Fill Out a Valid TREC One to four family residential contract Form

Buying or selling a home can feel like navigating a complex maze, but understanding the TREC One to Four Family Residential Contract Form can simplify the process significantly. This essential document serves as the foundation for real estate transactions in Texas, detailing the rights and obligations of both buyers and sellers. It covers key components such as the purchase price, financing details, and the closing date, ensuring that all parties are on the same page. Additionally, it outlines important contingencies, including inspections and repairs, which protect buyers from unforeseen issues. The form also addresses earnest money, a deposit that shows the buyer's serious intent, and specifies what happens if either party fails to uphold their end of the agreement. By grasping the major aspects of this contract, individuals can approach their real estate transactions with confidence, knowing they have a clear roadmap to follow.

Common mistakes

-

Failing to provide accurate property details. Buyers and sellers often overlook the importance of including the correct legal description, which can lead to disputes later.

-

Not specifying the sale price clearly. A vague or incomplete price can create confusion and misunderstandings between parties.

-

Ignoring the financing section. Buyers sometimes neglect to indicate how they plan to finance the purchase, which is crucial for the seller's evaluation.

-

Overlooking deadlines. Missing important dates for inspections, financing approval, or closing can jeopardize the transaction.

-

Failing to include necessary contingencies. Buyers should include contingencies for inspections, appraisals, and financing to protect their interests.

-

Not disclosing known issues with the property. Sellers must be transparent about any defects or problems to avoid legal repercussions later.

-

Using incorrect or outdated forms. Always ensure you are using the most current version of the TREC form to avoid complications.

-

Neglecting to review the contract thoroughly. Parties should read the entire document to understand their rights and obligations fully.

-

Forgetting to sign and date the contract. An unsigned contract is not legally binding, which can lead to significant issues.

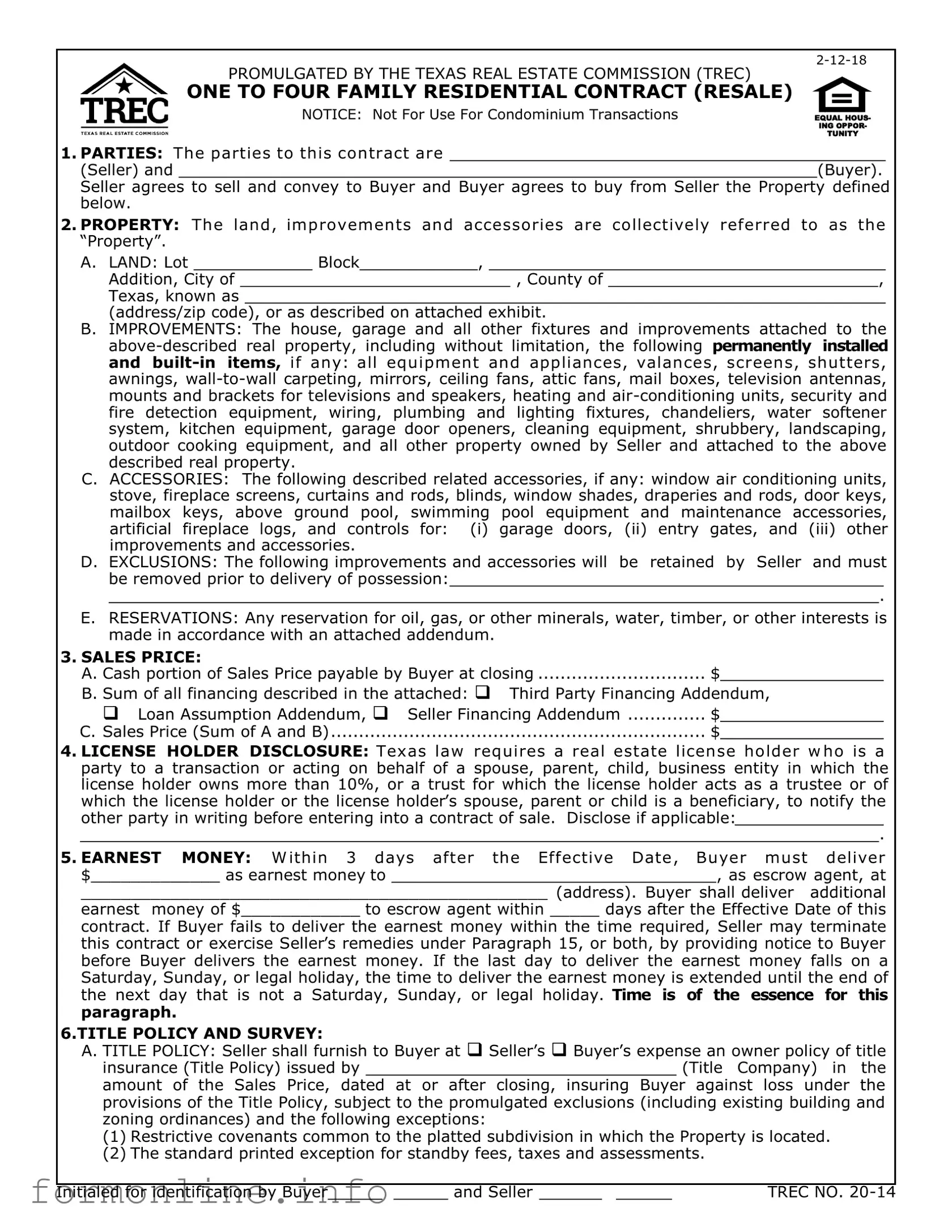

Preview - TREC One to four family residential contract Form

|

|

|||||

Contract Concerning |

Page of 10 |

|||||

|

PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION (TREC) |

|

|

|

|

|

|

(Address of Property) |

|

|

|

|

|

|

ONE TO FOUR FAMILY RESIDENTIAL CONTRACT (RESALE) |

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE: Not For Use For Condominium Transactions

EQUAL HOUS-

ING OPPOR-

TUNITY

1.PARTIES: The parties to this contract are

(Seller) and(Buyer). Seller agrees to sell and convey to Buyer and Buyer agrees to buy from Seller the Property defined below.

2.PROPERTY: The land, improvements and accessories are collectively referred to as the “Property”.

A. LAND: Lot |

Block |

, |

|

Addition, City of |

|

, County of |

, |

Texas, known as |

|

|

|

(address/zip code), or as described on attached exhibit.

B. IMPROVEMENTS: The house, garage and all other fixtures and improvements attached to the

C.ACCESSORIES: The following described related accessories, if any: window air conditioning units, stove, fireplace screens, curtains and rods, blinds, window shades, draperies and rods, door keys, mailbox keys, above ground pool, swimming pool equipment and maintenance accessories, artificial fireplace logs, and controls for: (i) garage doors, (ii) entry gates, and (iii) other improvements and accessories.

D.EXCLUSIONS: The following improvements and accessories will be retained by Seller and must be removed prior to delivery of possession:

.

E.RESERVATIONS: Any reservation for oil, gas, or other minerals, water, timber, or other interests is made in accordance with an attached addendum.

3.SALES PRICE:

A.Cash portion of Sales Price payable by Buyer at closing .............................. $

B.Sum of all financing described in the attached: Third Party Financing Addendum, Loan Assumption Addendum, Seller Financing Addendum .............. $

C.Sales Price (Sum of A and B)................................................................... $

4.LICENSE HOLDER DISCLOSURE: Texas law requires a real estate license holder w ho is a party to a transaction or acting on behalf of a spouse, parent, child, business entity in which the license holder owns more than 10%, or a trust for which the license holder acts as a trustee or of which the license holder or the license holder’s spouse, parent or child is a beneficiary, to notify the other party in writing before entering into a contract of sale. Disclose if applicable:

.

5.EARNEST MONEY: W ithin 3 days after the Effective Date, Buyer must deliver

$_____________ as earnest money to, as escrow agent, at

_______________________________________________ (address). Buyer shall deliver additional

earnest money of $____________ to escrow agent within _____ days after the Effective Date of this

contract. If Buyer fails to deliver the earnest money within the time required, Seller may terminate this contract or exercise Seller’s remedies under Paragraph 15, or both, by providing notice to Buyer before Buyer delivers the earnest money. If the last day to deliver the earnest money falls on a Saturday, Sunday, or legal holiday, the time to deliver the earnest money is extended until the end of the next day that is not a Saturday, Sunday, or legal holiday. Time is of the essence for this paragraph.

6.TITLE POLICY AND SURVEY:

A. TITLE POLICY: Seller shall furnish to Buyer at Seller’s Buyer’s expense an owner policy of title

insurance (Title Policy) issued by(Title Company) in the amount of the Sales Price, dated at or after closing, insuring Buyer against loss under the provisions of the Title Policy, subject to the promulgated exclusions (including existing building and zoning ordinances) and the following exceptions:

(1)Restrictive covenants common to the platted subdivision in which the Property is located.

(2)The standard printed exception for standby fees, taxes and assessments.

Initialed for identification by Buyer |

and Seller |

TREC NO. |

Contract Concerning |

Page 2 of 10 |

|

|

(Address of Property) |

|

(3)Liens created as part of the financing described in Paragraph 3.

(4)Utility easements created by the dedication deed or plat of the subdivision in which the Property is located.

(5)Reservations or exceptions otherwise permitted by this contract or as may be approved by Buyer in writing.

(6)The standard printed exception as to marital rights.

(7)The standard printed exception as to waters, tidelands, beaches, streams, and related matters.

(8)The standard printed exception as to discrepancies, conflicts, shortages in area or

boundary lines, encroachments or protrusions, or overlapping improvements: (i) will not be amended or deleted from the title policy; or

(ii) will be amended to read, "shortages in area" at the expense of Buyer Seller.

(9)The exception or exclusion regarding minerals approved by the Texas Department of Insurance.

B.COMMITMENT: Within 20 days after the Title Company receives a copy of this contract, Seller shall furnish to Buyer a commitment for title insurance (Commitment) and, at Buyer's expense, legible copies of restrictive covenants and documents evidencing exceptions in the Commitment (Exception Documents) other than the standard printed exceptions. Seller authorizes the Title Company to deliver the Commitment and Exception Documents to Buyer at Buyer's address shown in Paragraph 21. If the Commitment and Exception Documents are not delivered to Buyer within the specified time, the time for delivery will be automatically extended up to 15 days or 3 days before the Closing Date, whichever is earlier. If the Commitment and Exception Documents are not delivered within the time required, Buyer may terminate this contract and the earnest money will be refunded to Buyer.

C.SURVEY: The survey must be made by a registered professional land surveyor acceptable to the Title Company and Buyer’s lender(s). (Check one box only)

(1) Within days after the Effective Date of this contract, Seller shall furnish to Buyer

and Title Company Seller's existing survey of the Property and a Residential Real Property Affidavit promulgated by the Texas Department of Insurance

Date. If the existing survey or affidavit is not acceptable to Title Company or Buyer's lender(s), Buyer shall obtain a new survey at Seller's Buyer's expense no later than 3 days prior to Closing Date.

(2) Withindays after the Effective Date of this contract, Buyer shall obtain a new survey at Buyer's expense. Buyer is deemed to receive the survey on the date of actual receipt or the date specified in this paragraph, whichever is earlier.

(3) Within |

days after the Effective Date of this contract, Seller, at Seller's expense |

shall furnish a new survey to Buyer.

D. OBJECTIONS: Buyer may object in writing to defects, exceptions, or encumbrances to title: disclosed on the survey other than items 6A(1) through (7) above; disclosed in the Commitment other than items 6A(1) through (9) above; or which prohibit the following use

or activity: |

. |

Buyer must object the earlier of (i) the Closing Date or (ii) |

days after Buyer receives |

the Commitment, Exception Documents, and the survey. Buyer’s failure to object within the time allowed will constitute a waiver of Buyer’s right to object; except that the requirements in Schedule C of the Commitment are not waived by Buyer. Provided Seller is not obligated to incur any expense, Seller shall cure any timely objections of Buyer or any third party lender within 15 days after Seller receives the objections (Cure Period) and the Closing Date will be extended as necessary. If objections are not cured within the Cure Period, Buyer may, by delivering notice to Seller within 5 days after the end of the Cure Period: (i) terminate this contract and the earnest money will be refunded to Buyer; or (ii) waive the objections. If Buyer does not terminate within the time required, Buyer shall be deemed to have waived the objections. If the Commitment or Survey is revised or any new Exception Document(s) is delivered, Buyer may object to any new matter revealed in the revised Commitment or Survey or new Exception Document(s) within the same time stated in this paragraph to make objections beginning when the revised Commitment, Survey, or Exception Document(s) is delivered to Buyer.

E. TITLE NOTICES:

(1)ABSTRACT OR TITLE POLICY: Broker advises Buyer to have an abstract of title covering the Property examined by an attorney of Buyer’s selection, or Buyer should be furnished with or obtain a Title Policy. If a Title Policy is furnished, the Commitment should be promptly reviewed by an attorney of Buyer’s choice due to the time limitations on Buyer’s right to object.

(2)MEMBERSHIP IN PROPERTY OWNERS ASSOCIATION(S): The Property is is not

Initialed for identification by Buyer |

and Seller |

TREC NO. |

Contract Concerning |

Page 3 of 10 |

|

|

(Address of Property) |

|

subject to mandatory membership in a property owners association(s). If the Property is subject to mandatory membership in a property owners association(s), Seller notifies Buyer under §5.012, Texas Property Code, that, as a purchaser of property in the residential community identified in Paragraph 2A in which the Property is located, you are obligated to be a member of the property owners association(s). Restrictive covenants governing the use and occupancy of the Property and all dedicatory instruments governing the establishment, maintenance, or operation of this residential community have been or will be recorded in the Real Property Records of the county in which the Property is located. Copies of the restrictive covenants and dedicatory instruments may be obtained from the county clerk. You are obligated to pay assessments to the property owners association(s). The amount of the assessments is subject to change. Your failure to pay the assessments could result in enforcement of the association’s lien on and the foreclosure of the Property.

Section 207.003, Property Code, entitles an owner to receive copies of any document that governs the establishment, maintenance, or operation of a subdivision, including, but not limited to, restrictions, bylaws, rules and regulations, and a resale certificate from a property owners' association. A resale certificate contains information including, but not limited to, statements specifying the amount and frequency of regular assessments and the style and cause number of lawsuits to which the property owners' association is a party, other than lawsuits relating to unpaid ad valorem taxes of an individual member of the association. These documents must be made available to you by the property owners' association or the association's agent on your request.

If Buyer is concerned about these matters, the TREC promulgated Addendum for Property Subject to Mandatory Membership in a Property Owners Association(s) should be used.

(3)STATUTORY TAX DISTRICTS: If the Property is situated in a utility or other statutorily created district providing water, sewer, drainage, or flood control facilities and services, Chapter 49, Texas Water Code, requires Seller to deliver and Buyer to sign the statutory notice relating to the tax rate, bonded indebtedness, or standby fee of the district prior to final execution of this contract.

(4)TIDE WATERS: If the Property abuts the tidally influenced waters of the state, §33.135, Texas Natural Resources Code, requires a notice regarding coastal area property to be included in the contract. An addendum containing the notice promulgated by TREC or required by the parties must be used.

(5)ANNEXATION: If the Property is located outside the limits of a municipality, Seller notifies Buyer under §5.011, Texas Property Code, that the Property may now or later be included in the extraterritorial jurisdiction of a municipality and may now or later be subject to annexation by the municipality. Each municipality maintains a map that depicts its boundaries and extraterritorial jurisdiction. To determine if the Property is located within a municipality’s extraterritorial jurisdiction or is likely to be located within a municipality’s extraterritorial jurisdiction, contact all municipalities located in the general proximity of the Property for further information.

(6)PROPERTY LOCATED IN A CERTIFICATED SERVICE AREA OF A UTILITY SERVICE PROVIDER: Notice required by §13.257, Water Code: The real property, described in Paragraph 2, that you are about to purchase may be located in a certificated water or sewer service area, which is authorized by law to provide water or sewer service to the properties in the certificated area. If your property is located in a certificated area there may be special costs or charges that you will be required to pay before you can receive water or sewer service. There may be a period required to construct lines or other facilities necessary to provide water or sewer service to your property. You are advised to determine if the property is in a certificated area and contact the utility service provider to determine the cost that you will be required to pay and the period, if any, that is required to provide water or sewer service to your property. The undersigned Buyer hereby acknowledges receipt of the foregoing notice at or before the execution of a binding contract for the purchase of the real property described in Paragraph 2 or at closing of purchase of the real property.

(7)PUBLIC IMPROVEMENT DISTRICTS: If the Property is in a public improvement district,

§5.014, Property Code, requires Seller to notify Buyer as follows: As a purchaser of this parcel of real property you are obligated to pay an assessment to a municipality or county for an improvement project undertaken by a public improvement district under Chapter 372, Local Government Code. The assessment may be due annually or in periodic installments. More information concerning the amount of the assessment and the due dates of that assessment may be obtained from the municipality or county levying the assessment. The amount of the assessments is subject to change. Your failure to pay the assessments could result in a lien on and the foreclosure of your property.

(8)TRANSFER FEES: If the Property is subject to a private transfer fee obligation, §5.205,

Property Code, requires Seller to notify Buyer as follows: The private transfer fee

Initialed for identification by Buyer |

and Seller |

TREC NO. |

Contract Concerning |

Page 4 of 10 |

|

|

(Address of Property) |

|

obligation may be governed by Chapter 5, Subchapter G of the Texas Property Code.

(9) PROPANE GAS SYSTEM SERVICE AREA: If the Property is located in a propane gas system service area owned by a distribution system retailer, Seller must give Buyer written notice as required by §141.010, Texas Utilities Code. An addendum containing the notice approved by TREC or required by the parties should be used.

(10)NOTICE OF WATER LEVEL FLUCTUATIONS: If the Property adjoins an impoundment of water, including a reservoir or lake, constructed and maintained under Chapter 11, Water Code, that has a storage capacity of at least 5,000

impoundment; or (2) drought or flood conditions.”

7.PROPERTY CONDITION:

A. ACCESS, INSPECTIONS AND UTILITIES: Seller shall permit Buyer and Buyer’s agents access to the Property at reasonable times. Buyer may have the Property inspected by inspectors selected by Buyer and licensed by TREC or otherwise permitted by law to make inspections. Any hydrostatic testing must be separately authorized by Seller in writing. Seller at Seller's expense shall immediately cause existing utilities to be turned on and shall keep the utilities on during the time this contract is in effect.

B. SELLER'S DISCLOSURE NOTICE PURSUANT TO §5.008, TEXAS PROPERTY CODE (Notice): (Check one box only)

(1) Buyer has received the Notice.

(2) Buyer has not received the Notice. Withindays after the Effective Date of this contract, Seller shall deliver the Notice to Buyer. If Buyer does not receive the Notice, Buyer may terminate this contract at any time prior to the closing and the earnest money will be refunded to Buyer. If Seller delivers the Notice, Buyer may terminate this contract for any reason within 7 days after Buyer receives the Notice or prior to the closing, whichever first occurs, and the earnest money will be refunded to Buyer.

(3)The Seller is not required to furnish the notice under the Texas Property Code.

C.SELLER’S DISCLOSURE OF

D.ACCEPTANCE OF PROPERTY CONDITION: “As Is” means the present condition of the Property with any and all defects and without warranty except for the warranties of title and the warranties in this contract. Buyer’s agreement to accept the Property As Is under Paragraph 7D(1) or (2) does not preclude Buyer from inspecting the Property under Paragraph 7A, from negotiating repairs or treatments in a subsequent amendment, or from terminating this contract during the Option Period, if any.

(Check one box only)

(1) Buyer accepts the Property As Is.

(2) Buyer accepts the Property As Is provided Seller, at Seller’s expense, shall complete the following specific repairs and treatments:

.

(Do not insert general phrases, such as “subject to inspections” that do not identify specific repairs and treatments.)

E. LENDER REQUIRED REPAIRS AND TREATMENTS: Unless otherwise agreed in writing, neither party is obligated to pay for lender required repairs, which includes treatment for wood destroying insects. If the parties do not agree to pay for the lender required repairs or treatments, this contract will terminate and the earnest money will be refunded to Buyer. If the cost of lender required repairs and treatments exceeds 5% of the Sales Price, Buyer may terminate this contract and the earnest money will be refunded to Buyer.

F. COMPLETION OF REPAIRS AND TREATMENTS: Unless otherwise agreed in writing: (i) Seller shall complete all agreed repairs and treatments prior to the Closing Date; and (ii) all required permits must be obtained, and repairs and treatments must be performed by persons who are licensed to provide such repairs or treatments or, if no license is required by law, are commercially engaged in the trade of providing such repairs or treatments. At Buyer’s election, any transferable warranties received by Seller with respect to the repairs and treatments will be transferred to Buyer at Buyer’s expense. If Seller fails to complete any agreed repairs and treatments prior to the Closing Date, Buyer may exercise remedies under Paragraph 15 or extend the Closing Date up to 5 days if necessary for Seller to complete the repairs and treatments.

G. ENVIRONMENTAL MATTERS: Buyer is advised that the presence of wetlands, toxic substances, including asbestos and wastes or other environmental hazards, or the presence of a threatened or endangered species or its habitat may affect Buyer’s intended use of the Property. If Buyer is concerned about these matters, an addendum promulgated by TREC or

required by the parties should be used.

Initialed for identification by Buyer |

and Seller |

TREC NO. |

Contract Concerning |

Page 5 of 10 |

|

|

(Address of Property) |

|

H. RESIDENTIAL SERVICE CONTRACTS: Buyer may purchase a residential service contract from a residential service company licensed by TREC. If Buyer purchases a residential service contract, Seller shall reimburse Buyer at closing for the cost of the residential

service contract in an amount not exceeding $. Buyer should review any residential service contract for the scope of coverage, exclusions and limitations. The purchase of a residential service contract is optional. Similar coverage may be purchased from various companies authorized to do business in Texas.

8.BROKERS’ FEES: All obligations of the parties for payment of brokers ’ fees are contained in separate written agreements.

9.CLOSING:

A. The closing of the sale will be on or before, 20 , or within 7 days after objections made under Paragraph 6D have been cured or waived, whichever date is later (Closing Date). If either party fails to close the sale by the Closing Date, the non- defaulting party may exercise the remedies contained in Paragraph 15.

B. At closing:

(1) Seller shall execute and deliver a general warranty deed conveying title to the Property

to Buyer and showing no additional exceptions to those permitted in Paragraph 6 and furnish tax statements or certificates showing no delinquent taxes on the Property.

(2) Buyer shall pay the Sales Price in good funds acceptable to the escrow agent.

(3) Seller and Buyer shall execute and deliver any notices, statements, certificates, affidavits, releases, loan documents and other documents reasonably required for the closing of the sale and the issuance of the Title Policy.

(4) There will be no liens, assessments, or security interests against the Property which will not be satisfied out of the sales proceeds unless securing the payment of any loans assumed by Buyer and assumed loans will not be in default.

(5)If the Property is subject to a residential lease, Seller shall transfer security deposits (as defined under §92.102, Property Code), if any, to Buyer. In such an event, Buyer shall deliver to the tenant a signed statement acknowledging that the Buyer has acquired the Property and is responsible for the return of the security deposit, and specifying the exact dollar amount of the security deposit.

10.POSSESSION:

A.Buyer’s Possession: Seller shall deliver to Buyer possession of the Property in its present or

required condition, ordinary wear and tear excepted: upon closing and funding according to a temporary residential lease form promulgated by TREC or other written lease required by the parties. Any possession by Buyer prior to closing or by Seller after closing which is not authorized by a written lease will establish a tenancy at sufferance relationship between the parties. Consult your insurance agent prior to change of ownership and possession because insurance coverage may be limited or terminated. The absence of a written lease or appropriate insurance coverage may expose the parties to economic loss.

B.Leases:

(1)After the Effective Date, Seller may not execute any lease (including but not limited to mineral leases) or convey any interest in the Property without Buyer’s written consent.

(2)If the Property is subject to any lease to which Seller is a party, Seller shall deliver to Buyer copies of the lease(s) and any

11.SPECIAL PROVISIONS: (Insert only factual statements and business details applicable to the sale. TREC rules prohibit license holders from adding factual statements or business details for which a contract addendum, lease or other form has been promulgated by TREC for mandatory use.)

12.SETTLEMENT AND OTHER EXPENSES:

A. The following expenses must be paid at or prior to closing:

(1)Expenses payable by Seller (Seller's Expenses):

(a)Releases of existing liens, including prepayment penalties and recording fees; release of Seller’s loan liability; tax statements or certificates; preparation of deed;

(b) Seller shall also pay an amount not to exceed $ |

to be applied in the |

||

following order: Buyer’s Expenses which Buyer is prohibited from paying by FHA, VA, |

|||

Texas Veterans Land Board or other governmental loan programs, and then to other |

|||

Buyer’s Expenses as allowed by the lender. |

|

|

|

|

|

|

|

Initialed for identification by Buyer |

and Seller |

TREC NO. |

|

Contract Concerning |

Page 6 of 10 |

|

|

(Address of Property) |

|

(2)Expenses payable by Buyer (Buyer's Expenses): Appraisal fees; loan application fees; origination charges; credit reports; preparation of loan documents; interest on the notes from date of disbursement to one month prior to dates of first monthly payments; recording fees; copies of easements and restrictions; loan title policy with endorsements required by lender;

B.If any expense exceeds an amount expressly stated in this contract for such expense to be paid by a party, that party may terminate this contract unless the other party agrees to pay such excess. Buyer may not pay charges and fees expressly prohibited by FHA, VA, Texas Veterans Land Board or other governmental loan program regulations.

13.PRORATIONS: Taxes for the current year, interest, maintenance fees, assessments, dues and rents will be prorated through the Closing Date. The tax proration may be calculated taking into consideration any change in exemptions that will affect the current year's taxes. If taxes for the current year vary from the amount prorated at closing, the parties shall adjust the prorations when tax statements for the current year are available. If taxes are not paid at or prior to closing, Buyer shall pay taxes for the current year.

14.CASUALTY LOSS: If any part of the P roperty is damaged or destroyed by fire or other casualty after the Effective Date of this contract, Seller shall restore the Property to its previous condition as soon as reasonably possible, but in any event by the Closing Date. If Seller fails to do so due to factors beyond Seller’s control, Buyer may (a) terminate this contract and the earnest money will be refunded to Buyer (b) extend the time for performance up to 15 days and the Closing Date will be extended as necessary or (c) accept the Property in its damaged condition with an assignment of insurance proceeds, if permitted by Seller’s insurance carrier, and receive credit from Seller at closing in the amount of the deductible under the insurance policy. Seller’s obligations under this paragraph are independent of any other obligations of Seller under this contract.

15.DEFAULT: If Buyer fails to comply w ith this contract, Buyer w ill be in default, and Seller may (a) enforce specific performance, seek such other relief as may be provided by law, or both, or (b) terminate this contract and receive the earnest money as liquidated damages, thereby releasing both parties from this contract. If Seller fails to comply with this contract, Seller will be in default and Buyer may (a) enforce specific performance, seek such other relief as may be provided by law, or both, or (b) terminate this contract and receive the earnest money, thereby releasing both parties from this contract.

16.MEDIATION: It is the policy of the State of Texas to encourage resolution of disputes through alternative dispute resolution procedures such as mediation. Any dispute between Seller and Buyer related to this contract which is not resolved through informal discussion will be submitted to a mutually acceptable mediation service or provider. The parties to the mediation shall bear the mediation costs equally. This paragraph does not preclude a party from seeking equitable relief from a court of competent jurisdiction.

17.ATTORNEY'S FEES: A Buyer, Seller, Listing Broker, Other Broker, or escrow agent w ho prevails in any legal proceeding related to this contract is entitled to recover reasonable attorney’s fees and all costs of such proceeding.

18.ESCROW:

A.ESCROW: The escrow agent is not (i) a party to this contract and does not have liability for the performance or nonperformance of any party to this contract, (ii) liable for interest on the earnest money and (iii) liable for the loss of any earnest money caused by the failure of any financial institution in which the earnest money has been deposited unless the financial institution is acting as escrow agent.

B.EXPENSES: At closing, the earnest money must be applied first to any cash down payment, then to Buyer's Expenses and any excess refunded to Buyer. If no closing occurs, escrow agent may: (i) require a written release of liability of the escrow agent from all parties, (ii) require payment of unpaid expenses incurred on behalf of a party, and (iii) only deduct from the earnest money the amount of unpaid expenses incurred on behalf of the party receiving the earnest money.

C.DEMAND: Upon termination of this contract, either party or the escrow agent may send a release of earnest money to each party and the parties shall execute counterparts of the release and deliver same to the escrow agent. If either party fails to execute the release, either party may make a written demand to the escrow agent for the earnest money. If only one party makes written demand for the earnest money, escrow agent shall promptly

Initialed for identification by Buyer |

and Seller |

TREC NO. |

Contract Concerning |

Page 7 of 10 |

|

|

(Address of Property) |

|

provide a copy of the demand to the other party. If escrow agent does not receive written objection to the demand from the other party within 15 days, escrow agent may disburse the earnest money to the party making demand reduced by the amount of unpaid expenses incurred on behalf of the party receiving the earnest money and escrow agent may pay the same to the creditors. If escrow agent complies with the provisions of this paragraph, each party hereby releases escrow agent from all adverse claims related to the disbursal of the earnest money.

D. DAMAGES: Any party who wrongfully fails or refuses to sign a release acceptable to the escrow agent within 7 days of receipt of the request will be liable to the other party for (i) damages; (ii) the earnest money; (iii) reasonable attorney's fees; and (iv) all costs of suit.

E. NOTICES: Escrow agent's notices will be effective when sent in compliance with Paragraph 21. Notice of objection to the demand will be deemed effective upon receipt by escrow agent.

19. REPRESENTATIONS: All covenants, representations and warranties in this contract survive closing. If any representation of Seller in this contract is untrue on the Closing Date, Seller will be in default. Unless expressly prohibited by written agreement, Seller may continue to show the Property and receive, negotiate and accept back up offers.

20.FEDERAL TAX REQUIREMENTS: If Seller is a " foreign person,” as defined by Internal Revenue Code and its regulations, or if Seller fails to deliver an affidavit or a certificate of non- foreign status to Buyer that Seller is not a "foreign person,” then Buyer shall withhold from the sales proceeds an amount sufficient to comply with applicable tax law and deliver the same to the Internal Revenue Service together with appropriate tax forms. Internal Revenue Service regulations require filing written reports if currency in excess of specified amounts is received in the transaction.

21.NOTICES: All notices from one party to the other must be in w riting and are effective when mailed to,

To Buyer |

|

|

|

To Seller |

|

|

at: |

|

|

|

at: |

|

|

|

|

|

|

|

|

|

Phone: |

( |

) |

|

Phone: |

( |

) |

Fax: |

( |

) |

|

Fax: |

( |

) |

|

|

|

|

|

22.AGREEMENT OF PARTIES: This contract contains the entire agreement of the parties and cannot be changed except by their written agreement. Addenda which are a part of this contract are (Check all applicable boxes):

Third Party Financing Addendum Seller Financing Addendum

Addendum for Property Subject to Mandatory Membership in a Property

Owners Association

Buyer’s Temporary Residential Lease Loan Assumption Addendum

AddendumBuyer for Sale of Other Property by

Addendum for Reservation of Oil, Gas and Other Minerals

Addendum for

Addendum for Authorizing Hydrostatic Testing

Addendum Concerning Right to Terminate Due to Lender’s Appraisal

Environmental Assessment, Threatened or Endangered Species and Wetlands

Addendum

Seller’s Temporary Residential Lease

Short Sale Addendum

Addendum for Property Located Seaward of the Gulf Intracoastal Waterway

Addendum for Seller's Disclosure of

Information on

Federal Law

Addendum for Property in a Propane Gas System Service Area

Other (list):

Initialed for identification by Buyer |

and Seller |

TREC NO. |

Contract Concerning |

Page 8 of 10 |

|

|

(Address of Property) |

|

23.TERMINATION OPTION: For nominal consideration, the receipt of w hich is hereby

acknowledged by Seller, and Buyer's agreement to pay Seller $(Option Fee)

within 3 days after the Effective Date of this contract, Seller grants Buyer the unrestricted right

to terminate this contract by giving notice of termination to Seller withindays after the Effective Date of this contract (Option Period). Notices under this paragraph must be given by 5:00 p.m. (local time where the Property is located) by the date specified. If no dollar amount is stated as the Option Fee or if Buyer fails to pay the Option Fee to Seller within the time prescribed, this paragraph will not be a part of this contract and Buyer shall not have the unrestricted right to terminate this contract. If Buyer gives notice of termination within the time prescribed, the Option Fee will not be refunded; however, any earnest money will be refunded to Buyer. The Option Fee will will not be credited to the Sales Price at closing. Time is of the essence for this paragraph and strict compliance with the time for performance is required.

24.CONSULT AN ATTORNEY BEFORE SIGNING: TREC rules prohibit real estate license holders from giving legal advice. READ THIS CONTRACT CAREFULLY.

Buyer's |

|

Seller's |

Attorney is: |

|

Attorney is: |

Phone: |

( |

) |

Phone: |

( |

) |

Fax: |

( |

) |

Fax: |

( |

) |

|

|

|

|

EXECUTED the |

day of |

, 20 |

(Effective Date). |

(BROKER: FILL IN THE DATE OF FINAL ACCEPTANCE.) |

|

||

|

|

|

|

Buyer |

Seller |

Buyer |

Seller |

The form of this contract has been approved by the Texas Real Estate Commission. TREC forms are intended for use only by trained real estate license holders. No representation is made as to the legal validity or adequacy of any provision in any specific transactions. It is not intended for complex transactions. Texas Real Estate Commission, P.O. Box 12188, Austin, TX

Initialed for identification by Buyer |

and Seller |

TREC NO. |

|

|

|

Contract Concerning |

Page 9 of 10 |

|

|

(Address of Property) |

|

|

|

|

|

|

|

|

BROKER |

INFORMATION |

|

||||

|

|

|

|

(Print name(s) only. Do not sign) |

|

|||||

|

|

|

|

|

|

|

|

|

||

Other Broker Firm |

|

License No. |

Listing Broker Firm |

License No. |

||||||

|

|

Buyer only as Buyer’s agent |

|

|

|

|

|

|||

represents |

|

represents |

Seller and Buyer as an intermediary |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Seller as Listing Broker’s subagent |

|

|

|

Seller only as Seller’s agent |

|

|||

|

|

|

|

|

|

|

|

|

||

Associate’s Name |

|

License No. |

Listing Associate’s Name |

License No. |

||||||

|

|

|

|

|

|

|

|

|||

Associate’s Email Address |

|

Phone |

Listing Associate’s Email Address |

Phone |

||||||

|

|

|

|

|

|

|

|

|||

Licensed Supervisor of Associate |

|

License No. |

Licensed Supervisor of Listing Associate |

License No. |

||||||

|

|

|

|

|

|

|

|

|||

Other Broker's Address |

|

Phone |

Listing Broker’s Office Address |

Phone |

||||||

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip |

City |

State |

Zip |

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Selling Associate’s Name |

License No. |

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Selling Associate’s Email Address |

Phone |

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Licensed Supervisor of Selling Associate |

License No. |

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Selling Associate’s Office Address |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip |

|

Listing Broker has agreed to pay Other Broker __________________________________ of the total sales price

when the Listing Broker’s fee is received. Escrow agent is authorized and directed to pay Other Broker from Listing Broker’s fee at closing.

Initialed for identification by Buyer |

and Seller |

TREC NO. |

|

|

|

Contract Concerning |

Page 10 of 10 |

|

|

(Address of Property) |

|

OPTION FEE RECEIPT

Receipt of $___________________ (Option Fee) in the form of _____________________________________

is acknowledged.

Seller or Listing BrokerDate

EARNEST MONEY RECEIPT

Receipt of $____________________ Earnest Money in the form of

is acknowledged.

Escrow Agent |

Received by |

Email Address |

Date/Time |

Address |

|

|

Phone |

City |

State |

Zip |

Fax |

CONTRACT RECEIPT

Receipt of the Contract is acknowledged.

Escrow Agent |

Received by |

Email Address |

Date |

Address |

|

|

Phone |

City |

State |

Zip |

Fax |

|

|

|

|

|

ADDITIONAL EARNEST MONEY RECEIPT |

|

|

Receipt of |

$__________________ additional Earnest Money in the form of ____________________________ |

||

is acknowledged. |

|

|

|

Escrow Agent |

Received by |

Email Address |

Date/Time |

Address |

|

|

Phone |

City |

State |

Zip |

Fax |

Initialed for identification by Buyer |

and Seller |

TREC NO. |

|

|

|

Other PDF Templates

Free Printable D1 Form - Information about replacing lost, stolen, or defaced licences is detailed on the form for applicants' benefit.

For anyone looking to facilitate a smooth transition of ownership in equine matters, the Florida Horse Bill of Sale document is an indispensable resource. A thorough understanding of this form can significantly assist both buyers and sellers in ensuring a clear contract during the transaction process, so you may want to check out this essential horse bill of sale guide for more information.

Test Drive Agreement - It confirms the dealership's name, the salesperson, and customer details for clarity.

Documents used along the form

The TREC One to Four Family Residential Contract Form is a crucial document in real estate transactions in Texas. However, several other forms and documents often accompany it to ensure a smooth process. Below are five commonly used forms that you may encounter alongside the TREC contract.

- Seller's Disclosure Notice: This document requires the seller to disclose any known issues with the property. It provides buyers with essential information regarding the condition of the home.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint and its hazards.

- Ohio Mobile Home Bill of Sale: This legal document used to transfer ownership of a mobile home is essential for clarity in transactions, ensuring both parties have a clear record of the sale. For more information, visit the Mobile Home Bill of Sale.

- Residential Lease Agreement: If the property is being sold with tenants in place, this agreement outlines the terms of the rental arrangement, including rent, duration, and responsibilities.

- Option Fee and Period Agreement: This document gives the buyer the right to terminate the contract within a specified period, usually in exchange for a fee. It provides flexibility for buyers to conduct inspections or secure financing.

- Third-Party Financing Addendum: If the buyer is obtaining financing through a lender, this addendum outlines the terms and conditions of that financing, ensuring all parties are aware of the requirements.

These documents help clarify the responsibilities and expectations of both buyers and sellers. Understanding each form is essential for a successful transaction.

Similar forms

The TREC One to Four Family Residential Contract is similar to the Purchase Agreement, which is commonly used in real estate transactions. Both documents outline the terms and conditions of a property sale, including the purchase price, financing details, and contingencies. A Purchase Agreement serves as a legally binding commitment between the buyer and seller, much like the TREC contract, ensuring that both parties understand their obligations and rights throughout the transaction process.

Another document that shares similarities is the Lease Agreement. While a Lease Agreement typically governs rental arrangements, both documents detail essential terms such as duration, payment amounts, and responsibilities of the parties involved. The TREC contract and a Lease Agreement both aim to protect the interests of the parties by clearly outlining expectations and legal rights, whether for a sale or a rental situation.

The Option to Purchase Agreement also resembles the TREC contract. This document grants a potential buyer the right to purchase a property within a specified timeframe, often for a fee. Like the TREC contract, it includes terms regarding the purchase price and conditions of the sale. Both documents provide clarity and security for buyers, ensuring they have the opportunity to secure a property under agreed-upon terms.

Similarly, the Seller’s Disclosure Notice is another related document. This form requires sellers to disclose known issues with the property, ensuring buyers are fully informed before making a purchase. While the TREC contract formalizes the sale, the Seller’s Disclosure Notice complements it by promoting transparency and protecting the buyer’s interests, aligning with the overall goal of fair and informed transactions.

The Real Estate Listing Agreement also shares common ground with the TREC contract. This document is used when a seller engages a real estate agent to market their property. Both agreements outline the terms of engagement, including commissions and obligations of the parties. The Listing Agreement and the TREC contract work together to facilitate the sale process, ensuring that both the seller and the agent have a clear understanding of their roles and responsibilities.

Another document worth mentioning is the Closing Disclosure. This form is provided to buyers and sellers before closing on a property. It details all costs associated with the transaction, including loan terms and closing costs. While the TREC contract establishes the terms of the sale, the Closing Disclosure ensures that all financial aspects are transparent, helping both parties understand the final financial obligations before the transaction is completed.

The Addendum for Property Subject to Mandatory Membership in an Owners Association is also similar in nature. This document addresses the requirements and fees associated with membership in a homeowners' association (HOA). Like the TREC contract, it ensures that buyers are aware of additional obligations tied to the property. Both documents aim to provide clarity and protect the interests of the buyer by ensuring they understand all aspects of ownership.

When engaging in the sale or purchase of a motor vehicle in Ohio, it is essential to have the appropriate documentation, such as the Ohio Motor Vehicle Bill of Sale form, which can be found at autobillofsaleform.com/ohio-motor-vehicle-bill-of-sale-form/. This crucial document not only records the transaction details but also ensures a smooth transfer of ownership, safeguarding the interests of both the buyer and the seller throughout the process.

The Exclusive Right to Sell Agreement aligns closely with the TREC contract as well. This document grants a real estate agent the exclusive right to sell a property within a specified timeframe. It outlines the terms of the agent's commission and responsibilities. Both agreements serve to formalize the relationship between the seller and the agent, ensuring that expectations are clear and that both parties are committed to the successful sale of the property.

Lastly, the Home Inspection Agreement is relevant in this context. This document outlines the terms under which a home inspection will be conducted, including the scope of the inspection and the responsibilities of both the buyer and the inspector. While the TREC contract focuses on the sale itself, the Home Inspection Agreement addresses the condition of the property, ensuring that buyers have the opportunity to assess the home before finalizing their purchase.

Dos and Don'ts

When filling out the TREC One to Four Family Residential Contract form, attention to detail is crucial. Here are some essential do's and don'ts to keep in mind:

- Do read the entire contract carefully before filling it out. Understanding each section will help you avoid mistakes.

- Do use clear and legible handwriting or type the information. This ensures that all parties can read the details without confusion.

- Do provide accurate information, especially regarding the property address and the parties involved. Inaccuracies can lead to legal complications.

- Do consult a real estate professional or attorney if you have questions. Their expertise can guide you through the process.

- Do keep a copy of the completed contract for your records. This will be useful for future reference.

- Don't rush through the form. Taking your time can help prevent errors that might cost you later.

- Don't leave any sections blank unless instructed. Missing information can delay the transaction.

- Don't alter the contract without proper guidance. Changes can affect the legality of the agreement.

- Don't forget to check for signatures. An unsigned contract is not legally binding.

- Don't ignore deadlines. Timely submission of the contract is essential for a smooth transaction.

Key takeaways

When filling out and using the TREC One to Four Family Residential Contract form, it's important to keep several key points in mind. Here are some essential takeaways:

- Understand the purpose: This contract is designed for the sale of residential properties, including single-family homes and duplexes.

- Read all sections carefully: Each part of the contract contains important information that affects the transaction. Don't skip over any sections.

- Be precise with details: Ensure that all names, addresses, and property descriptions are accurate to avoid confusion later.

- Know the timelines: The contract outlines specific deadlines for actions such as inspections and closing. Keep track of these dates.

- Consider contingencies: These are conditions that must be met for the contract to be binding. Common contingencies include financing and inspections.

- Seek professional help: If you're unsure about any part of the contract, consult a real estate agent or attorney for guidance.

- Review the financing section: Understand how the purchase will be financed, whether through a mortgage, cash, or other means.

- Keep copies: After signing, make sure to keep a copy of the contract for your records. This is crucial for future reference.

How to Use TREC One to four family residential contract

Filling out the TREC One to Four Family Residential Contract form is an important step in the home buying or selling process. This form outlines the terms of the agreement between the buyer and seller. Follow these steps carefully to ensure all necessary information is included and accurately represented.

- Start with the date: Write the date when the contract is being executed at the top of the form.

- Identify the parties: Fill in the names of the buyer(s) and seller(s). Make sure to include their full legal names.

- Property description: Provide a detailed description of the property being sold, including the address and any relevant legal descriptions.

- Purchase price: Enter the total purchase price for the property. Be clear and precise with the numbers.

- Earnest money: Specify the amount of earnest money the buyer will provide to show their commitment to the purchase.

- Financing terms: Outline the type of financing the buyer will use, whether it's a conventional loan, FHA loan, or cash purchase.

- Closing date: Indicate the proposed closing date for the transaction. This is when the property will officially change hands.

- Contingencies: Include any contingencies that must be met for the sale to proceed, such as inspections or financing approvals.

- Additional terms: If there are any additional agreements or terms, write them in the space provided. Be specific.

- Signatures: Ensure that all parties sign and date the contract. This makes the agreement legally binding.

After completing these steps, review the contract carefully. Make sure all information is accurate and that both parties understand the terms. Once everything is confirmed, proceed with the next steps in the buying or selling process.