime while specifying how those assets should be managed and distributed after their death.

- Used for financial accounts like life insurance or retirement plans, these forms specify who will receive the assets upon the account holder's death.

- This document grants someone the authority to make financial or medical decisions on behalf of another person if they become incapacitated, ensuring that their wishes are respected.

- A legal document that establishes the identity of heirs when a person dies without a will. It can be useful when settling estates that involve property transfers.

- Mobile Home Bill of Sale: This legal document is crucial for the transfer of ownership of a mobile home in Utah, ensuring that the transaction is official and protecting both the buyer and seller. For more information, you can visit the Mobile Home Bill of Sale.

- The legal document that officially records the ownership of real estate. It may need to be updated or referenced when executing a TOD deed.

- A formal notice that may be filed with the county to inform interested parties about the death of the property owner, which can be important for legal clarity.

- This document provides proof of the existence of a trust and outlines its terms without revealing all the details, which can be useful when dealing with property transfers.

- A detailed list of all assets owned by the deceased, which helps in understanding the total estate and ensuring proper distribution according to the deceased's wishes.

Incorporating these documents into estate planning can help clarify the intentions of the property owner and streamline the transfer process. Each document plays a specific role in ensuring that assets are distributed according to the owner’s wishes, minimizing potential disputes among heirs and beneficiaries.

Similar forms

The Transfer-on-Death Deed (TOD) form is similar to a Last Will and Testament in that both documents allow individuals to dictate the distribution of their assets upon death. A will provides a comprehensive plan for asset distribution, appoints guardians for minor children, and names an executor to manage the estate. In contrast, a TOD deed specifically addresses the transfer of real property, bypassing the probate process. This simplicity can make the TOD deed an appealing choice for those looking to streamline the transfer of their home or other real estate without the complexities involved in a full estate plan.

Understanding the essentials of property transfer documents, such as the Connecticut Mobile Home Bill of Sale, is crucial for anyone involved in this process. This legal form allows the transfer of ownership of a mobile home and includes necessary details, ensuring a smooth transaction. For those looking for a reliable version, the Mobile Home Bill of Sale is an excellent resource to help navigate the requirements of this important document.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it is important to approach the process with care. Here are nine key points to consider:

- Do: Ensure that you understand the purpose of the Transfer-on-Death Deed.

- Do: Provide accurate information about the property and the beneficiaries.

- Do: Sign the form in the presence of a notary public.

- Do: File the deed with the appropriate local government office.

- Do: Keep a copy of the filed deed for your records.

- Don't: Leave any sections of the form blank.

- Don't: Forget to check state-specific requirements for validity.

- Don't: Assume that verbal agreements with beneficiaries are sufficient.

- Don't: Delay in filing the deed, as timing can affect its validity.

By following these guidelines, you can help ensure that your intentions regarding property transfer are clearly communicated and legally recognized.

Key takeaways

When considering a Transfer-on-Death Deed (TODD), it is essential to understand its implications and proper usage. Below are key takeaways to guide you through the process.

- Purpose: A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- Eligibility: This deed can be used for residential properties, but not for all types of real estate. Check your state’s regulations for specific eligibility requirements.

- Filling Out the Form: Complete the form accurately, including the legal description of the property and the names of the beneficiaries. Errors can lead to complications later.

- Signing Requirements: The deed must be signed by the property owner and typically requires notarization. Ensure you follow your state’s specific signing requirements.

- Recording the Deed: After signing, the deed must be recorded with the appropriate local government office. This step is crucial for the deed to be valid.

- Revocation: The property owner can revoke the deed at any time before death. To do so, a formal revocation must be filed with the same office where the deed was recorded.

Understanding these key points can help ensure that the Transfer-on-Death Deed serves its intended purpose effectively and compassionately for your loved ones.

How to Use Transfer-on-Death Deed

After obtaining the Transfer-on-Death Deed form, it is essential to accurately complete it to ensure that the transfer of property occurs smoothly upon the owner's passing. Following the completion of the form, it must be properly executed and recorded with the appropriate local authority to be effective.

- Begin by clearly writing the name of the property owner at the top of the form.

- Provide the address of the property being transferred, ensuring all details are accurate.

- List the names of the beneficiaries who will receive the property upon the owner's death.

- Include the relationship of each beneficiary to the property owner for clarity.

- Sign the form in the presence of a notary public to validate the deed.

- Have the notary public complete their section, confirming the signature and date.

- Make copies of the completed and notarized form for personal records.

- File the original deed with the local county recorder’s office to officially record the transfer.