Fill Out a Valid Wh 58 Form

The WH-58 form is a crucial document issued by the U.S. Wage and Hour Division of the Department of Labor, designed to facilitate the payment of back wages and other forms of compensation to employees. This form serves as a receipt for employees who have received payments due to wage disputes or investigations that have been conducted by the Wage and Hour Division. It includes essential details such as the employee's name, the employer's information, and the specific period during which the wages were owed. The form also outlines the total gross amount of back wages awarded, any legal deductions, and the net amount received by the employee. Importantly, the WH-58 includes a notice that informs employees of their rights under the Fair Labor Standards Act (FLSA), emphasizing that acceptance of this payment may waive their right to pursue further legal action regarding unpaid wages for the specified time frame. Employers are also required to certify the payment, ensuring accountability and compliance with labor laws. Given the complexities surrounding wage disputes, understanding the WH-58 form is vital for both employees and employers to navigate the intricacies of wage recovery effectively.

Common mistakes

-

Incorrect Employee Information: One common mistake is failing to accurately fill in the employee's name. This form requires the employee's name to be typed or printed clearly. Any errors can lead to delays in processing the payment.

-

Missing Payment Details: Another frequent error involves neglecting to provide complete payment information. Ensure that the gross amount, legal deductions, and net amount received are all filled out correctly. Incomplete data can result in confusion and further complications.

-

Improper Signature: Signing the form without confirming the payment amount can create issues. Employees should only sign after verifying that they have received the specified payment. This step is crucial to avoid forfeiting rights under the Fair Labor Standards Act.

-

Ignoring Certification Requirements: Employers must also be careful. They should ensure that their certification is complete and accurate. Any discrepancies in the employer's signature or title can lead to penalties and affect the validity of the form.

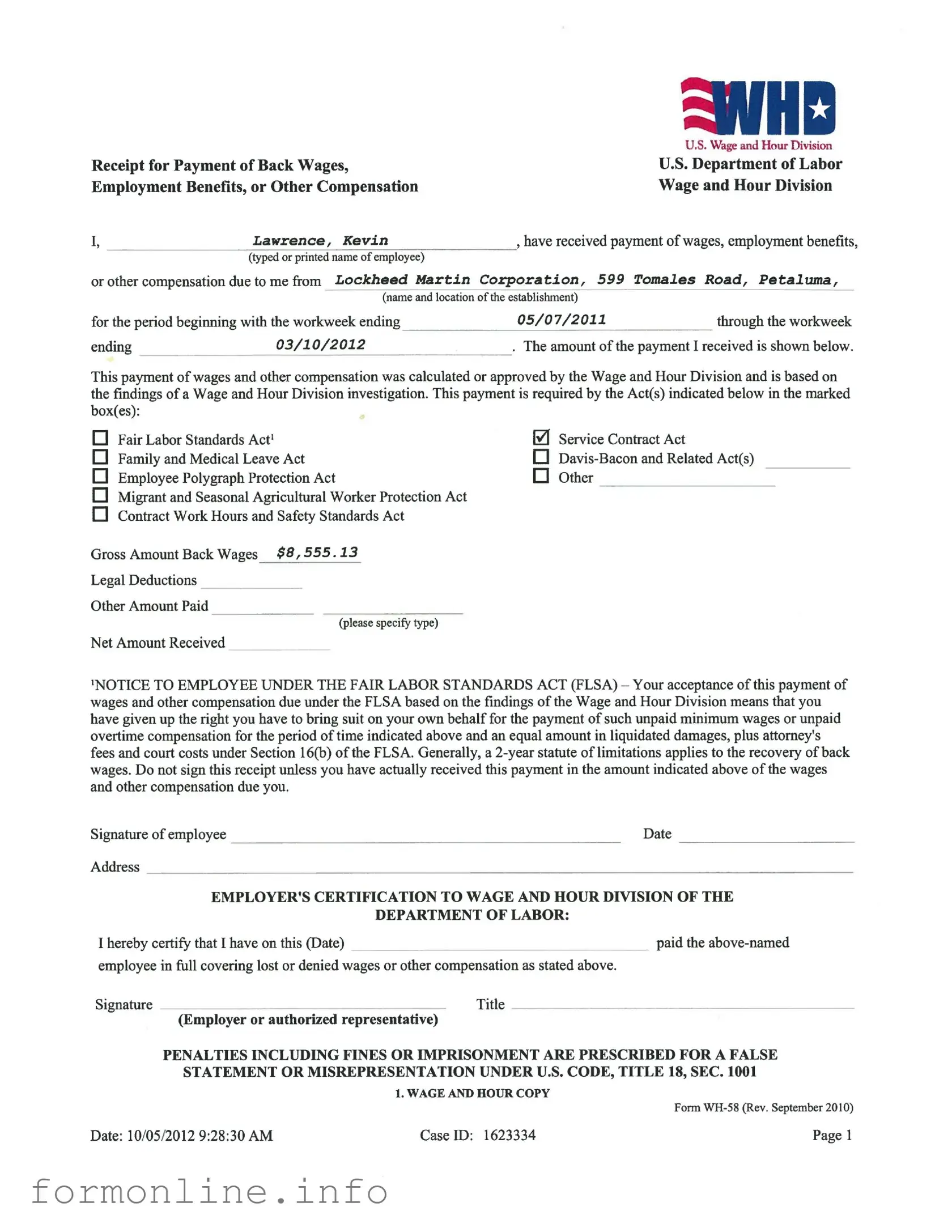

Preview - Wh 58 Form

|

3NHD |

|

U.S. Wage and Hour Division |

Receipt for Payment of Back Wages, |

U.S. Department of Labor |

Employment Benefits, or Other Compensation |

Wage and Hour Division |

I, _________________Lawrence,_ Kevin |

have received payment of wages, employment benefits, |

(typed or printed name ofemployee) |

|

or other compensation due to me from Lockheed Martin Corporation, 599 Tomales Road, Petaluma,

|

(name and location ofthe establishment) |

|

for the period beginning with the workweek ending |

05/07/2011______________ through the workweek |

|

ending |

03/10/2012 |

, The amount of the payment I received is shown below. |

This payment of wages and other compensation was calculated or approved by the Wage and Hour Division and is based on the findings of a Wage and Hour Division investigation. This payment is required by the Act(s) indicated below in the marked box(es):

П Fair Labor Standards Act1 |

0 Service Contract Act |

Family and Medical Leave Act |

О |

Employee Polygraph Protection Act |

Other |

Migrant and Seasonal Agricultural Worker Protection Act |

|

Contract Work Hours and Safety Standards Act |

|

Gross Amount Back Wages $0,555.13

Legal Deductions

Other Amount Paid

(please specify type)

Net Amount Received

‘NOTICE TO EMPLOYEE UNDER THE FAIR LABOR STANDARDS ACT (FLSA) - Your acceptance of this payment of wages and other compensation due under the FLSA based on the findings of the Wage and Hour Division means that you have given up the right you have to bring suit on your own behalf for the payment of such unpaid minimum wages or unpaid overtime compensation for the period of time indicated above and an equal amount in liquidated damages, plus attorney's fees and court costs under Section 16(b) of the FLSA. Generally, a

Signature of employee |

Date |

Address

EMPLOYER’S CERTIFICATION TO WAGE AND HOUR DIVISION OF THE

DEPARTMENT OF LABOR:

I hereby certify that I have on this (Date) |

paid the |

employee in full covering lost or denied wages or other compensation as stated above.

SignatureTitle

(Employer or authorized representative)

PENALTIES INCLUDING FINES OR IMPRISONMENT ARE PRESCRIBED FOR A FALSE

STATEMENT OR MISREPRESENTATION UNDER U.S. CODE, TITLE 18, SEC. 1001

1. WAGE AND HOUR COPY

Form

Date: 10/05/2012 9:28:30 AM |

Case ID: 1623334 |

Page 1 |

Other PDF Templates

Training Plan for Stem Opt Students - Employers are required to report on the training experience periodically.

When engaging in a transaction involving a motorcycle in New York, it is crucial to utilize a New York Motorcycle Bill of Sale form. This legal document not only captures the essential details about the buyer, seller, and the motorcycle, but also guarantees that the sale is documented properly. For convenient access to the form, you can visit autobillofsaleform.com/motorcycle-bill-of-sale-form/new-york-motorcycle-bill-of-sale-form/, ensuring that your transaction is both recognized and protected under the law.

Facial Release Form - The form includes a section for your emergency contacts.

Army Sworn Statement - The DA 2823 has been updated in November 2006, rendering previous editions obsolete for official use.

Documents used along the form

The WH-58 form is a critical document used by employees to acknowledge the receipt of back wages or other compensation. It serves as proof that the employee has received payment as determined by the Wage and Hour Division. Several other forms and documents often accompany the WH-58 to provide a comprehensive understanding of wage-related issues. Below are some commonly used documents.

- WH-150 Form: This form is used for filing a complaint regarding unpaid wages. Employees can detail their grievances, which helps the Wage and Hour Division investigate the issue.

- WH-56 Form: This document serves as a request for an investigation into potential violations of wage and hour laws. It allows employees to formally ask the Division to look into their claims.

- Employment Verification Form: For those needing to confirm employment status, our comprehensive Employment Verification document provides essential details for loan applications and background checks.

- WH-5 Form: The WH-5 is a notice of employee rights under the Fair Labor Standards Act. It informs employees about their rights concerning minimum wage and overtime pay.

- WH-58A Form: This is a supplementary form that provides additional details about the back wages received. It can include information about deductions and other payments.

- Form I-9: While not specific to wage issues, this employment eligibility verification form is often required when hiring employees. It ensures that workers are authorized to work in the U.S.

- W-2 Form: This tax document summarizes an employee's annual wages and the taxes withheld. It is essential for filing income tax returns and provides a complete financial picture for the employee.

These documents collectively support the processes surrounding wage claims and employee rights. Understanding them can help employees navigate their rights and responsibilities more effectively.

Similar forms

The WH-58 form is similar to the WH-150 form, which is a Wage and Hour Division (WHD) document used for reporting complaints regarding wage violations. Like the WH-58, the WH-150 allows employees to formally document their grievances regarding unpaid wages or overtime. Both forms serve as critical tools for employees seeking to assert their rights under the Fair Labor Standards Act (FLSA). They require specific information about the employee, employer, and the nature of the complaint, ensuring that the WHD can effectively investigate and address the reported issues.

In navigating the complexities of legal documentation, it's crucial to understand that the General Power of Attorney form can be vital. This form ensures that your financial and legal matters are handled according to your preferences, especially in situations where you may no longer be able to make decisions independently. For those looking to empower a trusted individual to act on their behalf, resources are available online, such as https://georgiapdf.com, which guide you through the process of obtaining and completing this essential document.

Another document that parallels the WH-58 is the WH-2 form, also known as the Wage and Hour Division's "Request for Review of Wage Determination." This form is used when employees or employers wish to contest wage determinations made by the WHD. Similar to the WH-58, the WH-2 requires detailed information about the employment situation, including wages and hours worked. Both documents facilitate communication between employees and the WHD, ensuring that disputes over wages are formally recorded and reviewed.

The WH-56 form, or "Request for Wage and Hour Division Investigation," is another document akin to the WH-58. This form is utilized by employees to request an investigation into potential wage violations. Like the WH-58, the WH-56 captures essential details about the employee's work situation and the alleged violations. The urgency of addressing wage disputes is reflected in both forms, as they aim to expedite the investigation process and ensure employees receive fair compensation for their labor.

Additionally, the WH-55 form, which serves as a "Notice of Wage and Hour Violation," shares similarities with the WH-58. This document is issued by the WHD to inform employers of potential violations discovered during an investigation. Both forms highlight the importance of compliance with wage laws and the consequences of failing to adhere to them. They act as formal notifications, ensuring that both employees and employers understand their rights and responsibilities under the law.

Lastly, the WH-1 form, known as the "Wage and Hour Division Complaint Form," is comparable to the WH-58 in that it allows employees to file complaints regarding wage-related issues. The WH-1 requires comprehensive information about the employee's work history and the nature of the complaint, similar to the WH-58's structure. Both forms are essential for initiating the process of addressing wage disputes, emphasizing the need for employees to have a clear and formal avenue for reporting violations of their rights.

Dos and Don'ts

When filling out the WH-58 form, there are specific actions that should be taken and others that should be avoided to ensure accuracy and compliance.

- Do provide your full name as it appears on official documents.

- Do accurately state the name and location of your employer.

- Do include the correct dates for the work period in question.

- Do clearly indicate the gross amount of back wages you received.

- Do read the notice regarding your rights under the Fair Labor Standards Act before signing.

- Don't sign the form unless you have received the payment indicated.

- Don't provide inaccurate or misleading information about your employment or payment.

- Don't leave any sections of the form blank; ensure all required fields are completed.

- Don't ignore the potential legal implications of providing false information.

Key takeaways

- Understand the Purpose: The WH-58 form is used to acknowledge the receipt of back wages or other compensation due to an employee.

- Identify the Employer: Ensure that the employer's name and address are clearly stated on the form.

- Review Payment Details: Check that the gross amount of back wages, legal deductions, and net amount received are accurately filled out.

- Know Your Rights: Signing the form means you give up the right to sue for unpaid wages or overtime for the specified period.

- Be Aware of Time Limits: Generally, there is a two-year statute of limitations for recovering back wages.

- Sign Only After Receipt: Do not sign the form unless you have actually received the payment indicated.

- Employer Certification: The employer must certify the payment to the Wage and Hour Division, confirming that the employee has been paid as stated.

How to Use Wh 58

Filling out the WH-58 form is straightforward. This form is used to acknowledge the receipt of back wages or other compensation. Make sure to have all necessary information ready before you start. Here’s how to fill it out step by step.

- Employee Information: At the top of the form, type or print your name clearly in the space provided.

- Employer Information: Fill in the name and address of your employer. In this case, it’s Lockheed Martin Corporation, 599 Tomales Road, Petaluma.

- Time Period: Indicate the workweek period for which you are receiving payment. Use the dates provided: from the workweek ending 05/07/2011 to the workweek ending 03/10/2012.

- Payment Amount: Enter the gross amount of back wages you received. For example, $0,555.13.

- Legal Deductions: If there are any legal deductions, list them in the space provided. If there are none, you can leave it blank.

- Other Amount Paid: Specify any other amounts paid, if applicable. If not, leave this blank.

- Net Amount Received: Write down the net amount you received after deductions.

- Employee Signature: Sign the form to confirm that you have received the payment. Include your address and the date of signing.

- Employer Certification: The employer or authorized representative must complete this section by certifying the payment. They should include the date and their signature.

Once you’ve filled out the form, make sure to keep a copy for your records. It’s important to understand that signing this form means you are giving up certain rights regarding unpaid wages. Always double-check your entries for accuracy before submitting.