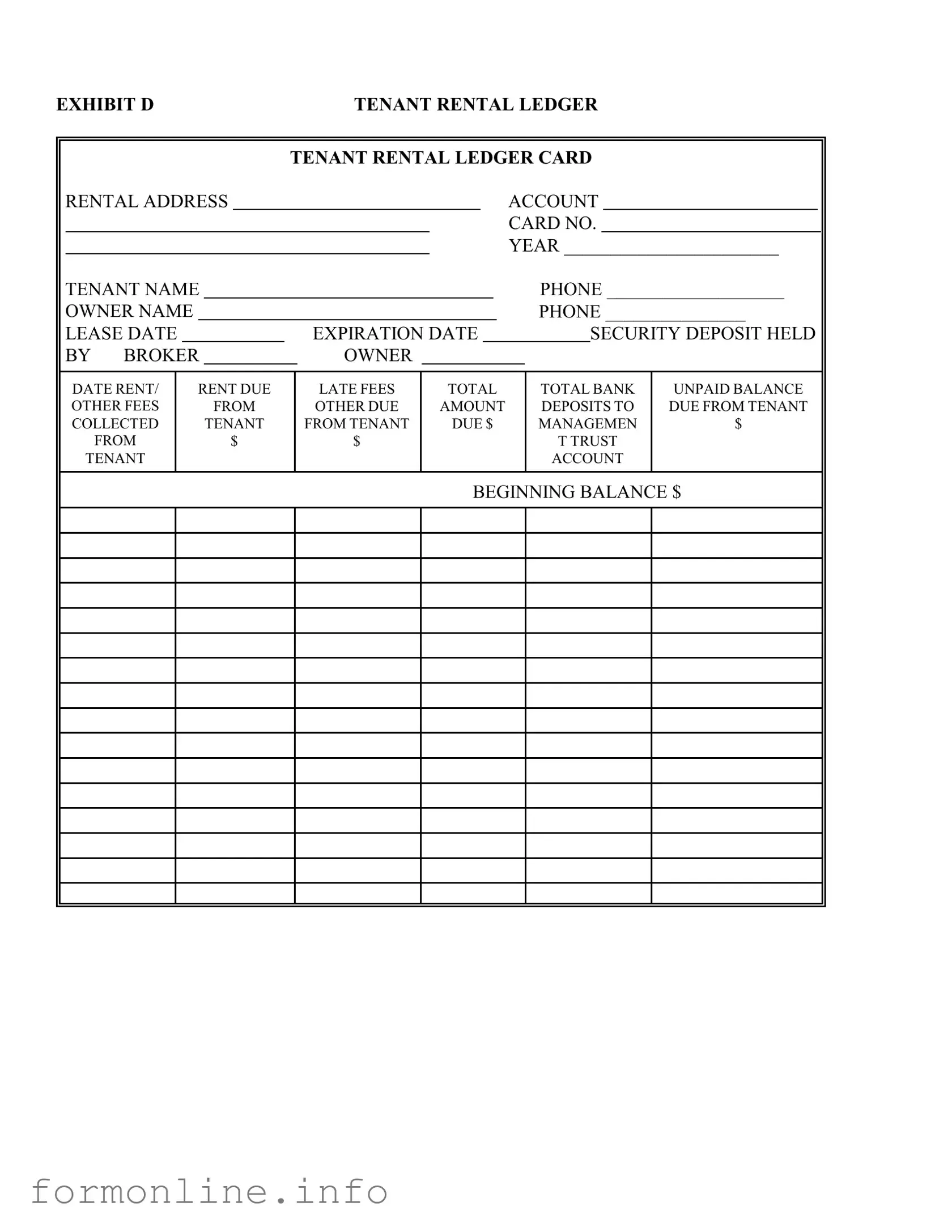

Fill Out a Valid Tenant Ledger Card Form

The Tenant Ledger Card form serves as a crucial tool for property owners and managers, providing a comprehensive overview of a tenant's rental history and financial obligations. This form captures essential information such as the rental address, tenant name, and contact details for both the tenant and the owner. Additionally, it outlines key dates, including the lease start and expiration dates, as well as the security deposit held by the broker or owner. Financial details are meticulously recorded, including rent and other fees collected from the tenant, amounts due, and any late fees incurred. The form also tracks the total amount due and the unpaid balance, ensuring that both parties have a clear understanding of the financial relationship. Deposits made to the management trust account are noted, providing a transparent view of the tenant's financial standing throughout the lease period. By systematically organizing this information, the Tenant Ledger Card facilitates effective communication and accountability between tenants and property management.

Common mistakes

-

Incomplete Tenant Information: Failing to provide complete tenant details, such as the tenant's full name and phone number, can lead to confusion and miscommunication.

-

Missing Owner Information: Not including the owner's name and contact information can complicate matters if issues arise regarding payments or lease terms.

-

Incorrect Lease Dates: Entering wrong lease start or expiration dates may cause disputes over tenancy and payment obligations.

-

Security Deposit Errors: Misreporting the security deposit amount can lead to legal complications, especially if the deposit is not returned properly at the end of the lease.

-

Failure to Document Fees: Not accurately recording rent and other fees collected from the tenant can create discrepancies in financial records.

-

Neglecting Late Fees: Forgetting to include late fees when applicable can result in a loss of revenue and may encourage late payments in the future.

-

Overlooking Total Amount Due: Failing to calculate the total amount due from the tenant can lead to misunderstandings about what is owed.

-

Inaccurate Bank Balance Reporting: Not keeping track of the total bank unpaid balance can create significant issues in financial management and transparency.

Preview - Tenant Ledger Card Form

EXHIBIT D |

|

|

TENANT RENTAL LEDGER |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TENANT RENTAL LEDGER CARD |

|

|||||||||||||

|

|

RENTAL ADDRESS |

|

|

|

|

|

|

|

|

ACCOUNT |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARD NO. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR _______________________ |

|

||||||

|

|

TENANT NAME |

|

|

|

|

|

|

|

|

|

|

PHONE ___________________ |

|

|||||||

|

|

OWNER NAME |

|

|

|

|

|

|

|

|

|

|

PHONE _______________ |

|

|||||||

|

|

LEASE DATE |

|

|

|

EXPIRATION DATE |

|

|

|

|

|

SECURITY DEPOSIT HELD |

|

||||||||

|

|

BY BROKER |

|

|

|

OWNER |

|

|

|

|

|

|

|

|

|

|

|

|

|||

DATE RENT/ OTHER FEES COLLECTED FROM TENANT

RENT DUE

FROM

TENANT

$

LATE FEES

OTHER DUE

FROM TENANT

$

TOTAL

AMOUNT

DUE $

TOTAL BANK |

UNPAID BALANCE |

DEPOSITS TO |

DUE FROM TENANT |

MANAGEMEN |

$ |

T TRUST |

|

ACCOUNT |

|

|

|

BEGINNING BALANCE $

Other PDF Templates

Profits or Loss From Business - Deductible expenses can include home office costs if you meet certain criteria.

Can You File a Lien Without a Notice to Owner in Florida - This document outlines both the contractor's claim and the owner's responsibilities regarding payment.

In order to make the process smoother for vehicle owners who may not be able to attend to their motor vehicle transactions personally, the Texas Motor Vehicle Power of Attorney form can be extremely useful. By granting this authority, owners can ensure that their designated representative is empowered to act on their behalf, whether it's for registration, title acquisition, or even selling the vehicle. For those interested in utilizing this form, you can download the form in pdf to get started.

Medexpress Weirton - Testing authorities ensure rigorous oversight of the process.

Documents used along the form

The Tenant Ledger Card is an essential document for tracking rental payments and other financial interactions between landlords and tenants. Alongside this form, several other documents are frequently utilized to ensure clarity and compliance in rental agreements. The following list outlines these additional forms and their purposes.

- Lease Agreement: This document outlines the terms and conditions of the rental arrangement, including the duration of the lease, rent amount, and responsibilities of both the landlord and tenant.

- Rental Application: Prospective tenants complete this form to provide personal information, rental history, and references. It helps landlords assess the suitability of applicants.

- Security Deposit Receipt: This receipt acknowledges the amount of security deposit received from the tenant. It serves as proof of the transaction and outlines conditions for the return of the deposit.

- Notice of Rent Increase: Landlords use this form to formally inform tenants of any changes to the rent amount. It typically includes the new rate and the effective date of the increase.

- Maintenance Request Form: Tenants submit this form to report issues needing attention in the rental property. It helps landlords track maintenance requests and ensure timely responses.

- Move-In/Move-Out Checklist: This checklist documents the condition of the property at the beginning and end of the tenancy. It is crucial for determining any damages that may affect the security deposit return.

- ATV Bill of Sale: This form is pivotal for documenting the sale and ownership transfer of an all-terrain vehicle in New York, ensuring all necessary details are accurately recorded, as outlined by nypdfforms.com/.

- Eviction Notice: Should a tenant fail to meet their obligations, this document serves as a formal notice to terminate the lease agreement. It outlines the reasons for eviction and any required actions by the tenant.

Understanding these documents can help both landlords and tenants navigate their rental agreements more effectively. Each form plays a vital role in maintaining clear communication and accountability throughout the rental process.

Similar forms

The Tenant Ledger Card is similar to a Rent Roll. A Rent Roll is a document that lists all the rental units in a property along with key details about each unit, such as tenant names, lease dates, and rental amounts. Like the Tenant Ledger Card, it helps property owners track income from their rental properties. Both documents serve as essential tools for property management, allowing for easy monitoring of who owes rent and how much. They are often used in financial reporting and for managing tenant relationships.

Another document similar to the Tenant Ledger Card is the Security Deposit Receipt. This receipt details the amount of the security deposit collected from a tenant, the property address, and the terms under which the deposit is held. Both documents ensure transparency between landlords and tenants regarding financial transactions. They provide a record that can be referenced in case of disputes over the return of the security deposit at the end of a lease.

The Payment History Report shares similarities with the Tenant Ledger Card as well. This report details all payments made by a tenant over a specific period, including rent, late fees, and other charges. Like the Tenant Ledger Card, it helps landlords keep track of what has been paid and what is still owed. Both documents are vital for maintaining accurate financial records and can be useful during audits or tenant disputes.

In South Carolina, ensuring a clear and valid transaction during the purchase or sale of a vehicle is crucial, and utilizing the https://autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form can streamline the process, providing both buyer and seller with essential documentation to avoid any ambiguities and to facilitate the registration of the motor vehicle.

Lastly, the Move-In Inspection Report is akin to the Tenant Ledger Card in that it documents the condition of a rental unit at the start of a lease. This report includes notes on any existing damages or issues. While the Tenant Ledger Card focuses on financial aspects, the Move-In Inspection Report ensures that both parties have a clear understanding of the property's condition. Both documents are important for protecting the interests of landlords and tenants alike.

Dos and Don'ts

When filling out the Tenant Ledger Card form, it is essential to adhere to certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid.

- Do: Clearly write the tenant's name and contact information.

- Do: Include the rental address accurately to avoid confusion.

- Do: Specify the lease dates, including both the start and expiration dates.

- Do: Record the security deposit amount in the appropriate section.

- Do: Document all fees collected from the tenant, including rent and late fees.

- Don't: Leave any sections blank; incomplete information can lead to disputes.

- Don't: Use abbreviations that may not be understood by others reviewing the form.

- Don't: Forget to include the total amount due and any unpaid balance.

- Don't: Alter any entries after they have been recorded; this can compromise the integrity of the document.

Key takeaways

Understanding the Tenant Ledger Card is essential for both landlords and tenants. Here are some key takeaways to keep in mind when filling out and using this important form:

- Accurate Information: Ensure that all fields are filled out accurately. This includes tenant names, contact information, and property details.

- Record Keeping: Use the Tenant Ledger Card to maintain a clear record of all financial transactions related to the rental property.

- Lease Dates: Clearly note the lease start and expiration dates. This helps both parties understand the duration of the rental agreement.

- Security Deposit: Document the security deposit amount and who is holding it. This is crucial for the return process at the end of the lease.

- Rent and Fees: Track all rent payments and any additional fees collected from the tenant. This includes late fees and other charges.

- Total Amount Due: Calculate the total amount due from the tenant, including rent and any other fees. This provides a clear picture of outstanding balances.

- Bank Deposits: Keep a record of any deposits made into the management trust account. This ensures transparency in financial dealings.

- Unpaid Balances: Monitor any unpaid balances carefully. This helps in managing the financial relationship between landlord and tenant.

- Regular Updates: Update the ledger regularly. Consistent record-keeping prevents disputes and fosters trust between parties.

By following these guidelines, both landlords and tenants can ensure a smooth rental experience. Keeping accurate records is not just beneficial; it is a key part of maintaining a healthy landlord-tenant relationship.

How to Use Tenant Ledger Card

After gathering the necessary information, you can begin filling out the Tenant Ledger Card form. This form is essential for tracking rental payments and related financial details for tenants. Follow these steps to complete the form accurately.

- Write the rental address in the designated space labeled RENTAL ADDRESS.

- Fill in the ACCOUNT CARD NO. with the appropriate number.

- Enter the year in the YEAR field.

- Provide the tenant's name in the TENANT NAME section.

- Include the tenant's phone number in the PHONE field.

- Write the owner's name in the OWNER NAME section.

- Fill in the owner's phone number in the PHONE field next to the owner's name.

- Enter the lease start date in the LEASE DATE field.

- Fill in the lease expiration date in the EXPIRATION DATE section.

- Document the security deposit amount in the SECURITY DEPOSIT field.

- Indicate who holds the security deposit in the HELD BY section (either BROKER or OWNER).

- List the date of the rent collection in the DATE field.

- Fill in the amount of rent or other fees collected from the tenant in the RENT/OTHER FEES COLLECTED FROM TENANT section.

- Enter the rent due from the tenant in the RENT DUE FROM TENANT field.

- Document any late fees in the LATE FEES section.

- List any other amounts due from the tenant in the OTHER DUE FROM TENANT field.

- Calculate the total amount due and write it in the TOTAL AMOUNT DUE section.

- Record the total unpaid balance in the TOTAL BANK UNPAID BALANCE field.

- Document any deposits made by the tenant in the DEPOSITS TO DUE FROM TENANT section.

- Indicate the management trust account's beginning balance in the MANAGEMENT TRUST ACCOUNT BEGINNING BALANCE field.