Printable Vehicle Repayment Agreement Form

When navigating the world of vehicle financing, understanding the Vehicle Repayment Agreement form becomes essential. This document serves as a crucial bridge between lenders and borrowers, outlining the terms of repayment for a vehicle loan. It typically includes key details such as the loan amount, interest rate, repayment schedule, and any associated fees. Both parties must clearly understand their responsibilities, as the agreement specifies the consequences of missed payments or defaults. Additionally, the form often addresses provisions for early repayment and the process for resolving disputes. By laying out these critical elements, the Vehicle Repayment Agreement helps ensure transparency and fosters a sense of trust between the lender and the borrower.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide correct personal details, such as name, address, or contact number. This can lead to delays or complications in processing the agreement.

-

Incorrect Vehicle Information: Some people mistakenly enter wrong details about the vehicle, including the make, model, year, or VIN. This can cause issues in the validation of the agreement.

-

Missing Signatures: A common oversight is not signing the form. Without the necessary signatures, the agreement is invalid and cannot be processed.

-

Failure to Read Terms: Many individuals skip reading the terms and conditions. This can result in misunderstandings about payment obligations and consequences for non-compliance.

-

Omitting Financial Information: Some people neglect to include important financial details, such as income or existing debts. This information is crucial for assessing repayment capability.

-

Not Keeping Copies: After submission, individuals often forget to keep a copy of the completed form. Retaining a copy is essential for future reference and to track the agreement.

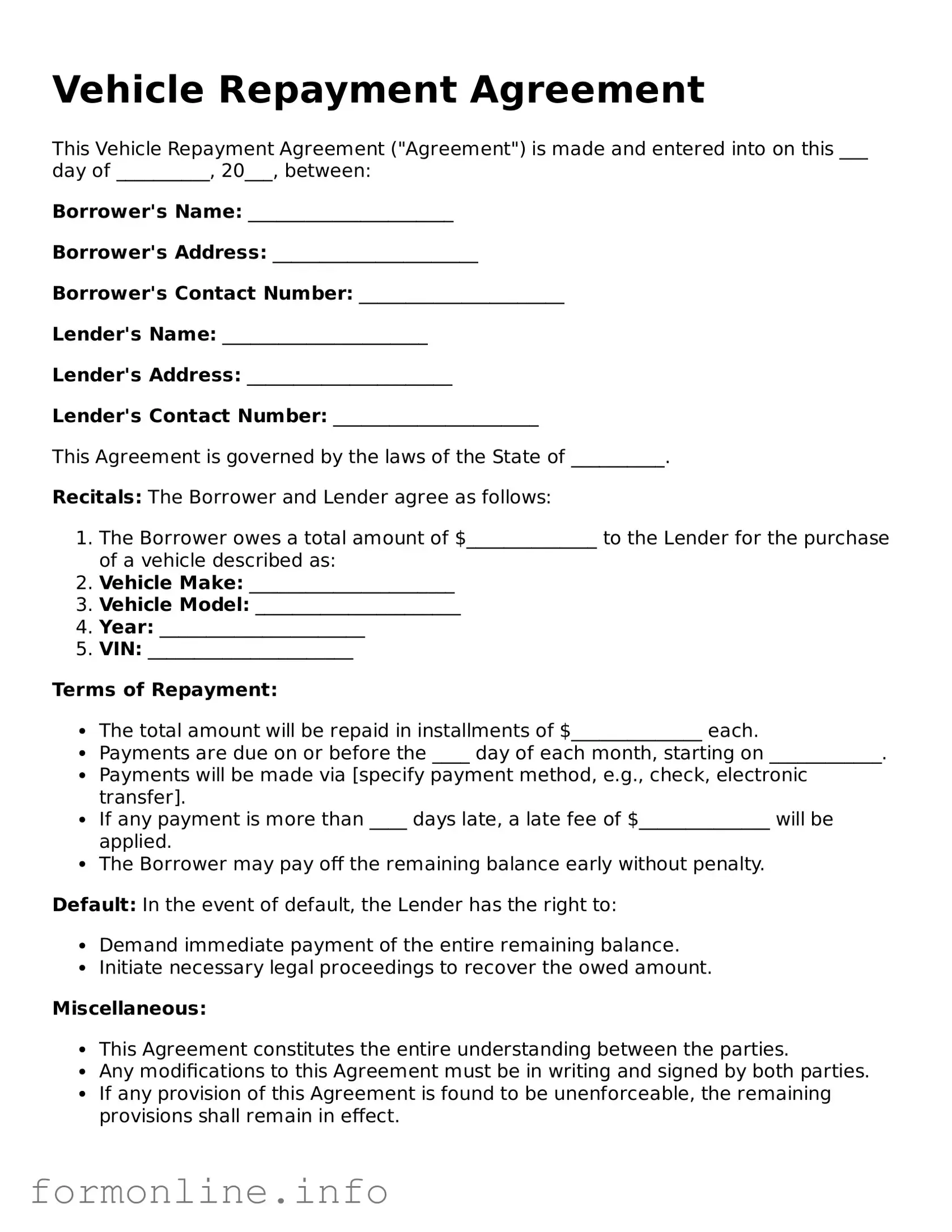

Preview - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made and entered into on this ___ day of __________, 20___, between:

Borrower's Name: ______________________

Borrower's Address: ______________________

Borrower's Contact Number: ______________________

Lender's Name: ______________________

Lender's Address: ______________________

Lender's Contact Number: ______________________

This Agreement is governed by the laws of the State of __________.

Recitals: The Borrower and Lender agree as follows:

- The Borrower owes a total amount of $______________ to the Lender for the purchase of a vehicle described as:

- Vehicle Make: ______________________

- Vehicle Model: ______________________

- Year: ______________________

- VIN: ______________________

Terms of Repayment:

- The total amount will be repaid in installments of $______________ each.

- Payments are due on or before the ____ day of each month, starting on ____________.

- Payments will be made via [specify payment method, e.g., check, electronic transfer].

- If any payment is more than ____ days late, a late fee of $______________ will be applied.

- The Borrower may pay off the remaining balance early without penalty.

Default: In the event of default, the Lender has the right to:

- Demand immediate payment of the entire remaining balance.

- Initiate necessary legal proceedings to recover the owed amount.

Miscellaneous:

- This Agreement constitutes the entire understanding between the parties.

- Any modifications to this Agreement must be in writing and signed by both parties.

- If any provision of this Agreement is found to be unenforceable, the remaining provisions shall remain in effect.

IN WITNESS WHEREOF, the parties hereto have executed this Vehicle Repayment Agreement as of the date first written above.

Borrower's Signature: ___________________________

Date: ___________________________

Lender's Signature: ___________________________

Date: ___________________________

Common Forms:

Miscarriage Bleeding at 8 Weeks - This document can provide emotional support by clarifying the process following a miscarriage.

Florida Association of Realtors Forms - Provisions allow for changes in operations of the property during the contract period with mutual consent.

For those navigating legal and financial responsibilities, understanding the proper use of a Power of Attorney document can be invaluable. This form empowers individuals to designate a trusted agent to manage their affairs effectively, ensuring decisions reflect their intentions even in times of incapacity.

Free Deed of Trust Template - A Deed of Trust can also detail insurance and property maintenance requirements.

Documents used along the form

When entering into a Vehicle Repayment Agreement, various other forms and documents may be necessary to ensure a smooth transaction. Each document serves a specific purpose, helping to clarify terms, protect rights, and facilitate the overall process. Below is a list of commonly used forms that often accompany the Vehicle Repayment Agreement.

- Loan Application Form: This document collects personal and financial information from the borrower, allowing the lender to assess creditworthiness and determine loan eligibility.

- Credit Report Authorization: Borrowers typically sign this form to give lenders permission to obtain their credit reports, which helps in evaluating their financial history and risk level.

- Promissory Note: This is a written promise from the borrower to repay the loan under specified terms. It outlines the loan amount, interest rate, and repayment schedule.

- Title Transfer Document: This form is essential for transferring ownership of the vehicle from the seller to the buyer. It includes details about the vehicle and the parties involved in the transaction.

- Mobile Home Bill of Sale: This document is essential for transferring ownership of a mobile home from one party to another, providing key details about the transaction, including buyer and seller identities, and information about the mobile home itself. For more information, visit the Mobile Home Bill of Sale.

- Bill of Sale: A bill of sale serves as proof of the transaction, detailing the sale price and the date of sale. It protects both parties by documenting the exchange.

- Insurance Verification: Lenders often require proof of insurance before finalizing a loan. This document confirms that the vehicle is insured, reducing the lender's risk.

- Payment Schedule: This document outlines the repayment terms, including due dates, amounts, and methods of payment, providing clarity to both parties involved.

- Default Notice: In the event of missed payments, this document notifies the borrower of their default status and outlines the potential consequences, such as repossession.

- Release of Liability: This form protects the seller by releasing them from any future claims related to the vehicle after the sale is completed.

Each of these documents plays a crucial role in the vehicle financing process. Understanding their purpose can help ensure that both parties are protected and informed throughout the agreement. By being well-prepared with the necessary paperwork, borrowers and lenders can navigate the complexities of vehicle financing more effectively.

Similar forms

The Vehicle Repayment Agreement form shares similarities with a Loan Agreement. Both documents outline the terms under which a borrower agrees to repay borrowed funds. They typically include details such as the loan amount, interest rate, repayment schedule, and consequences for default. This clarity helps protect both the lender and the borrower by establishing clear expectations and responsibilities.

Another document that resembles the Vehicle Repayment Agreement is the Promissory Note. Like the Vehicle Repayment Agreement, a Promissory Note serves as a written promise to pay a specific amount of money at a designated time. It includes essential details such as the principal amount, interest rate, and payment terms. This document provides legal evidence of the debt and can be enforced in court if necessary.

A Lease Agreement is also similar in nature, especially when it involves vehicles. This document outlines the terms under which one party rents a vehicle from another. Key components include the duration of the lease, monthly payments, and responsibilities for maintenance and insurance. Both agreements require clear communication about payment obligations and the consequences of non-compliance.

The Installment Agreement shares characteristics with the Vehicle Repayment Agreement as well. This type of agreement allows for the payment of a debt in smaller, manageable amounts over time. It details the total amount owed, the installment schedule, and any applicable interest. Such agreements are designed to make repayment easier for individuals who may not be able to pay a lump sum upfront.

When dealing with transactions involving personal property, it's essential to ensure proper documentation is in place. One useful resource for ensuring clarity in these agreements is the print and fill out the form which serves as a General Bill of Sale. This document not only facilitates the transfer of ownership but also protects the interests of both the buyer and seller by detailing the terms agreed upon during the transaction.

A Security Agreement is another document that can be compared to the Vehicle Repayment Agreement. This agreement establishes a legal claim on collateral—in this case, the vehicle—until the debt is fully repaid. It outlines the rights and responsibilities of both parties regarding the collateral, ensuring that the lender has recourse in the event of default. This adds an additional layer of security for the lender.

Finally, a Bill of Sale can be considered similar in the context of vehicle transactions. While it primarily serves as proof of ownership transfer, it often includes payment terms if the vehicle is sold on credit. It details the sale price, payment method, and any warranties or guarantees. Like the Vehicle Repayment Agreement, it ensures that both parties are clear on the terms of the transaction.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it's crucial to approach the task with care. Here’s a list of six important do's and don'ts to keep in mind:

- Do read the entire form carefully before starting. Understanding all sections can prevent mistakes.

- Do provide accurate and complete information. Double-check names, addresses, and vehicle details.

- Do sign and date the form where required. An unsigned form may lead to delays or rejections.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

- Don't leave any required fields blank. Incomplete forms can result in processing issues.

By following these guidelines, you can help ensure a smoother experience with your Vehicle Repayment Agreement. Stay organized and attentive to detail!

Key takeaways

Filling out the Vehicle Repayment Agreement form is a crucial step in ensuring a clear understanding between parties involved in a vehicle loan. Here are some key takeaways to keep in mind:

- Accuracy is Essential: Ensure all information is correct. This includes the names of the parties, vehicle details, and payment terms. Mistakes can lead to disputes later.

- Read the Terms Carefully: Before signing, review all terms and conditions. Understand the repayment schedule, interest rates, and any penalties for late payments.

- Keep a Copy: After completing the form, make sure to retain a signed copy for your records. This will serve as proof of the agreement and help if any issues arise.

- Communicate Changes Promptly: If there are any changes to the repayment plan or personal circumstances, inform the other party immediately. Open communication can prevent misunderstandings.

How to Use Vehicle Repayment Agreement

After receiving your Vehicle Repayment Agreement form, you are ready to begin the process of filling it out. This form is crucial for establishing the terms of your repayment plan. Follow the steps below to ensure that all necessary information is accurately provided.

- Read the Instructions: Before you start filling out the form, take a moment to carefully read any instructions provided. This will help you understand what information is needed.

- Provide Your Personal Information: Fill in your full name, address, and contact information at the top of the form. Ensure that this information is current and accurate.

- Enter Vehicle Details: Include the make, model, year, and VIN (Vehicle Identification Number) of the vehicle in question. This information is essential for identifying the vehicle.

- Specify Loan Amount: Clearly state the total amount you are borrowing or the remaining balance on your loan. This should be an exact figure.

- Outline Repayment Terms: Indicate the repayment schedule, including the amount due each month and the total number of payments. Be specific about the start date and end date of the repayment period.

- Include Signatures: Both you and the lender must sign and date the form. This confirms that both parties agree to the terms outlined in the document.

- Review for Accuracy: Double-check all entries for any errors or omissions. It’s important that everything is correct before submission.

- Submit the Form: Send the completed form to the appropriate lender or financial institution. Ensure that you keep a copy for your records.

Once you have submitted the Vehicle Repayment Agreement form, you will receive confirmation from your lender regarding the acceptance of your repayment plan. Keep an eye on your email or mailbox for any further instructions or communications.