Fill Out a Valid U.S. DoL Form

The U.S. Department of Labor (DoL) form serves as a critical tool for various administrative processes within the department, impacting both employers and employees. This form facilitates the collection of essential information regarding employment practices, wage standards, and workplace safety. It is utilized for a range of purposes, including the reporting of labor disputes, the application for benefits, and compliance with federal regulations. By providing a structured format, the form ensures that data is submitted consistently, allowing for efficient processing and analysis. Additionally, it often requires detailed information about the employer's practices, employee classifications, and wage rates, thereby promoting transparency and accountability in the labor market. Understanding the components and requirements of the U.S. DoL form is vital for anyone involved in labor relations, as it plays a significant role in upholding workers' rights and maintaining fair labor standards across the country.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all the necessary details. Omitting crucial information can delay processing or even lead to rejection of the form.

-

Incorrect Contact Information: Providing an incorrect phone number or email address can hinder communication. It’s vital to ensure that contact details are accurate and up-to-date.

-

Failure to Sign: A common oversight is forgetting to sign the form. Without a signature, the form is considered invalid, and processing cannot proceed.

-

Using Inappropriate Language: Some applicants may use slang or informal language. It is important to maintain a professional tone throughout the application.

-

Not Following Instructions: Each section of the form comes with specific guidelines. Ignoring these instructions can lead to errors that may require resubmission.

-

Submitting Without Reviewing: Rushing to submit the form without a thorough review can result in mistakes. Taking the time to double-check can prevent unnecessary complications.

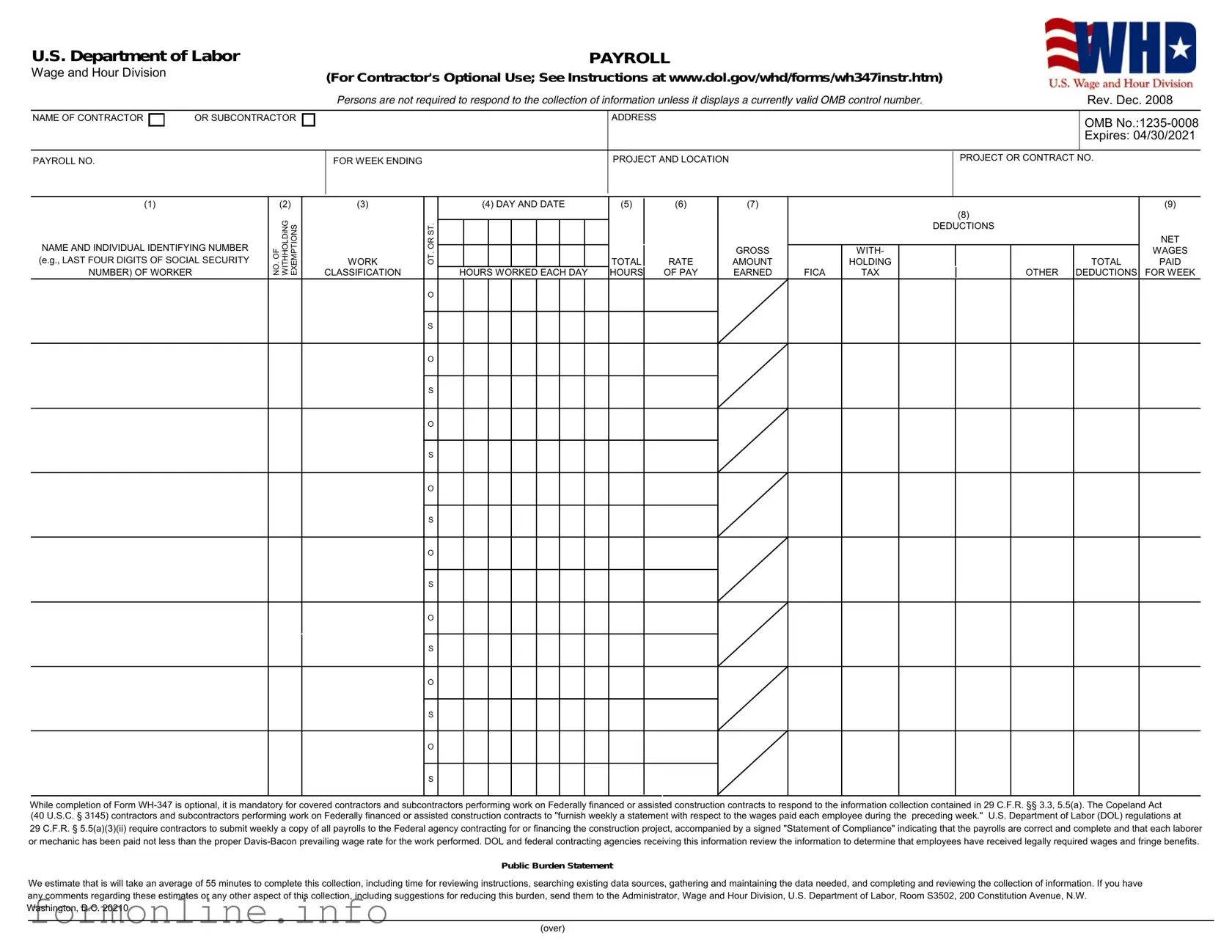

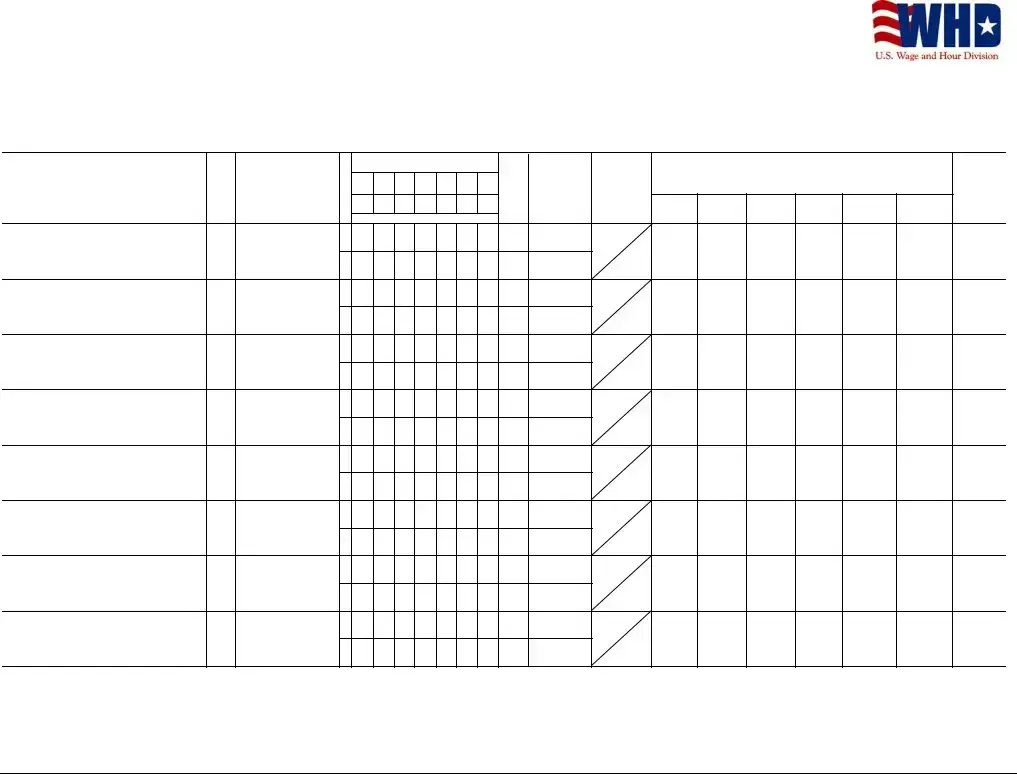

Preview - U.S. DoL Form

U.S. Department of Labor |

|

PAYROLL |

|

|

Wage and Hour Division |

|

(For Contractor's Optional Use; See Instructions at www.dol.gov/whd/forms/wh347instr.htm) |

|

|

|

|

Persons are not required to respond to the collection of information unless it displays a currently valid OMB control number. |

Rev. Dec. 2008 |

|

NAME OF CONTRACTOR |

OR SUBCONTRACTOR |

|

ADDRESS |

OMB |

|

|

|

|

Expires: 04/30/2021 |

|

|

|

|

|

PAYROLL NO. |

|

FOR WEEK ENDING |

PROJECT AND LOCATION |

PROJECT OR CONTRACT NO. |

(1)

NAME AND INDIVIDUAL IDENTIFYING NUMBER (e.g., LAST FOUR DIGITS OF SOCIAL SECURITY NUMBER) OF WORKER

(2)

NO. OF WITHHOLDi NG TXE EMP IONS

(3)

WORK

CLASSIFICATION

(4) DAY AND DATE |

(5) |

(6) |

(7) |

|

|

(8) |

|

(9) |

|

|

|

|

|

|

|

|

|

T. |

|

|

|

|

|

DEDUCTIONS |

|

|

ORS |

|

|

|

|

|

|

|

NET |

|

|

GROSS |

|

WITH- |

|

|

WAGES |

|

OT. |

|

|

|

|

|

|||

TOTAL |

RATE |

AMOUNT |

|

HOLDING |

|

TOTAL |

PAID |

|

HOURS WORKED EACH DAY |

HOURS |

OF PAY |

EARNED |

FICA |

TAX |

OTHER |

DEDUCTIONS |

FOR WEEK |

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

While completion of Form

(40 U.S.C. § 3145) contractors and subcontractors performing work on Federally financed or assisted construction contracts to "furnish weekly a statement with respect to the wages paid each employee during the preceding week." U.S. Department of Labor (DOL) regulations at

29 C.F.R. § 5.5(a)(3)(ii) require contractors to submit weekly a copy of all payrolls to the Federal agency contracting for or financing the construction project, accompanied by a signed "Statement of Compliance" indicating that the payrolls are correct and complete and that each laborer or mechanic has been paid not less than the proper

Public Burden Statement

We estimate that is will take an average of 55 minutes to complete this collection, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have any comments regarding these estimates or any other aspect of this collection, including suggestions for reducing this burden, send them to the Administrator, Wage and Hour Division, U.S. Department of Labor, Room S3502, 200 Constitution Avenue, N.W. Washington, D.C. 20210

(over)

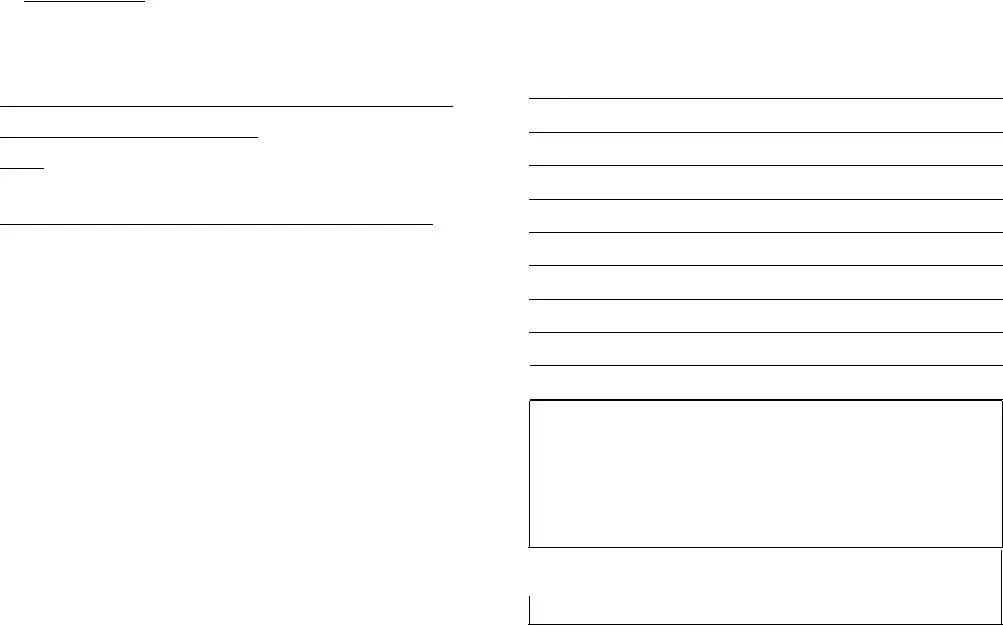

Date

I,

(Name of Signatory Party) |

|

(Title) |

do hereby state:

(1) That I pay or supervise the payment of the persons employed by

(b)WHERE FRINGE BENEFITS ARE PAID IN CASH

−Each laborer or mechanic listed in the above referenced payroll has been paid, as indicated on the payroll, an amount not less than the sum of the applicable basic hourly wage rate plus the amount of the required fringe benefits as listed in the contract, except as noted in section 4(c) below.

(c)EXCEPTIONS

(Contractor or Subcontractor)

on the

EXCEPTION (CRAFT) |

EXPLANATION |

; that during the payroll period commencing on the

(Building or Work)

day of |

|

, |

|

, and ending the |

|

day of |

|

, |

|

, |

all persons employed on said project have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of said

from the full

(Contractor or Subcontractor)

weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in Regulations, Part

3 (29 C.F.R. Subtitle A), issued by the Secretary of Labor under the Copeland Act, as amended (48 Stat. 948,

63 Stat. 108, 72 Stat. 967; 76 Stat. 357; 40 U.S.C. § 3145), and described below:

(2)That any payrolls otherwise under this contract required to be submitted for the above period are correct and complete; that the wage rates for laborers or mechanics contained therein are not less than the applicable wage rates contained in any wage determination incorporated into the contract; that the classifications set forth therein for each laborer or mechanic conform with the work he performed.

(3)That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with a State apprenticeship agency recognized by the Bureau of Apprenticeship and Training, United States Department of Labor, or if no such recognized agency exists in a State, are registered with the Bureau of Apprenticeship and Training, United States Department of Labor.

(4)That:

(a)WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS, OR PROGRAMS

−in addition to the basic hourly wage rates paid to each laborer or mechanic listed in the above referenced payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate programs for the benefit of such employees, except as noted in section 4(c) below.

REMARKS:

NAME AND TITLE |

SIGNATURE |

|

|

THE WILLFUL FALSIFICATION OF ANY OF THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR SUBCONTRACTOR TO CIVIL OR CRIMINAL PROSECUTION. SEE SECTION 1001 OF TITLE 18 AND SECTION 231 OF TITLE 31 OF THE UNITED STATES CODE.

Other PDF Templates

Printable Sports Physical Form - Ultimately, the Sports Physical Form is a foundational document for safeguarding athletes during their active pursuits.

Understanding the importance of a comprehensive Power of Attorney document is vital, especially in Florida, where it facilitates important financial and legal decision-making. For more insights, check our guide on creating a comprehensive Power of Attorney form to ensure your needs are met effectively.

Aao Form - Prioritizing timely communication can lead to improved treatment outcomes.

Profits or Loss From Business - Enhancing your understanding of this form can empower you in your business endeavors.

Documents used along the form

When dealing with U.S. Department of Labor (DoL) forms, there are several other documents that individuals and businesses may need to prepare or submit. These forms often complement the primary DoL documentation and help ensure compliance with labor laws and regulations. Below is a list of commonly used forms and documents.

- Employer Identification Number (EIN) Application: This form is used by businesses to obtain a unique identifier from the Internal Revenue Service (IRS). It is essential for tax purposes and is often required when filling out DoL forms.

- Trailer Bill of Sale Form: A autobillofsaleform.com/trailer-bill-of-sale-form serves as a legal document that records the sale and transfer of a trailer from a seller to a buyer, outlining key transaction details.

- Wage and Hour Division (WHD) Complaint Form: Employees can use this form to report violations related to wage and hour laws. It serves as a formal complaint that initiates an investigation by the DoL.

- Labor Condition Application (LCA): Employers seeking to hire foreign workers under the H-1B visa program must submit this form. It outlines the job conditions and wage rates that comply with labor standards.

- Occupational Safety and Health Administration (OSHA) Forms: These documents are used to report workplace injuries or safety violations. They help ensure that workplaces adhere to safety regulations set by OSHA.

- Family and Medical Leave Act (FMLA) Forms: Employees requesting leave under the FMLA must complete specific forms to certify their eligibility. This documentation helps protect employees' rights to take necessary leave for family or medical reasons.

Understanding these forms and documents can greatly assist in navigating the complexities of labor regulations. Each plays a vital role in ensuring compliance and protecting the rights of both employees and employers.

Similar forms

The U.S. Department of Labor (DoL) form is similar to the Employment Eligibility Verification Form (I-9). The I-9 form is used by employers to verify the identity and employment authorization of individuals hired for employment in the United States. Like the DoL form, the I-9 requires the employee to provide personal information, including name, address, and date of birth. Both forms aim to ensure compliance with federal regulations regarding employment and labor, emphasizing the importance of proper documentation in the hiring process.

Another document that bears similarity to the U.S. DoL form is the Federal Tax Form W-4. The W-4 form is completed by employees to indicate their tax situation to their employer. This document helps employers withhold the correct amount of federal income tax from employees' paychecks. Both the W-4 and the DoL form require personal information and are essential for compliance with federal laws. They serve to protect both the employee and the employer by ensuring accurate reporting and withholding of taxes and labor regulations.

The Occupational Safety and Health Administration (OSHA) forms also share similarities with the U.S. DoL form. OSHA forms are used to report workplace injuries and illnesses, ensuring that employers maintain a safe working environment. Both the OSHA forms and the DoL form are designed to protect workers' rights and safety. They require detailed information about incidents or employment status, highlighting the commitment to uphold labor standards and safeguard employee welfare.

In addition to the forms already discussed, the Mobile Home Bill of Sale is another vital document that serves to officially confirm the transfer of ownership for a mobile home, ensuring that both the buyer and seller have clear records of the transaction and the essential details involved.

Lastly, the Fair Labor Standards Act (FLSA) compliance forms are comparable to the U.S. DoL form. FLSA compliance forms are utilized to ensure that employers adhere to minimum wage and overtime pay regulations. These forms require employers to document hours worked and wages paid. Similar to the DoL form, FLSA compliance forms emphasize the importance of accurate record-keeping and adherence to labor laws, ensuring that employees receive fair compensation for their work.

Dos and Don'ts

When filling out the U.S. Department of Labor (DoL) form, there are some important dos and don’ts to keep in mind. Here’s a straightforward list to help you navigate the process smoothly.

- Do read the instructions carefully before you start filling out the form.

- Do provide accurate and complete information to avoid delays.

- Do double-check your entries for any typos or errors.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank; this can lead to processing issues.

- Don’t use jargon or unclear language; clarity is key.

- Don’t rush through the form; take your time to ensure accuracy.

- Don’t forget to sign and date the form before submitting it.

Key takeaways

When filling out and using the U.S. Department of Labor (DoL) form, there are several important points to keep in mind. Here are nine key takeaways:

- Understand the purpose of the form. Each DoL form serves a specific function, whether it's for reporting, compliance, or requesting information.

- Gather all necessary information before starting. This includes personal details, employment history, and any supporting documents that may be required.

- Fill out the form completely and accurately. Incomplete or incorrect information can lead to delays or rejections.

- Use clear and concise language. Avoid jargon and ensure that your responses are easy to understand.

- Review the form before submission. Double-check for any errors or omissions to ensure everything is correct.

- Keep a copy of the completed form. This serves as a record of your submission and can be useful for future reference.

- Be aware of submission deadlines. Timeliness is crucial to avoid penalties or missed opportunities.

- Follow up after submission. Confirm that your form was received and inquire about the processing timeline.

- Seek assistance if needed. If you have questions or need help, do not hesitate to reach out to the appropriate DoL office or a legal professional.

By following these guidelines, you can navigate the process of filling out and using the U.S. DoL form more effectively.

How to Use U.S. DoL

Filling out the U.S. Department of Labor (DoL) form can seem daunting, but with a clear approach, you can complete it efficiently. After you fill out the form, you will need to submit it according to the instructions provided, ensuring that all required information is accurate and complete.

- Gather all necessary information and documents that you will need to complete the form.

- Read the form carefully to understand what information is required in each section.

- Start filling out the form by entering your personal details, such as your name, address, and contact information.

- Provide any additional information requested, such as employment details or specific circumstances related to your request.

- Review your entries for accuracy and completeness before moving on to the next section.

- If applicable, attach any supporting documents that are required to accompany your submission.

- Double-check the form for any missing signatures or dates.

- Submit the completed form according to the instructions provided, either online or by mail.