Fill Out a Valid Utility Bill Form

When managing household expenses, understanding your utility bill is essential. The Utility Bill form is a key document that outlines your usage of essential services like electricity, water, gas, and sometimes even internet or trash collection. This form typically includes important details such as the billing period, total amount due, and a breakdown of charges based on your consumption. Additionally, it may highlight any past due balances, late fees, or special notices from the utility provider. By reviewing this form carefully, you can gain insights into your energy habits, identify potential savings, and ensure that you are being charged correctly. Whether you are a homeowner or a renter, knowing how to read and interpret this form can empower you to take control of your utility expenses.

Common mistakes

-

Incorrect Account Number: Many individuals mistakenly enter the wrong account number. This can lead to delays in processing the payment or even cause the payment to be credited to the wrong account.

-

Missing Signature: A common oversight is failing to sign the form. Without a signature, the utility company may not accept the submission, resulting in potential service interruptions.

-

Inaccurate Payment Amount: Some people miscalculate the total amount due. This can lead to underpayment or overpayment, both of which can complicate future billing.

-

Failure to Update Personal Information: It is essential to keep contact information current. If a person moves or changes their phone number and fails to update this on the form, they may miss important notifications regarding their account.

-

Neglecting to Review Before Submission: Rushing through the form without a final review can lead to various errors. Taking a moment to double-check all entries can prevent many common mistakes.

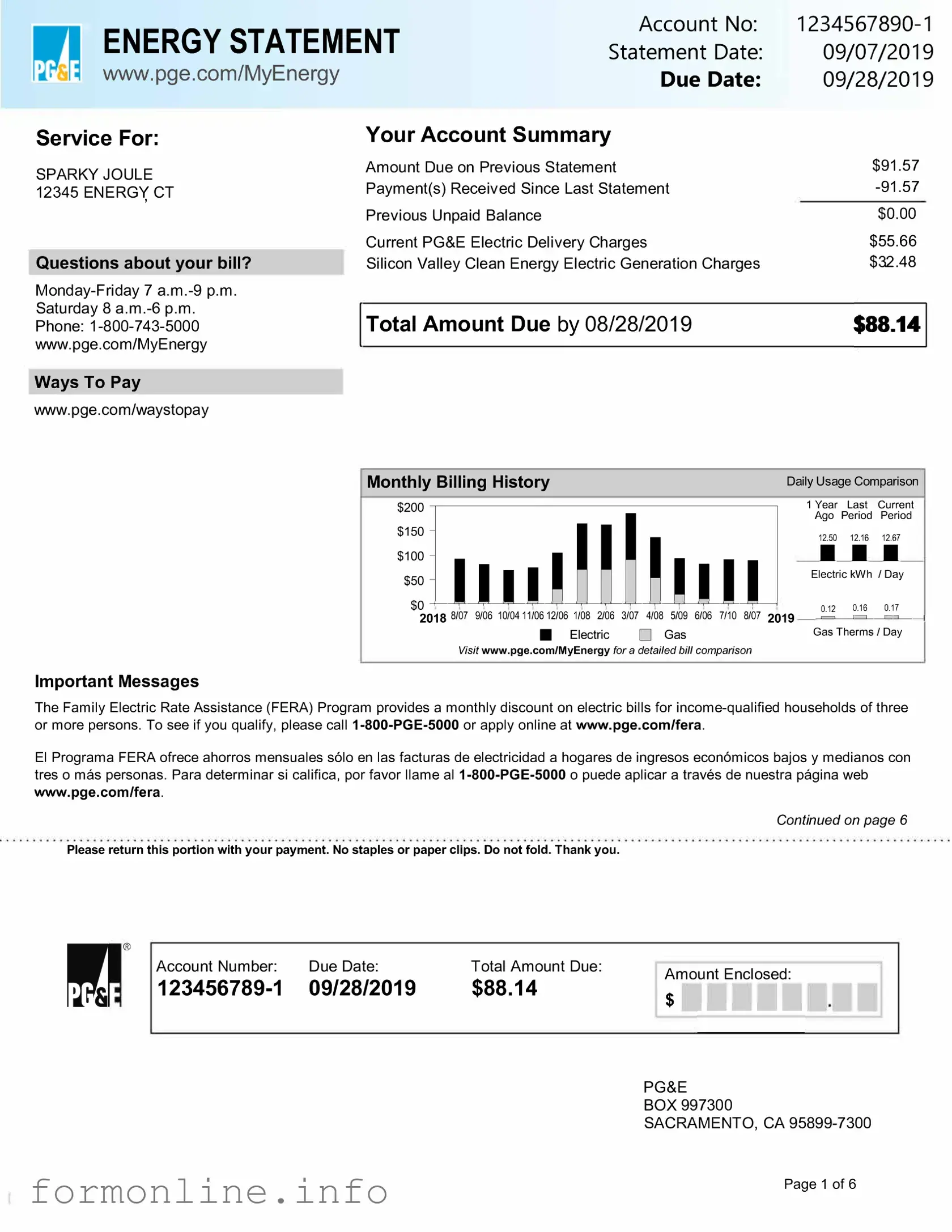

Preview - Utility Bill Form

ENERGY STATEMENT |

Account No: |

|

Statement Date: |

09/07/2019 |

|

www.pge.com/MyEnergy |

Due Date: |

09/28/2019 |

|

|

Service For:

SPARKY JOULE 12345 ENERG'( CT

Questions about your bill?

Ways To Pay

www.pge.com/waystopay

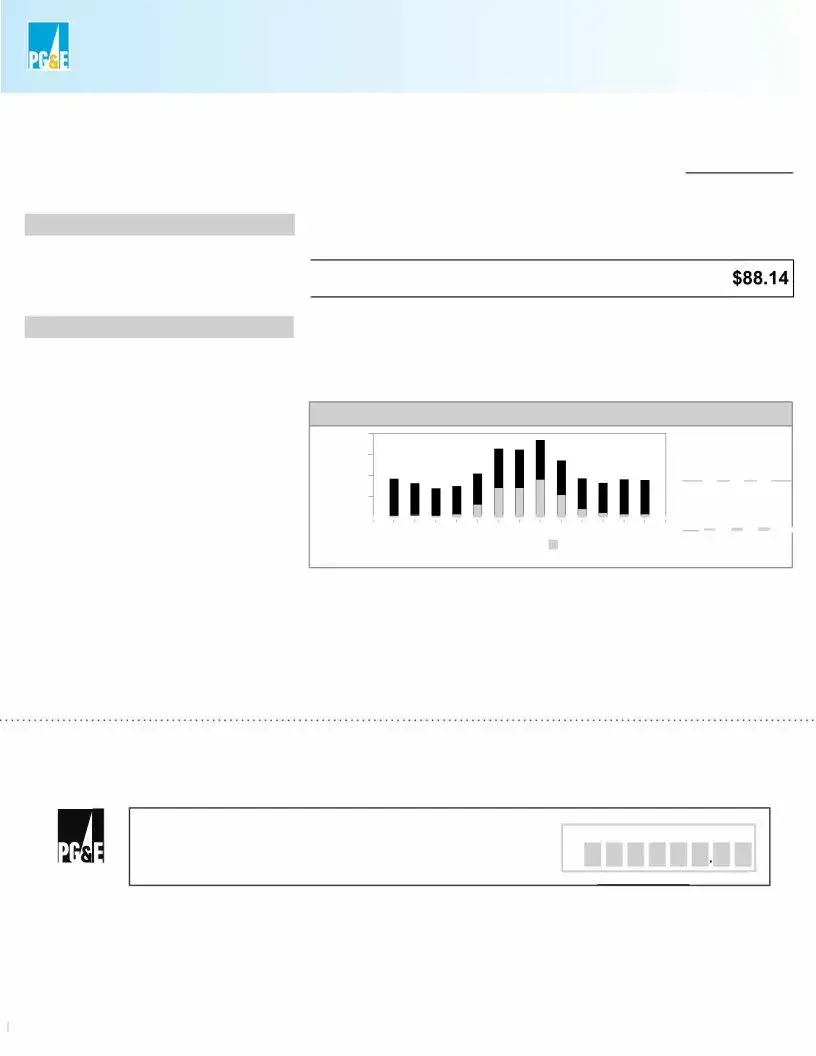

Your Account Summary

Amount Due on Previous Statement |

$91.57 |

Payment(s) Received Since Last Statement |

|

Previous Unpaid Balance |

$0.00 |

Current PG&E Electric Delivery Charges |

$55.66 |

Silicon Valley Clean Energy Electric Generation Charges |

$32.48 |

I Total Amount Due by 08/28/2019 |

$88.14 |

Monthly Billing History |

|

|

|

|

Daily Usage Comparison |

|||||

$200 |

|

|

|

|

|

|

|

1 Year |

Last |

Current |

|

|

|

|

|

|

|

Ago |

Period |

Period |

|

$150 |

|

|

|

|

|

|

|

12.50 |

12.16 |

12.67 |

$100 |

|

|

|

|

|

|

|

■ ■ ■ |

||

$50 |

|

|

|

|

|

|

|

Electric kWh / Day |

||

|

|

|

|

|

|

|

|

|

|

|

$0 |

0.12 |

0.16 |

0.17 |

|||||||

2018 8/07 |

9/06 10/04 11/06 12/06 1/08 2/06 |

3/07 4/08 |

5/09 6/06 |

7/10 8/07 |

||||||

|

|

|

■ |

Electric |

D |

Gas |

|

Gas Therms/ Day |

||

Visit www.pge.com/MyEnergy for a detailed bill comparison

Important Messages

The Family Electric Rate Assistance (FERA) Program provides a monthly discount on electric bills for

El Programa FERA ofrece ahorros mensuales solo en las facturas de electricidad a hogares de ingresos econ6micos bajos y medianos con tres o mas personas. Para determinar si califica, por favor llame al

Continued on page 6

Please return this portion with your payment. No staples or paper clips. Do not fold. Thank you.

®

Account Number: |

Due Date: |

Total Amount Due: |

Amount Enclosed: |

|

09/28/2019 |

$88.14 |

|||

$ |

PG&E

BOX 997300

SACRAMENTO, CA

Page 1 of 6

ENERGY STATEMENT |

Account No: |

|

Statement Date: |

09/07/2019 |

|

www.pge.com/MyEnergy |

Due Date: |

09/28/2019 |

|

|

Important Phone Numbers -

TTY

Servicio al Cliente en Espanol (Spanish)

Djch VI) khach tieng Vi�t (Vietnamese) |

||

Business Customer Service |

Rules and rates

You may be eligible for a lower rate. To learn more about optional rates or view a complete list of rules and rates, visit www.pge.com or call

If you believe there is an error on your bill, please call

To avoid having service turned off while you wait for the outcome of a complaint to the CPUC specifically regarding the accuracy of your bill, please contact CAB for assistance. If your case meets the eligibility criteria, CAB will provide you with instructions on how to mail a check or money order to be impounded pending resolution of your case. You must continue to pay your current charges while your complaint is under review to keep your service turned on.

If you are not able to pay your bill, call PG&E to discuss how we can help. You may qualify for reduced rates under PG&E's CARE program or other special programs and agencies may be available to assist you. You may qualify for PG&E's Energy Savings Assistance Program which is an energy efficiency program for

Important definitions

Rotating outage blocks are subject to change without advance notice due to operational conditions.

Tier 1/Baseline allowance: Some residential rates are given a Tier 1/Baseline allowance - a CPUC approved percentage of average customer usage during summer and winter months. Your Tier 1/Baseline allowance provides for basic needs at an affordable price and encourages conservation. Your allowance is assigned based on the climate where you live, the season and your heat source. As you use more energy, you pay more for usage. Any usage over your baseline allowance will be charged at a higher price.

High Usage: An increased price per kWh whenever electricity usage exceeds four times the Baseline Allowance (Tier 1) in a billing period. This charge does not apply to

DWR bond charge: Recovers the cost of bonds issued by the Department of Water Resources (DWR) to purchase power to serve electric customers during the California energy crisis. DWR bond charges are collected on behalf of DWR and do not belong to PG&E.

Power Charge Indifference Adjustment (PCIA): Ensures that

Gas Public Purpose Program (PPP) Surcharge. Used to fund

Visit www.pge.com/billexplanation for more definitions. To view most recent bill inserts including legal or mandated notices, visit www.pge.com/billinserts.

Your Electric Charges Breakdown

Conservation Incentive |

|

Transmission |

12.42 |

Distribution |

35.08 |

Electric Public Purpose Programs |

4.71 |

Nuclear Decommissioning |

0.33 |

DWR Bond Charge |

1.91 |

Competition Transition Charges (CTC) |

0.42 |

Energy Cost Recovery Amount |

|

PCIA |

10.26 |

Taxes and Other |

0.25 |

Total Electric Charges |

$55.66 |

"PG&E" refers to Pacific Gas and Electric Company, a subsidiary of PG&E Corporation. © 2019 Pacific Gas and Electric Company. All rights reserved. Please do not mark in box. For system use only.

Update My Information (English Only)

Please allow

Account Number:

Change my mailing address to: ________________

City _____________ State |

ZIP code ____ |

|

Primary |

Primary |

|

Ways To Pay

•Online via web or mobile at www.pge.com/waystopay

•By mail: Send your payment along with this payment stub in the envelope provided.

•By debit card, Visa, MasterCard, American Express, or Discover: Call

•At a PG&E payment center or local office: To find a payment center or local office near you, please visit www.pge.com or call

Page 2 of 6

ENERGY STATEMENT

Details of PG&E Electric Delivery Charges

Service For: 12345 ENERGY CT

Service Agreement ID: 111111111

Rate Schedule: E1 X Residential Service

07/02/2019 - 07/31/2019 Your Tier

Tier 1 Allowance |

297.00 |

kWh |

(30 days x 9.9 kWh/day) |

|

Tier 1 Usage |

297.000000 |

kWh |

@$0.22376 |

$66.46 |

Tier 2 Usage |

83.000000 |

kWh |

@$0.28159 |

23.37 |

Generation Credit |

|

|

|

|

Power Charge Indifference Adjustment |

|

|

10.26 |

|

Franchise Fee Surcharge |

|

|

|

0.25 |

Total PG&E Electric Delivery Charges |

$55.66 |

|||

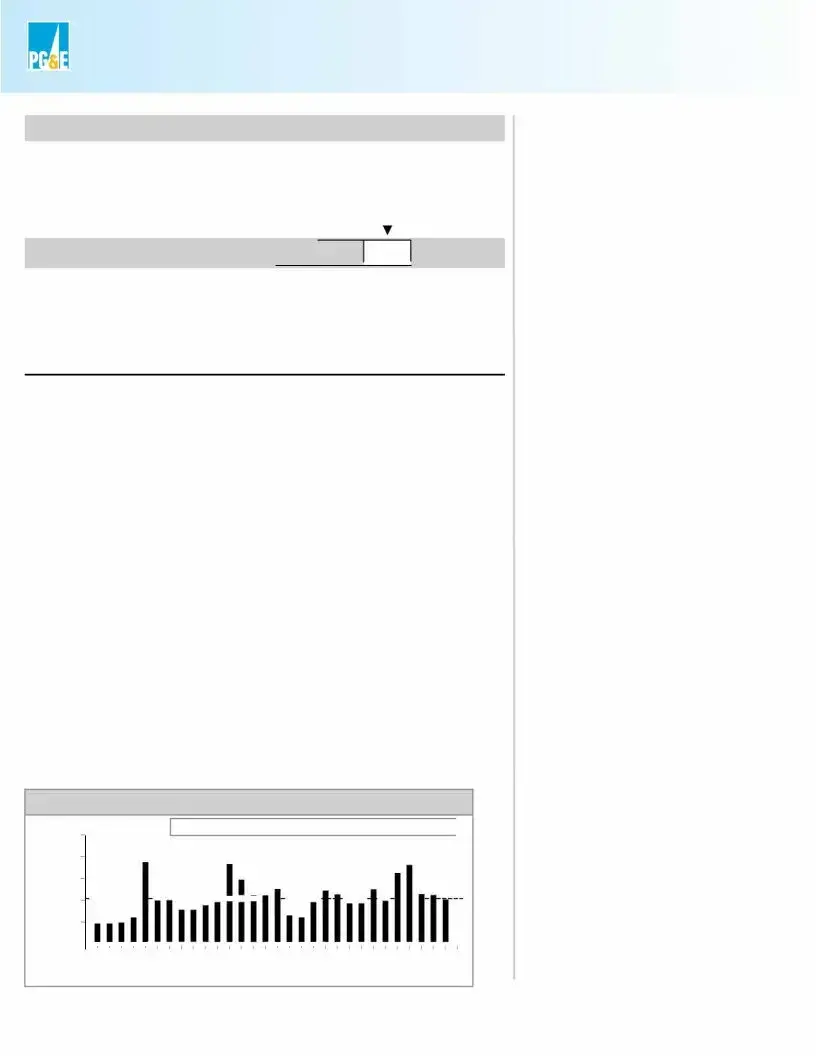

Electric Usage This Period: 380.000000 kWh, 30 billing days |

||||||||||

30kWh |

|

|

|

|

Average Daily Usage 12.67 I |

|||||

24 |

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

12 |

- - |

|||||||||

6 |

|

|

|

|

|

|

|

|

|

|

0 |

||||||||||

|

7/2 |

7/5 |

7/8 |

7/11 |

7/14 |

7/17 |

7/20 |

7/23 |

7/26 |

7/29 |

Due Date: |

09/28/2019 |

Service Information |

1111111111 |

Meter# |

|

Current Meter Reading |

37,710 |

Prior Meter Reading |

37,330 |

Total Usage |

380.000000 kWh |

Baseline Territory |

X |

Heat Source |

B - Not Electric |

Serial |

G |

Rotating Outage Block |

50 |

Visit www.pge.com/MyEnergy for a detailed bill comparison. |

Page 3 of 6 |

|

ENERGY STATEMENT

www.pge.com/MyEnergy

Details of Silicon Valley Clean Energy Electric Generation Charges

08/02/2019 - 08/31/2019 (30 billing days)

Service For: 12345 ENERGY CT

Service Agreement ID: 11111111

07/02/2019 - 07/31/2019

Rate Schedule: |

$32.37 |

|

Generation - Total |

380.000000 kWh @$0.08519 |

|

|

Net Charges 32.37 |

0. 11 |

Energy Commission Surcharge |

||

Customers receive clean electricity and save money with SVCE. Please see updated |

||

SVCE electric rates and comparisons to PG&E at www.svcleanenergy.com/rates |

||

Total Silicon Valley Clean Energy |

$32.48 |

|

Electric Generation Charges |

||

Account No: |

|

Statement Date: |

09/07/2019 |

Due Date: |

09/28/2019 |

Service Information |

|

Total Usage |

380.000000 kWh |

For questions regarding charges on this page, please contact:

SILICON VALLEY CLEAN ENERGY

Additional Messages

About Silicon Valley Clean Energy (SVCE) Serving 13 Santa Clara County communities, SVCE is a

Understanding SVCE Charges

PG&E continues to provide and bill for electric delivery. SVCE replaces PG&E generation charges. Under PG&E Electric Delivery Charges, note the Generation Credit. This is what PG&E would have charged for power, and now credits back to you. The Power Charge Indifference Adjustment and Franchise Fee are factored into SVCE rates. Learn more:

SVCE is committed to protecting customer privacy.

Learn about our privacy policy at

Visit www.pge.com/MyEnergy for a detailed bill comparison. |

Page 4 of 6 |

|

ENERGY STATEMENT

www.pge.com/MyEnergy

Details of Gas Charges

08/02/2019 - 08/31/2019 (30 billing days)

Service For: 12345 ENERGY CT

Service Agreement ID: 1111111111

Rate Schedule: G1 X Residential Service

07/02/2019 - 07/31/2019 |

Your Tier |

|||

|

|

|

|

|

Tier 1 Allowance |

17.70 Therms (30 days x |

0.59 Therms/day) |

||

|

|

|||

Tier 1 Usage |

5.000000Therms @$ 1.28395 |

$6.42 |

||

Gas PPP Surcharge ($0.09047 /Therm) |

0.45 |

|||

Total Gas Charges |

|

|

$6.87 |

|

Account No:

Statement Date: 09/07/2019

Due Date: 09/28/2019

Service Information

Meter# |

11111111 |

Current Meter Reading |

2,588 |

Prior Meter Reading |

2,583 |

Difference |

5 |

Multiplier |

1.031647 |

Total Usage |

5.000000 Therms |

Baseline Territory |

X |

Serial |

G |

Gas Procurement Costs ($/Therm)

07/02/2019 - 07/31/2019$0.28462

Gas Usage This Period: 5.000000 Therms, 30 billing days

Therms |

|

|

|

|

|

= Average Daily Usage 0. 17 I |

|||||

5 |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

7/2 |

7/5 |

7/8 |

7/11 |

7/14 |

7/17 |

7/20 |

7/23 |

7/26 |

7/29 |

|

|

Visit www.pge.com/MyEnergy for a detailed bill comparison. |

Page 5 of 6 |

|

ENERGY STATEMENT |

Statement Date: |

|

09/07/2019 |

|

Account No: |

||

www.pge.com/MyEnergy |

Due Date: |

09/28/2019 |

|

|

|||

Important Messages (continued from page 1)

CARE Program. You may qualify for a monthly discount with the California Alternate Rates for Energy (CARE) Program. To find out more and apply online, visit www.pge.com/care.

Usted podría reunir los requisitos de un descuento mensual con el California Alternate Rates for Energy Program (CARE). Para obtener más información y hacer su solicitud en Internet, visite www.pge.com/espanol/care.

Electric power line safety PG&E cares about your safety. Be aware of your surroundings and keep yourself, tools, equipment and antennas at least 10 feet away from overhead power lines. If you see an electric power line fall to the ground, keep yourself and others away. Call

Call 811 before you dig. A common cause of pipeline accidents is damage from digging. If you plan on doing any digging, such as planting a tree or installing a fence, please call 811 at least two working days before you dig. One free call will notify underground utilities to mark the location of underground lines, helping you to plan a safe project.

Visit www.pge.com/MyEnergy for a detailed bill comparison.

Page 6 of 6

Other PDF Templates

Air Force Award Form - A section for the nominee's telephone number (both DSN and commercial) is also present.

For those interested in leasing property, understanding the significance of a well-drafted Residential Lease Agreement is vital for both tenants and landlords. This document ensures the clarity of rental terms and helps prevent disputes. You can find a helpful template at this link: a comprehensive Residential Lease Agreement resource.

Invoice Maker - Access a free and straightforward method for PDF creation of invoices.

Documents used along the form

The Utility Bill form is often accompanied by several other documents to support various applications or requests. Below is a list of common forms and documents that may be required alongside the Utility Bill form.

- Identification Document: This may include a driver's license or passport. It verifies the identity of the individual submitting the utility bill.

- Proof of Residency: This document confirms the individual’s current address. It can be a lease agreement or another official document showing the address.

- Income Verification: Pay stubs or tax returns can serve this purpose. They help establish financial eligibility for certain programs or assistance.

- Application Form: This is a standard form that collects necessary information for the application process. It usually requires personal details and the purpose of the request.

- Authorization Letter: If someone else is submitting the utility bill on behalf of the individual, a signed authorization letter is often required.

- Bank Statement: A recent bank statement may be requested to further verify financial status or residency.

- Affidavit of Service: To ensure proper notification in legal proceedings, you may need to complete an Affidavit of Service form, confirming delivery of legal documents to concerned parties.

- Service Agreement: This document outlines the terms of service with the utility provider. It may be needed to confirm account details.

These documents help ensure that the information provided is accurate and complete, facilitating a smoother process for the individual involved.

Similar forms

The utility bill serves as a vital document for individuals and businesses, providing evidence of the consumption of services such as water, electricity, or gas. Similar to this, a lease agreement outlines the terms under which a tenant occupies a property. It includes details about the rental amount, duration of the lease, and responsibilities of both parties. Both documents establish a clear relationship between service providers and consumers or landlords and tenants, ensuring accountability and transparency.

A bank statement is another document akin to a utility bill. It reflects transactions and balances in a bank account over a specific period. Just as a utility bill indicates usage and payment history, a bank statement provides a record of financial activity. Both documents are often required for verification purposes, such as applying for loans or rental agreements.

A credit card statement also shares similarities with a utility bill. It summarizes the charges made on a credit card account during a billing cycle. Like utility bills, credit card statements provide a detailed account of usage and payment history. They serve as important financial records for budgeting and assessing spending habits.

Another comparable document is a pay stub. This document outlines an employee's earnings for a specific pay period, including deductions and net pay. Both utility bills and pay stubs serve as proof of financial transactions. They are often required for various applications, such as loans or housing, to demonstrate income and payment history.

Property tax statements are similar to utility bills in that they detail the amount owed for property taxes based on assessed value. These statements inform property owners of their financial obligations to local governments. Both documents are essential for maintaining accurate records of payments and ensuring compliance with financial responsibilities.

A phone bill is another document that closely resembles a utility bill. It provides a detailed account of phone usage and charges incurred during a billing cycle. Like utility bills, phone bills serve as proof of service and payment history. They are often required for identity verification or when applying for new services.

Insurance statements, such as those from health or auto insurance providers, are also similar to utility bills. These documents outline coverage details, premiums, and claims history. Both utility bills and insurance statements are crucial for maintaining records of payments and ensuring that services remain active and compliant with policy requirements.

A mortgage statement shares characteristics with a utility bill. It provides a breakdown of the mortgage payment due, including principal, interest, and escrow amounts. Both documents are essential for tracking financial obligations and ensuring timely payments. They also serve as proof of financial responsibility when applying for additional credit or loans.

Additionally, when it comes to transferring ownership of a mobile home, it is essential to understand the legal documentation involved. The Virginia Mobile Home Bill of Sale is a key form in this process, serving as proof of the transaction and detailing the buyer and seller's information along with crucial aspects of the mobile home. For those looking for a reliable template, you can find a helpful Mobile Home Bill of Sale available online to ensure a smooth and legally binding transfer of ownership.

Rental payment receipts are similar to utility bills in that they provide proof of payment for services rendered. These receipts document the amount paid and the period covered. Both types of documents are crucial for maintaining accurate records and can be used in disputes or financial assessments.

Lastly, a tax return can be compared to a utility bill, as both serve as official records of financial transactions. A tax return summarizes income, deductions, and tax liabilities for a given year. Like utility bills, tax returns are often required for various financial applications, including loans and rental agreements, to demonstrate financial history and responsibility.

Dos and Don'ts

When filling out a Utility Bill form, it's important to follow some guidelines to ensure accuracy and efficiency. Here are six things you should and shouldn't do:

- Do: Double-check your account number for accuracy.

- Do: Use clear and legible handwriting if filling out a paper form.

- Do: Provide your current address as it appears on your utility bill.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations that may confuse the utility provider.

- Don't: Forget to sign and date the form before submission.

Key takeaways

Filling out and using the Utility Bill form is an important task for many individuals and households. Here are some key takeaways to keep in mind:

- Ensure that all required fields are completed accurately. Missing information can lead to delays in processing.

- Double-check the account number and billing address. These details are crucial for correct identification and service.

- Keep a copy of the completed form for your records. This can be useful for future reference or in case of disputes.

- Submit the form through the appropriate channels. Whether online or by mail, follow the instructions provided to avoid complications.

- Monitor your utility account after submission. Confirm that the changes or requests have been processed as expected.

How to Use Utility Bill

Completing the Utility Bill form is an essential step in ensuring your account is up to date. By following the instructions carefully, you will provide the necessary information for processing your bill accurately. Let’s walk through the steps to fill out the form seamlessly.

- Begin by locating the Utility Bill form on your device or in physical format.

- At the top of the form, enter your full name in the designated field.

- Next, fill in your account number. This number can typically be found on previous bills.

- Provide your current address, ensuring to include the street address, city, state, and zip code.

- In the following section, indicate the service address if it differs from your mailing address.

- Enter the date of the bill you are addressing, which is usually printed on the bill itself.

- Fill in the total amount due as stated on your utility bill.

- If applicable, include any payment reference number provided by your utility company.

- Finally, review all the information for accuracy before submitting the form.

Once you have completed these steps, you will be ready to submit the form according to your utility company's specified method, whether that be online, via mail, or in person. Be sure to keep a copy for your records!